|

WF: In calendar 2017, how has your Edelweiss Arbitrage Fund's return stacked up compared to short term income funds on a pre and post tax basis?

Bhavesh: Edelweiss Arbitrage Fund (Reg Gr Plan): 5.95% Pre Tax as well as Post Tax (LTCG: Nil after 1 Year)

Median Short Term Fund: 5.94% Pre Tax, 3.88% Post Tax (@34.608%)

Average Short Term Fund: 5.84% Pre Tax, 3.82% Post Tax (@34.608%)

Crisil Short Term Bond Fund Index: 6.11% Pre Tax, 4.00% Post Tax (@34.608%)

Data as on November 30, 2017.

WF: Are returns in arbitrage funds correlated purely to money market rates or could they spike with heightened interest in equity F&O?

Bhavesh: Returns of arbitrage fund are more correlated with sentiments of equity market. Bullish sentiments in equity segment leads to more interest from various participant leading to higher open interest and thereby higher spreads. Similarly, bearish sentiment leads to lower open interest and thereby puts pressure on the spreads.

WF: Does bond market volatility of the kind we have seen in recent months impact arbitrage returns?

Bhavesh: Most of the time we hold low duration paper in our fund, so volatility in bond market have limited impact on our performance. However, such volatility impacts debt funds negatively and as a result arbitrage funds become more attractive on a relative basis.

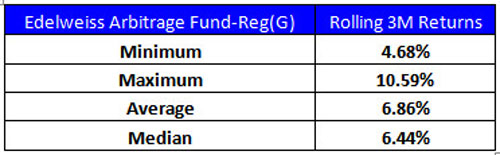

WF: What are the factors that can cause fluctuations in arbitrage returns? Over the last 3 years, what has been the range of rolling 3 month returns of this category?

Bhavesh: Various factors which impact returns of arbitrage are

Sentiments of Equity market Open interest in SSF Total AUM of all arbitrage funds Volatility in equity markets Interest rate in economy Currency hedging cost

We have completed a little over 3 Years since our inception on 27th June 2014. In last 3.5 Years the range of returns on a rolling 3 months basis for our fund is 4.68% to 10.59%. From since inception till December 31, 2017.

Past performance may or may not be sustained in future.

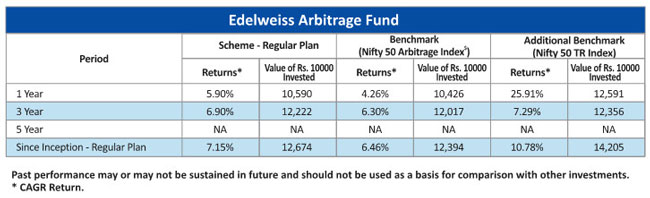

Performance as on November 30, 2017

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are of Regular Plan of EdelweissArbitrage Fund. Returns are for Growth Option only.

Since Inception returns are calculated on Rs. 10/- invested at inception of the scheme. In case the start/end date is non business day, the NAV of previous day is used for computation.

2. The scheme is currently managed by Bhavesh Jain (managing this fund from June 27, 2014) and Mr. Dhawal Dalal (Managing this fund from December 22, 2016).

3. Standard Benchmark prescribed by SEBI vide circular August 22, 2011.

4. For the performance of other Schemes managed by the Fund Managers, please refer to the relevant scheme.

5. Since the scheme is in existence for more than 1 year but less than 5 years hence performance data for 5 years and more is not provided.

Click here to view the return of the returns of other funds managed by the Fund Manager

WF: Should arbitrage funds be considered as a proxy to short term income funds - with a horizon of 3-6 months? Can they also be considered for tenures shorter than 3 months?

Bhavesh: In a normal scenario, arbitrage fund should be considered a proxy to Liquid/Liquid plus Funds and Fixed Deposit. One can consider arbitrage fund for any tenure which is more than a month. In a sideways to rising interest rate, arbitrage can be considered as a substitute to even short term income funds like we have seen in last one year. (Arb fund 5.95% vs Median STIF 5.94% Pre Tax and 3.88% Post Tax)

WF: Your fund has now crossed Rs.5,000 crores: is there an optimal size beyond which the fund may start under-delivering?

Bhavesh: There are funds with more than 10,000 crores AUM as well as funds with less than 1,000 crores AUM. Edelweiss Arbitrage Fund has been able to consistently outperform both sets of funds. We have been amongst the top performing arbitrage fund when our AUM was 58 crores (During our NFO) and we continue to be amongst the best performing arbitrage fund even today when our AUM has almost jumped by 100X to 5800 crores. We are confident of maintaining same kind of performance even after reaching 10,000 crores AUM.

Source: ACE MF

Disclaimer: Mr. Bhavesh Jain is the Fund Manager of the Scheme and the views express above are his own. Investor must make their own investment decision based on their specific investment objectives and financial positions and such AMFI qualified advisors as may be necessary. Opinion expressed above are not necessary those of Edelweiss Asset Management Limited (EAML) or any of its Director, Officers, Employees and personnel. Consequently, EAML, or any of its Directors, Officers, Employees and personnel do not accept any responsibility for the editorial content or its accuracy, completeness or reliability and hereby disclaim any liability with regard to the same.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Share this article

|