|

WF: What were the key discussions in the Investment Outlook Summit and who do you typically invite?

Supreet: We set the theme of the event as "The Dynamic Shift"to best represent the shifting macro forces in the Indian Economy and capital markets, which are tectonic in scale but rapid in pace. Our expert speakers dissected these macro forces in detail and dived into investment implications for investors and advisors. We covered areas such as the Union Budget and the Indian Economy, outlook for Indian Fixed Income, Indian Equities, and Global Macro Forces through the following presentations:

Life after the Budget - Sajjid Chinoy, Chief Economist India, JP Morgan India Disinflation: Imperfectly Credible - Namdev Chougule, Head Fixed Income, JP Morgan AM At the Cusp or Behind the Curve? - Harshad Patwardhan, Head Equities and Rajendra Nair, India Portfolio Manager, JP Morgan AM Hong Kong Retirement Insights - Michael Falcon, CEO, JP Morgan Funds Asia Pacific Leading Investors through a sea of Liquidity-Tai Hui, Chief Market Strategist, JP Morgan Funds Asia

The presentations can be downloaded and viewed at: http://jpminvestmentsummit2015.com/

We had 210 participants from across all segments of the distributor fraternity (Bank, NDs, IFAs, RIAs and Platforms). The audience represented organizations that account to roughly 1/3rd of the industry AUM. The profile of attendees varied from Research and Product Heads of banks and NDs to IFAs from 10 cities.

WF: How are you positioning JPM AMC in the Indian fund management industry and how does this initiative help strengthen this positioning?

Supreet: Our biggest strengths are our investment capabilities and our Market insights. Our superior long term investment performance speaks for our investment capabilities. Additionally, we have received strong feedback on our Market Insights program and how that is helping advisors make better informed forward looking investment decisions for their clients. Let me be the first to acknowledge that we are not trying to be everything to everyone. So, given a choice to invest precious resources into either investment capabilities or distribution capabilities, we tilt significantly towards the former. We aspire to be the AMC of choice for distributors who seek investment insights in addition to a suite of performing funds. This summit is an extension of our relentless pursuit towards this objective.

WF: What were the key take-aways that the speakers left for the audience to reflect on in each session?

Supreet: I've enlisted the key take-aways from each of the sessions as below:

India after the Budget - Sajjid Chinoy (Chief India Economist, J.P.Morgan, India)

Key takeaways:

Budget did very well on institutional progress that could have very long-run impact on the economy

World Class Comprehensive Bankruptcy Code Formalizing the monetary policy framework along with RBI: Inflation targeting of 4% (+/-2%) Dispute Resolution framework for public contracts Independent Public Debt Management Agency

The budget was visionary by adopting "growth" as a priority along with macro-stability

Public infrastructure allocation was increased with a heavy focus on roads and railways, while private investment remains a concern Execution is the key. For it to work, capex cycle must be kick-started Budget provides a big thrust to infrastructure creation, but by slowing the pace of fiscal consolidation

India Disinflation: Imperfectly Credible - Namdev Chougule (Head of Fixed Income, J.P. Morgan Asset Management, India)

Key takeaways:

Disinflationary forces are very strong in the economy. We would not be surprised if CPI falls below 5% in the next couple of readings RBI is running a risk of being behind the curve India is today at the similar situation as 2000, with fiscal deficit closer to 4%, similar macro-economic situation, current account at manageable levels and inflation closer to 5%. We think economy has potential to grow at a faster pace without stroking any inflation

At the cusp or behind the curve? - Rajendra Nair (Investment Manager and India Country Specialist, J.P. Morgan Asset Management, Hong Kong), Harshad Patwardhan (Head of Equities, J.P. Morgan Asset Management, India)

Key takeaways:

India offers a unique combination of catalysts Policy revival led by political change Economic cycle seems to have bottomed Monetary policy has just started to ease Valuations are reasonable

Retirement Insights: The Value of Advice - Michael Falcon (Head of Asia Pacific Funds Business, J.P. Morgan Asset Management)

Key takeaways:

Different considerations for different life stages Focus on what is in your control Diversification may provide better returns with less risks Advisors can help clients reach retirement goals

Leading investors through a sea of liquidity - Tai Hui (Chief Market Strategist, J.P. Morgan Asset Management, Asia)

Key takeaways:

Global liquidity to remain ample and hunt for yield to continue Expensive fixed income to push investors to look for alternative ways to generate yield USD strength to persist in the medium to long term, risk of S/T correction

WF: Which were the sessions that your distribution partners found most engaging? Where did you see the highest interactions?

