|

WF: Apart from global market concerns, a niggling worry domestically is the prolonged earnings slump. There was an expectation for FY16 to post a large earnings growth, then we pushed that expectation into FY17 and now the latest estimates push the "big" growth year to FY18. What lies at the core of this prolonged earnings slump? Why is it so difficult to get it going?

Harshad: There are multiple reasons, but there is one that many of us are finding very difficult to comprehend, perhaps because it's playing out for the first time in India since the last 40 years - that is deflation. None of us has experienced it in active memory. Naturally, companies, economists, analysts - all are grappling with a new phenomenon in India - they are all taking some time to get a grip on the situation.

I am not saying deflation is the only factor - there are many other factors including the persisting decline in exports month on month due to ongoing global demand weakness, to name just one. Commodity prices have come off very significantly, which not only impacts commodity oriented businesses in India, but has also contributed to WPI (Wholesale Price Index) going into negative territory for a long period - a phenomenon we have not seen in the last 40 years.

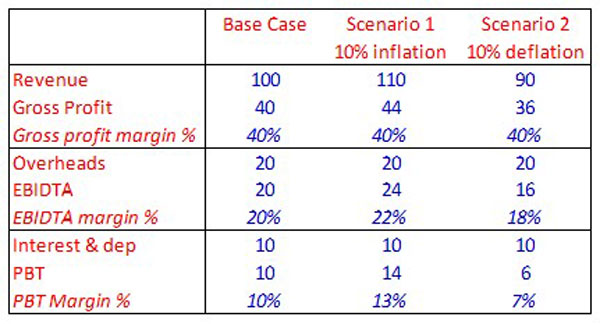

Now, lets take a very simple illustrative example to understand how deflation in the general price level of goods impacts a company's earnings.

Scenario 1 is what we are familiar with - an inflationary scenario. Assuming competitive intensity in an industry remains the same, gross profit margins should remain the same. So, in an inflationary environment (scenario 1), with revenue going up primarily due to inflation in prices, absolute level of gross profit increases (margin remains the same). Overheads being fixed in the short to medium term, remain the same, thus enabling EBIDTA to expand from 20% to 22%. Since interest and depreciation also remain constant in the short to medium term, PBT increases smartly from 10 to 14 - a 40% increase in bottom line, caused by a 10% increase in price of goods sold (volume remaining the same). As I mentioned, this is a situation we are all familiar with.

Now what is happening in our country - which we are grappling with - is scenario 2. With WPI falling, prices are falling. As can be seen in scenario 2, with gross profit margin remaining constant, absolute level of gross profit reduces. With overheads, interest and depreciation remaining constant, the net profit before tax collapses from 10 to 6 - a sharp earnings degrowth.

Now, for earnings to actually grow in a deflationary environment, you need a very significant increase in volumes - and for that you need a very healthy demand environment - which we don't have at present in the country.

If you look at the latest GDP print for our economy, this is the first time at least in my memory that the nominal GDP growth number is lower than the real GDP growth number. We are used to a phenomenon where real GDP growth is say 6%, then we factor in say 7% inflation to arrive at the nominal GDP growth of 13% and we extrapolate this 13% into top line growth of corporates. Now, with WPI declining instead of rising, the same 6% real GDP growth translates to say a 5% or 4% nominal growth. We have to still get used to the dynamics of deflation, in making our earnings forecasts.

Take the latest numbers published by a FMCG major - volumes grew 6%, but revenue grew only 3% - that's the impact of deflation. Normally, a 6% volume growth would have resulted in over a 10% revenue growth, in an inflationary environment.

The second aspect of deflation is that it has a very significant impact on consumer behavior. Expectations of inflation - the belief that prices will be higher in future than they are today - plays a key role in a consumer's purchase decisions. But deflation expectations - a belief that prices will fall in the near future - make him postpone his purchase decision. When people put off purchases, demand falls, and prices fall to induce purchases - thus fueling the deflation cycle. The most dramatic illustration of this phenomenon is property. Other areas where this plays out, albeit to a lower extent is consumer discretionary items - like durables etc.

For a company, a deflationary environment not only impacts its profits, but also impairs its debt repayment capacity. The absolute amount of debt remains the same, but the profits generated to service and to pay this off reduce sharply.

Some economists suggest that the problem for companies is that their revenue is linked to WPI but expenses are linked to CPI! Expenses - like wages and salaries are linked to CPI (Consumer Price Index) in terms of determining the level of increments etc. So, when you have a gap between WPI and CPI - like we are seeing today in India, it creates further stress on the bottom line.

Japan has been battling deflation for almost two decades now - and we all know the debilitating impact it has had on growth in that country. For demand to be robust, you need moderate inflation expectations in the economy.

I must add a caveat here that this is a very simplified illustrative example, to highlight the impact of one variable - deflation - in constraining earnings growth. In reality, a variety of factors play their own roles in determining earnings momentum at a macro level, and even more factors come into play when you look at the micro level - at an individual company level.

WF: How difficult is it going to be to get out of this rut? If WPI persists in negative zone, even if volumes pick up, it will still be a case of two steps forward but one step back - i.e., volume growth will drive earnings upwards while falling prices drive earnings downwards.

Harshad: Yes, absolutely. I think you are 100% right. What we should look for - and nobody in this country would have imagined that we will be hoping for this situation - is for commodity prices including oil to actually go up and stabilize at a slightly higher level than where they are today. Conventional wisdom in India was always that falling oil and commodity prices are great for us. But, beyond a point, everyone shares the pain.

We need moderate inflation and moderate inflation expectations for a healthy growth environment, and for this, stabilization of commodity prices a little above the current distress levels, will be very useful.

WF: How do you cast a portfolio in this environment?

Harshad: Such environments actually highlight the importance of bottom up stock picking. It is important to understand the macro context, but finally, one needs to find companies that are able to withstand the macro pressures. There are private sector banks, some auto companies and so on which are actually seeing earnings upgrades rather than downgrades. You have to be very bottom up focused and very earnings focused.

In this environment of price deflation coupled with a falling stock market, it is very easy to fall prey to value traps. There are businesses that look very cheap based on historical valuations, but whose earnings growth outlook is severely impaired by price deflation in their products. One needs to be very careful about such companies.

One needs to look at businesses that are domestically focused and whose products are relatively less prone to international price movements. The internal dynamics in our country are strong - look for businesses that tap into this opportunity.

Source: J.P. Morgan Asset Management for all data.

Disclaimer: The opinions/ views expressed herein are the independent views of the interviewee and are not to be taken as an advice or recommendation to support an investment decision. The information included in this document has been taken from source considered as reliable; JPMorgan Asset Management India Pvt. Ltd. cannot however guarantee its accuracy and no liability in respect of any error or omission is accepted. These materials have been provided to you for information purposes only and should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein.

The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Investment involves risk. Past performance is not indicative of future performance and investors may not get back the full amount invested. As an investor you are advised to conduct your own verification and consult your own financial advisor before investing.

JPMorgan Asset Management India Pvt. Ltd. offers only the units of the schemes under JPMorgan Mutual Fund, a mutual fund registered with SEBI.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Share this article

|