|

|

|

|

|

||

|

| AMC Speak |

27th March 2012 |

|||

| Shape your practice to align with emerging trends | ||||

| AjitMenon, Executive Vice President, DSP Blackrock Investment Managers | ||||

|

Only a fraction of all qualified advisors go on to developing really successful practices. One of the things that sets successful advisors apart from others is a keen understanding of emerging business trends to identify opportunities before most others do, and respond to changing dynamics before most others do. Its also about developing an honest assessment of your core competencies, which in turn helps you achieve clarity on how you can differentiate yourself in a competitive market and win clients in the segment you wish to focus on. To enable Platinum Circle advisors to do just that, Ajit Menon shared DSP Blackrock's perspectives on emerging business trends and a framework for each advisor to help build his / her own differentiation. |

||||

|

In the recently concluded Wealth Forum Platinum Circle Advisors Conference, held in Mumbai on 23rd March 2012, Ajit Menon led a panel discussion titled "Sharpen your strategy to win market share". He presented key emerging business trends, which advisors should bear in mind while shaping their advisory practice. Trend 1- Asset correlations are increasing, specially in times of stress

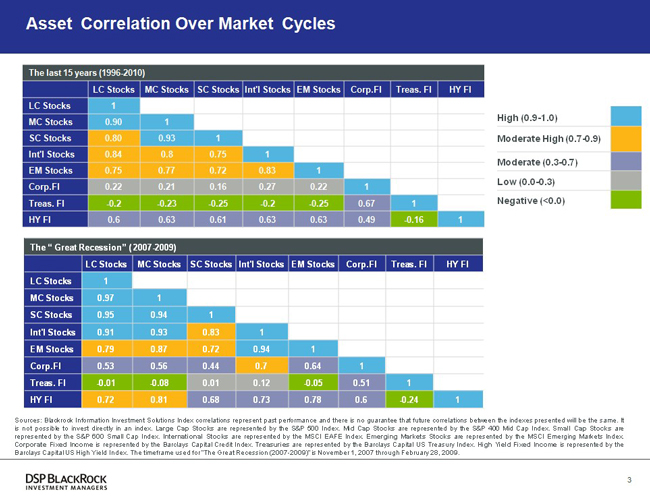

Increasing correlation among asset classes challenges the traditional view of asset allocation. In times of stress, correlation increases among asset classes as is evidenced in the above table ( no.2). The data source, though pertaining to international indices, would in our opinion also reflect similarly for our markets, especially as we get more and more integrated. Helping clients deal with volatility is becoming a much bigger responsibility for advisors, as what is important will be portfolio construction based on risk exposure and not just standard asset classes or sub-classes. The role of an advisor gets into sharper focus as a consequence of this trend. Trend 2 - Age of the global citizen Investors have access to much more information than they ever did before, through multiple media. Investors are exposed to many more investment alternatives than they ever experienced before - and this trend is only growing - especially in the area of alternative investments. Importantly though, this deluge of information and options will actually drive investors closer towards advisors. With so much information available and so many options available, investors will look towards somebody who can help them sift through this mass of information and help them make the right choice. Contrary to earlier beliefs that the internet will replace the advisor, what's emerging is that access to so much information and options is actually driving investors towards advisors, not away from them. Trend 3 - Income distribution more important than accumulation? Retirement planning has traditionally focussed on the accumulation phase - the phase where one creates a corpus that is designed to help you meet your retirement needs. As life expectancy increases, and market volatility increases, there is a new challenge that advisors have to face up to - which is the distribution phase of retirement planning more than the accumulation phase. Available research clearly demonstrate that one of the biggest determinants of success in the distribution phase is now the phase of the market when distribution begins. If an investor retires at 60 and starts drawing down earnings from his corpus, his portfolio over the next 20 years will look spectacularly different for the same average rate of return, based on when in the market cycle he begins the withdrawals. If he has a couple of good market years in his first two years post retirement, his corpus after 20 years would look much healthier than if he were to begin withdrawals during two bad years in a market cycle. Likewise, every 1% increase or decrease in the rate of withdrawal can add or delete 10-15 years of portfolio longevity. Being aware of this should help advisors do the necessary course corrections for their clients and therefore help strengthen credibility and trust with their clients. In volatile times like these, distribution planning and management are acquiring a whole new dimension for advisors globally - and India will be no exception. Yes, we do have more people in accumulation phase than in the distribution phase - but at the same time, each advisor does have his or her share of retiring clients - and these concerns are absolutely critical for such clients. Managing income distribution is therefore becoming a core requirement for today's advisors. Trend 4 - Evolution of wealth management - Teaming

