|

AMC Speak

AMC Speak

2 important lessons from India's No 1 equity fund manager

Vinit Sambre, Fund Manager, DSP BlackRock Investment Managers

11th November 2016

|

|

In a nutshell

Vinit Sambre - manager of DSP BlackRock's MicroCap and Small & Mid Cap funds - was recently recognized in the ET Wealth - Morningstar FM rankings 2016 as the No.1 equity fund manager in the country. Speaking on the occasion of DSP Blackrock Small & MidCap Fund's 10th anniversary, Vinit shared with us two key lessons he has learnt, which are helping him outperform markets and peers. The first is about staying true to style irrespective of phases in the market cycle - especially when valuations climb and the temptation increases to sacrifice quality in the quest for perceived cheap valuations. The second is to ensure that one spends enough time building conviction in a stock before investing rather than after.

|

|

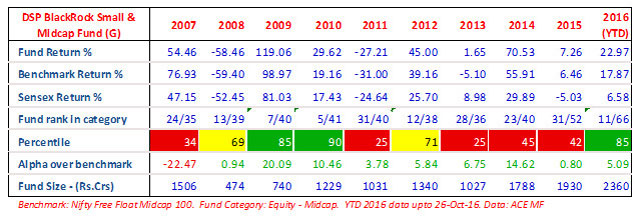

What do percentiles and their colours signify?

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

WF: Congratulations on your recognition as India's best equity manager in the ET Wealth - Morningstar FM Rankings 2016. To what do you attribute your winning performance?

Vinit: I think the most important contributor has been our ability to stick to a disciplined, fundamentals based investment approach, irrespective of market cycles. We focus on long term and avoid taking short term calls. In my experience, in different phases of a market cycle, there is a big temptation to alter one's investment approach. In bull markets when quality gets fully valued, it is easy to start looking at going down the quality chain, into stocks that may appear cheap especially on a relative valuation basis. Many of these turn out to be value traps in hindsight. We have tried to avoid this situation, by not compromising at all on the quality of stocks we buy.

One question I ask myself is that when I am buying a stock in a bullish market, will I still like to have it in my portfolio in a bad market? This question gives a lot of clarity on what to own and what to avoid. We stay away from weak franchises, irrespective of their price.

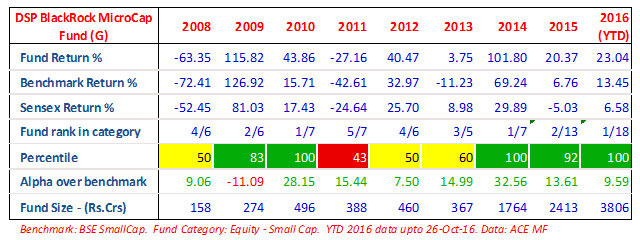

WF: A review of performance of the two key funds you manage - the Small & Midcap Fund and the MicroCap Fund, suggests that though both have been consistent alpha generators over the years, the quantum of alpha and the absolute performance of your MicroCap Fund has been significantly better than the Small & MidCap Fund in CY14 and CY15, though the gap has significantly narrowed in CY16YTD. Is this a case of there being better alpha opportunities in smaller companies than in midcaps? Is your natural flair more geared towards picking winners in the small caps space?

Click here to know more about percentiles and the colour codes

Click here to know more about percentiles and the colour codes

Vinit: If you look at a theoretical framework, as you go into smaller companies, their growth prospects are higher, but the risks associated are also higher. Now, if you select your small cap stocks correctly, you will have a portfolio of companies with high growth, which should therefore deliver a superior performance to mid and large cap stocks oriented portfolios.

Having said that, I must add that in the last 12 months, we have made a focused attempt to replicate the approach we have in our MicroCap Fund in our Small & MidCap Fund, in terms of taking strictly long term views and owning high conviction ideas only. Results in CY16 so far are showing that we are moving in the right direction with our Small & MidCap Fund.

WF: Your Small & MidCap Fund completes 10 years this month. These 10 years have seen different phases of market cycles playing out. What are some of the key lessons you think advisors and investors should imbibe from the decade long journey of this fund?

Vinit: One lesson I have personally learned in this journey is the importance of spending a lot more time researching a stock and building conviction BEFORE buying rather than AFTER buying. Spend a lot of time before making an investment decision. But once you have made your decision and bought, your approach should change completely. One has to be "lazy" - in the sense that one has to be patient to allow the stock to deliver the promise you saw in it. There will be poor quarters in the journey, which will test your conviction. You need to revisit your hypothesis and confirm your conviction in the thesis. Sustaining your conviction through lean phases is what will help you get the performance you seek. We saw this in 2011, 2013 and 2015, when weak markets severely tested our conviction in stocks we owned. We stayed put, and our conviction bore results eventually.

I guess what is true for fund managers is equally true for investors as well. Do your homework well before investing, but once you invest, be patient for results to show up. Test your convictions from time to time, but don't take actions unless there is reason to believe your convictions are now misplaced.

WF: Small and midcaps are seen as very expensive on historical PE basis. What is the case for investing in this segment, at a stage when valuations are so rich?

Vinit: Yes I agree that valuations are currently much higher than historical averages. Even if one factors in 1 year forward earnings, valuations still look stretched. What this means is that we should either expect a healthy correction within the next 6 months, or if that doesn't happen, we must accept that there will be a time correction, to allow earnings to catch up. Implications for investors is that one should not enter small and midcaps now by extrapolating last 1-2 years performance. There is a strong case for investing in this segment with a 3 year view, as earnings momentum will only accelerate from here on, which will make this segment an attractive investment proposition, from a 3 year perspective.

WF: Small and midcaps usually trade at a significant premium to large caps when bull markets mature - ie at the last phase of a bull market. Now that this is clearly in evidence, does it therefore suggest that we are perhaps at the tail end of this bull market?

Vinit: Yes, there has been such a historical trend. Again, like I said, it perhaps means that we should be prepared for a correction in the near to medium term. But, I believe from a long term perspective, we are still in the initial stage of a structural bull market. For a bull market to end, usually earnings peak out. In our case, earnings momentum is yet to pick up in a meaningful way in this cycle. We are going to see much stronger earnings momentum over the next 3-4 years. Also the reforms process - while slow - is certainly in the right direction, and will further aid earnings momentum. Investors should now invest in equity funds with a 3 year + horizon. There are very good long term opportunities for patient investors.

WF: Which sectors within the mid and small caps spaces appear attractive at today's valuations? Where do you see the brightest growth prospects that justify these valuations?

Vinit: I think the consumer oriented segment - especially the discretionary space is what is looking attractive. This is a broad theme - within this, there are stocks we like in the textiles space, media space, auto and auto ancillaries space. Another sector that looks attractive now is health care - it has been beaten down currently due to US FDA issues. I think these issues will get resolved in the next 1-2 years. Investing now should be a good long term opportunity. Then there are stocks we like in speciality chemicals, in garment exports and in cement. So, really a broad range of attractive opportunities.

WF: If you were to pick one theme that you believe will create significant wealth in the mid and small caps spaces over the next 5 years, which would it be and why?

Vinit: I believe it will be the consumer discretionary space. I think there are 2 trends that will drive this space over the next 5 years. One is rising incomes and rising aspirations of a growing middle class, which will fuel demand across the spectrum of consumer discretionary items. Second is the implementation of GST, which will see a big transition from unorganized sector to the organized sector. This will benefit listed organized sector players significantly. I believe this theme can create significant wealth over the next 5 years, on the back of both these drivers.

Share this article

|