|

WF: "AMC calls" are seen with a lot of scepticism by a section of the industry, who believe these are nothing more than sales pushes which should be ignored by advisors. How would you react to this belief?

Chintan: Our calls are formed on the basis of our research bandwidth and the extensive experience of our fund managers. Whenever we perceive a good opportunity in a particular sector or segment of the market, we provide our investors with a range of relevant investment solutions that could help them utilise the investment opportunity.

The distributors can choose to implement our calls in their core or satellite investment approach based on their investors' profile.

WF: Should advisors consider such calls primarily for tactical asset allocation only and not use them for primary/strategic asset allocation?

Chintan: Our calls can be tactical or strategic. The advisor has to decide whether to implement these calls as part of tactical or strategic asset allocation based on the investor's profile.

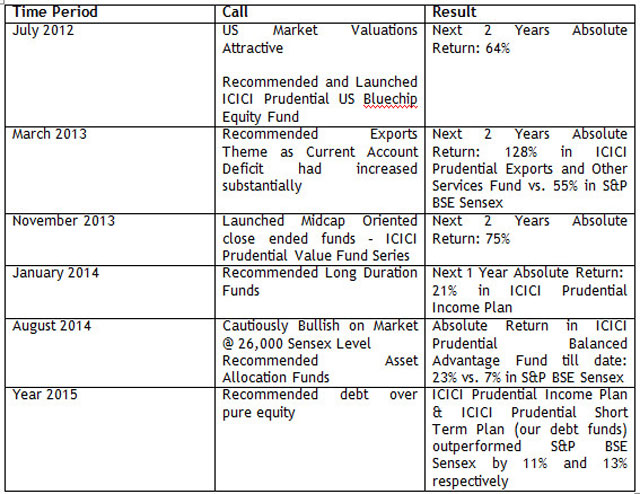

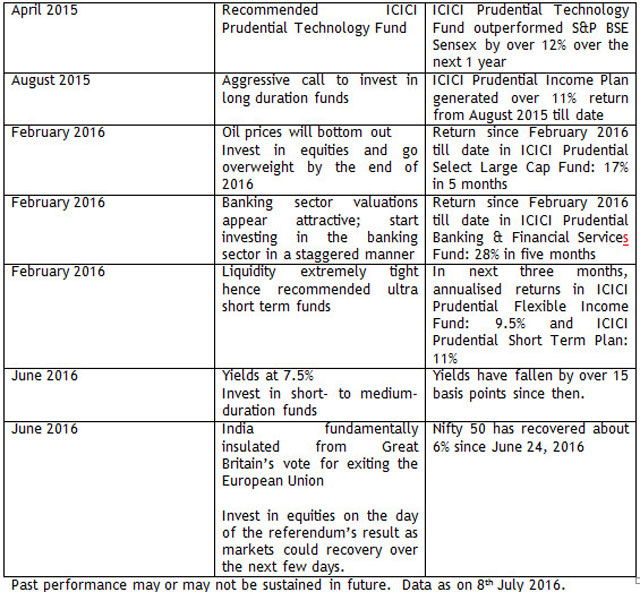

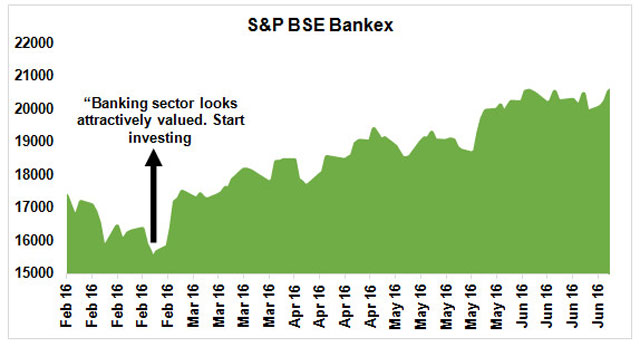

WF: Can you take us through some of your calls in recent years and how they have actually panned out?

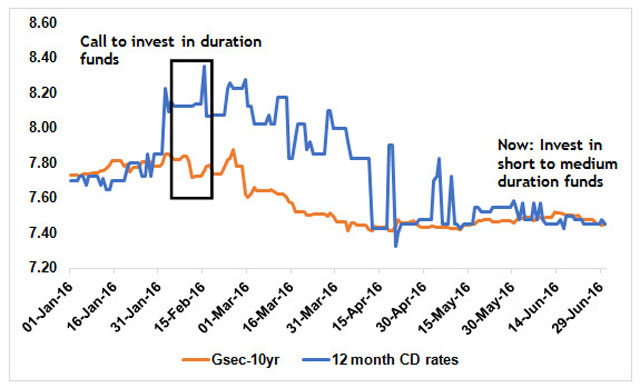

Chintan:

WF: How should retail oriented advisors react to such calls, when they do not overlay tactical asset allocation over a strategic one?