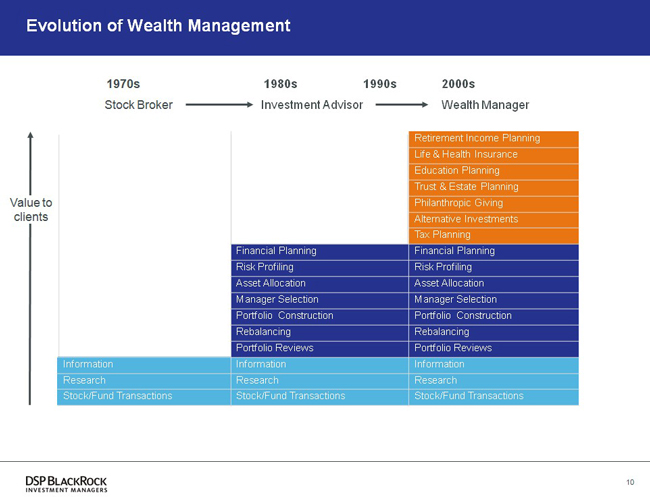

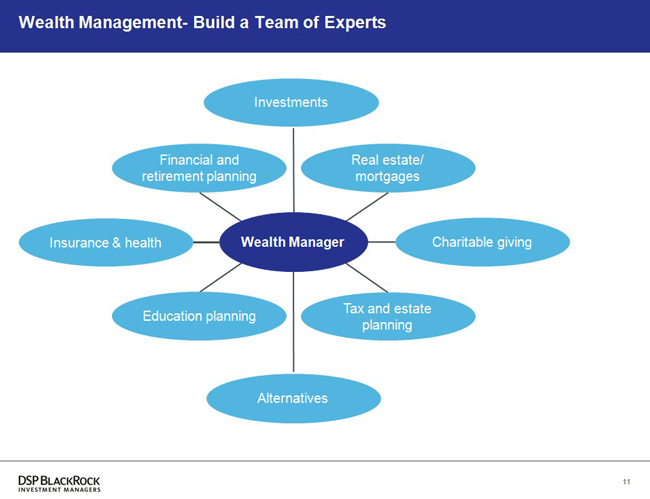

The above chart showcases the evolution of the advisory practise in more developed markets. Successful investment advisors are now growing beyond investment advice and are becoming wealth managers, by adding on more services that help their clients grow, protect and distribute their wealth. To scale up from investment advisor to wealth manager does not always mean adding all the new skill sets yourself - the new paradigm seems to be a team approach.

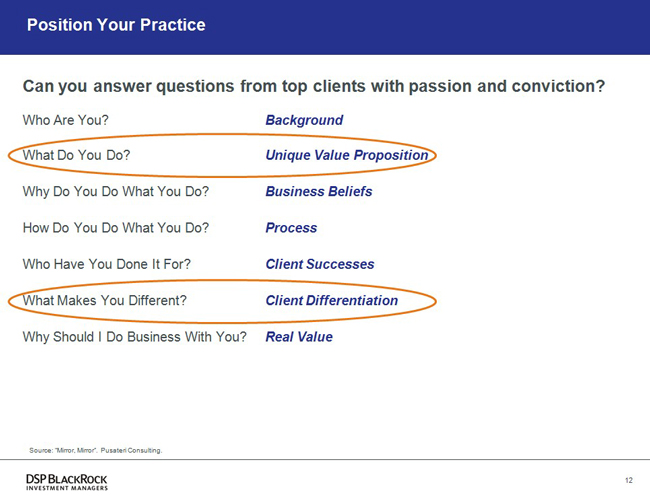

Positioning your practice After taking the advisors through these emerging trends, Ajit left them with these questions - the answers to which would help each advisor decide how to position his / her own practice.

In the panel discussion that followed, these are exactly the questions that were posed to the advisors on the panel - to get insights into how they have attempted to differentiate themselves in a competitive market place. |

||||