|

WF: How do you view value investing at a time when the Indian equities are at a lifetime high?

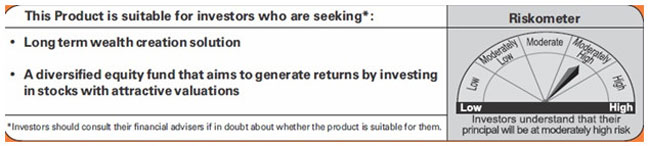

Mrinal: As an investment strategy, value investing is all about picking stocks where the market price of a particular stock is below the stock's intrinsic value. However, in the current momentum market, earnings are playing a catch-up with the valuation. So, finding value stocks is a challenge. The only solution here is to remain patient in such a phase. Historically, it has been observed that once in every ten years, there will be atleast one year when value investing style is likely to underperform. For those who survive that phase, by continuing to staying true to value style, can be richly rewarded in the years ahead. For successful value investing, patience is the key factor.

WF: How does running an open ended value fund impact the strategy you follow when it comes to meeting investor expectations?

Mrinal: While running a value fund what matters the most to us is if an investment is worthwhile in terms of margin of safety. Very often the stock picks in such a fund will not be market favourites. However, there is nothing wrong in such a move as long as the returns are generated. While investor expectations are justifiable, value investing requires patience such that the strategy play out over a long period of time. At times in a growth market like India, it is difficult to get a value pick, which is what happened during 2007 and is currently happening.

WF: In pursuing value buys, there is always a danger of falling into a value trap. How do you try to distinguish between a likely value buy and a probable value trap?

Mrinal: Management evaluation is one of the key aspects when it comes to keeping away from a value trap. There could be good business but with an incompetent management, which is likely to turn out to be a value trap. Over the years we have refined our management evaluation process which has held us in good stead. Once we are fully convinced about the management potential, only then do we go ahead with investing decisions.

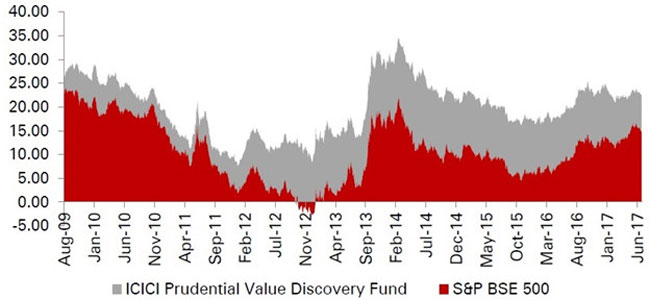

WF: Do you think a phase of underperformance is engrained in value style of investing?

Mrinal: There are two important principles that are used when selecting stocks under value investing - intrinsic value and margin of safety. Studies have shown that famous value investors have underperformed the markets roughly one-third of their investing career. However, this under-performance is to achieve long-term outperformance. Very often, companies purchased by value investors are likely to be undervalued and maybe perceived in a negative light. However, gradually, markets tend to recognize their value. This phase of market discovery of a stock's value is what leads to periods of underperformance.As can be seen from the chart below, the fund has outperformed its benchmark in terms of five- year returns on all days since inception.

The information herein is solely for private circulation and for reading/understanding of registered Advisors/Distributors and should not be circulated to investors/prospective investors.

Data Source: MFI; Data in % CAGR terms; Returns are calculated for the period between Aug 16, 2009 to June 30, 2017. Past performance may or may not sustain in the future. It is necessary to consult tax/financial advisor before making investments in mutual funds.

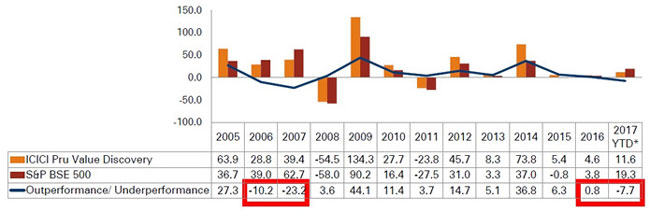

WF: After nine years of strong outperformance, on YTD basis ICICI Prudential Value Discovery has slipped into negative alpha territory. To what will you attribute this?