Supreet: The event was timed 4 days after the Union Budget was presented and coincidentally a day after the second surprise rate cut from RBI. Therefore, it was no surprise that Sajjid Chinoy received the maximum number of questions followed by Harshad Patwardhan's presentation. Overall, each presentation was very interactive with participants expressing their opinion on topics through voting meters in addition to the Q&A rounds.

WF: What were your key insights from a day full of interactions with key distribution partners?

Supreet: At the risk of generalizing, we found our partners to be reasonably balanced in their market and business expectations devoid of either irrational exuberance or pessimism.

Since we had an august gathering of distributors representing roughly 1/3rd of the industry AUM, we used the opportunity to ask the audience their opinion on a range of questions. Each participant had a voting devise that submitted the response electronically and we could instantaneously publish the results. Some of the interesting insights are as below:

What do you predict will be the best performing asset class in 2015?

Clearly, the audience was split between Equities and Fixed Income to be the best performing asset class in 2015, making a strong case for Balanced Funds.

Where do you expect the Repo rate to be at the end of the Fiscal Year 2016?

90% of the respondents believe that RBI will cut rates by 50bps or more for the rest of the FY, confirming that the case for duration is stronger than accrual.

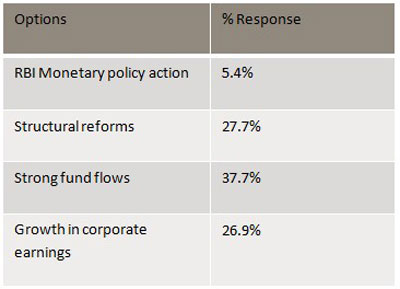

Which single most important factor will drive markets higher this year?

Only 37% of the respondents believe that markets will continue to be supported by strong fund flows. Majority of respondents believe that fundamentals like corporate earnings growth and Structural reforms will act as the most important catalyst for our markets. This also explains the modest returns expectations in the next question, reflective of the slow pace of pick up in Fundamentals so far.

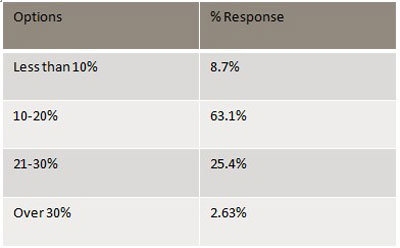

What are your return expectations for Indian equities in 2015?

More than 2/3rd of the respondents expect modest returns from Indian Equities in 2015 while less than 1/3rd expect returns upwards of 20%.

Source: J.P. Morgan Asset Management for all data.

Disclaimer: The opinions/ views expressed herein are the independent views of the interviewee and are not to be taken as an advice or recommendation to support an investment decision. The information included in this document has been taken from source considered as reliable; JPMorgan Asset Management India Pvt. Ltd. cannot however guarantee its accuracy and no liability in respect of any error or omission is accepted. These materials have been provided to you for information purposes only and should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein.

The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Investment involves risk. Past performance is not indicative of future performance and investors may not get back the full amount invested. As an investor you are advised to conduct your own verification and consult your own financial advisor before investing.

JPMorgan Asset Management India Pvt. Ltd. offers only the units of the schemes under JPMorgan Mutual Fund, a mutual fund registered with SEBI.

The voting results shown above are purely based on the votes casted by the participants and J.P. Morgan Asset Management may or may not hold the same view. There was no intervention in the voting process. All the results were calculated by using the voting devise. The approximate figure mentioning the industry AUM has been derived basis the data available from MF Dex.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Share this article

|