Chintan: We regularly provide tactical as well as strategic calls. So, in case a retail-oriented advisor chooses not to overlay tactical asset allocation with a strategic one, he/she can choose to follow our strategic calls.

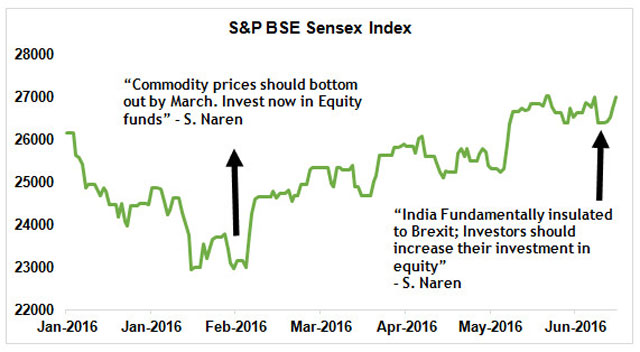

For example, our call to invest in equities on the day when Great Britain voted for exiting the European Union was a strategic call. Similarly, our call to go overweight on equities by the end of 2016 is also a strategic call.

WF: A big challenge distributors face with AMC calls is the decision on when to exit. Can you give some guidance on this critical aspect?

Chintan: In case of tactical calls, we have given exit calls as and when our calls played out. For example, in April 2015, we had recommended investing in the information technology sector. After the call played out, we recommended exiting the sector in early January 2016.

The advisors can choose to exit or book profits after the call has been played out. At the time of giving the call, we provide our distributors with the rationale behind making the call and the time-frame for the investment strategy. The advisor can monitor all the parameters and circumstances under which the call was made and exit as when the call plays out.

The advisor can also use his/her discretion depending and choose to exit early or continue to stay invested depending on the investor's goal, risk appetite and profile.

The advisor could also cross-check with the AMC's if in doubt whether or not to exit.

WF: Some distributors say that the first six months' experience is absolutely critical for new investors to develop confidence, and good AMC calls help immensely in delivering this. There is a risk in this strategy, but in recent years, as most of your calls have come good, it has benefited many new investors immensely. How should one use guidance from your calls for new investors?

Chintan: It is here where the advisor's role is extremely crucial. The advisor is in the position to understand the investor's profile, risk appetite, goal, and investment time horizon. The advisor can effectively communicate our strategic calls to new investors and help then have a good investment experience. Depending upon the investor's profile, the advisor can use his/her discretion to decide whether our tactical calls or strategic calls would suit their investors.

WF: What would be your suggested asset allocation now for an investor with a 3 year perspective - in terms of allocating across the range of equity and debt fund categories?

Chintan:

Equity:

Aggressive Investments: Investors may invest in these funds to benefit from domestic and global cyclical uptick.

ICICI Prudential Select Large Cap Fund

ICICI Prudential Top 100 Fund

Moderate-risk Investments: These funds are well diversified across various sectors and could be part of investor's core equity portfolio

ICICI Prudential Focused Bluechip Equity Fund

ICICI Prudential Value Discovery Fund

ICICI Prudential Multicap Fund

Conservative Investments: These funds may be suitable for conservative investors for long term wealth as these funds dynamically manage equity levels

ICICI Prudential Balanced Advantage Fund

ICICI Prudential Balanced Fund

Debt:

Aggressive investors with a 3 year of investment horizon: Funds that can dynamically change duration strategy based on market condition

ICICI Prudential Long Term Plan

Investors with moderate risk appetite: Funds with short to medium duration could give better risk-adjusted returns.

ICICI Prudential Dynamic Bond Fund

ICICI Prudential Short Term Plan

Conservative investors seeking to earn from Accrual + Duration: Accrual funds are better suited for conservative investors

ICICI Prudential Regular Savings Fund

ICICI Prudential Corporate Bond Fund

ICICI Prudential Regular Income Fund

(Income is not assured and is subject to the availability of distributable surplus.)

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The information contained herein is only for the reading/understanding of the registered Advisors/Distributors and should not be circulated to investors/prospective investors. All data/information in this material is specific to a time and may or may not be relevant in future post issuance of this material. ICICI Prudential Asset Management Company Limited (the AMC) takes no responsibility of updating any data/information in this material from time to time. The AMC (including its affiliates), ICICI Prudential Mutual Fund (the Fund), ICICI Prudential Trust Limited (the Trust) and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The sector(s)/stock(s) mentioned in this communication do not constitute any recommendation of the same and ICICI Prudential Mutual Fund may or may not have any future position in these sector(s)/stock(s). Past performance may or may not be sustained in the future. Nothing contained in this document shall be construed to be an investment advise or an assurance of the benefits of investing in the any of the Schemes of the Fund. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Share this article

|