Mrinal: Value as a style invariably underperforms in a momentum market. This is not the case of only 2017, such times were seen in 2006-2007 as well. We believe that we are in the midst of a rally where the earnings are catching up with the valuation. By the very theory of value investing, the fund generally takes a conservative approach when valuations become expensive. This can be seen the PE levels maintained by the fund over the years. As of June 2017, the portfolio of ICICI Prudential Value Discovery Fund is available at a reasonable valuation of 20x PE as compared to the broader market (S&P BSE 500) which is at 25x.

However, as the euphoria phase tapers off, and valuations turn reasonable, the fund outperforms the market by a wide margin, which is clearly seen in the fund's historical performance as well. (Shown below)

The information herein is solely for private circulation and for reading/understanding of registered Advisors/Distributors and should not be circulated to investors/prospective investors.

YTD -Year to Date. *YTD as on June 30, 2017. Data Source: MFI; Data in % absolute returns; Returns are calculated for each year. Past performance may or may not sustain in the future. It is necessary to consult tax/financial advisor before making investments in mutual funds.

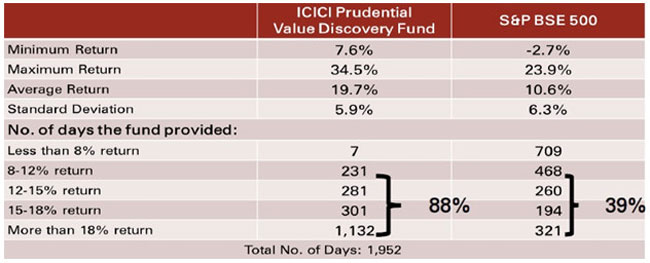

Because it takes time for value strategy to play out, we maintain that the ideal investment period to see the full effect of its investment style would be 5 years and above.In this fund's history (since Aug 16, 2004), 88% of the time the 5 year rolling returns were more than 12%.

The information herein is solely for private circulation and for reading/understanding of registered Advisors/Distributors and should not be circulated to investors/prospective investors.

Data Source: MFI; Data as of June 30, 2017. Returns in CAGR % terms. Past performance may or may not be sustained in future. It is necessary to consult tax/financial advisor before making investments in mutual funds.

Through all of the above instances, it can seen that the strategy followed typically leads to significant outperformance which more than compensates for short term underperformance. As alluded before, one has to remain patient and stay invested. And rewards can be seen in the SIP performance.

The information herein is solely for private circulation and for reading/understanding of registered Advisors/Distributors and should not be circulated to investors/prospective investors.Data source: MFI. As on June 30, 2017. Returns are calculated on XIRR basis. The calculation is based on an investment of Rs. 10,000 pm since June 2012 & June 2007 respectively and invested till June 2017. Data is as on 30thJune 2017. Past performance may or may not sustain in the future

WF: A value fund in a market that's scaling new highs every day, in an environment where valuation concerns abound, seems frankly as a counter-intuitive bet. What is the investment argument for this fund at this time?

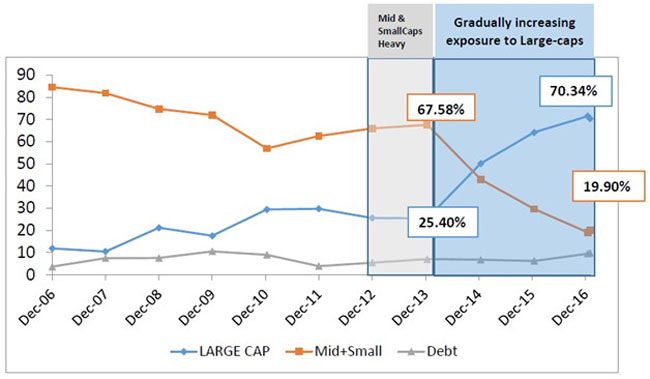

Mrinal: At a time when market valuations are stretched in several pockets, with the mid and small caps expensive when compared to large caps, the fund is building a portfolio which is poised to outperform once the valuation moderates. So, while the approach is conservative, the fund is building aggression by way of a concentrated portfolio, with 41 high conviction stocks, as of June 2017. The fund had higher number of stocks around 60 stocks in Jan 2016. The fund has shifted the portfolio from midcap &smallcap to large-cap, since the midcaps &smallcaps have turned expensive.`

Source: MFI Explorer

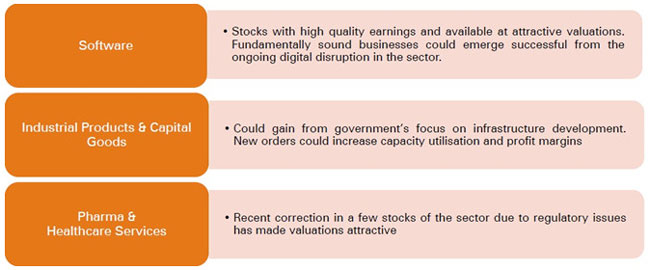

The fund is taking the contrarian approach (value buy) while allocating to pharma and software - two sectors which are currently stressed. Through select stocks in industrials and utilities, the fund seeks to tap into the capex recovery cycle.

Current Portfolio Positioning

The information herein is solely for private circulation and for reading/understanding of registered Advisors/Distributors and should not be circulated to investors/prospective investors.

Data as of June 30, 2017; The stock(s)/sector(s) mentioned in this slide do not constitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in this stock(s). Past performance may or may not be sustained in the future. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the Scheme.

WF: You have included software as one of your key sectoral positions now, and have Wipro, Infosys and HCL Tech in your major holdings. Can you please help us understand the value proposition in software companies, in the context of growing fears of continued sluggishness in top line, ongoing AI led disruption, and visa regulations that have upset established delivery models?

Mrinal: True, software industry as a whole is facing a challenging time in the midst of digital disruption worldwide. As a result, stocks with high quality earnings are available at attractive valuations, making it an attractive value buy. We are of the view that fundamentally sound businesses could emerge successful from the ongoing disruption phase. As that occurs, the sector is likely to be re-rated.

WF: In the banking space, you have a much larger exposure to private sector banks in your key holdings (HDFC Bank, ICICI Bank, Kotak Mahindra Bank) - all of which are rich on valuations, as compared to PSU banks (only SBI present in your key holdings) - which are much cheaper on valuations. Can you please walk us through your thinking on the value propositions in private and PSU banks?

Mrinal: Just because a stock is cheap doesn't make it a value buy. When it comes to banking space, we believe private banks are better placed to be a proxy for economic growth. Cyclically we are quite close to the bottom of the cycle and things could start looking up in a few quarters for corporate banking business. These banks have suffered double whammy of low growth and high NPLs over the past few years and we believe that they are close to the end of this vicious cycle.

WF: If you were only focusing on deep value and had the luxury of a 5 year horizon without daily NAV pressures to contend with, which sector/theme would you be most confident of investing in now?

Mrinal: All of themes that we currently hold is likely to remain.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The information contained in this communication is only for the reading/understanding of the registered Advisors/Distributors. All data/information used in the preparation of this communication is specific to a time and may or may not be relevant in future post issuance of this communication. ICICI Prudential Asset Management Company Limited (the AMC) takes no responsibility of updating any data/information in this communication from time to time. The AMC (including its affiliates), ICICI Prudential Mutual Fund (the Fund), ICICI Prudential Trust Limited (the Trust) and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this communication in any manner.

Nothing contained in this communication shall be construed to be an investment advice or an assurance of the benefits of investing in the any of the Schemes of the Fund. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Share this article

|