|

I strongly believe that it is the "Emotional Arbitrage" that creates wealth for investors and not the "Information Arbitrage". But emotions do play havoc with investment plans of investors during volatile periods in the markets. SIPs/STPs tend to get stopped, fence sitters generally prefer to keep their surplus under the mattress and delay investments. While we all are convinced of the long term prospects of the Indian equities, it is the near term uncertainty because of Local and Global factors that fuels this tendency to put off investment decisions.

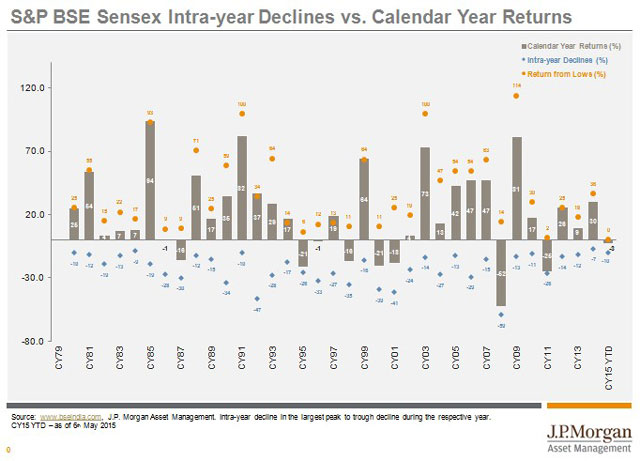

In an effort to handle objections with regards to the volatility and to encourage investors to stay the course, we put together a simple yet impactful chart of Intra-Year Declines Vs. Calendar year Returns for Sensex.

(Click here to see a larger version of the graph)

As the legends denote, the grey bars depict the calendar year returns, the blue diamonds denote intra-year decline (decline from the peak of the year to a subsequent low in the same year) and the orange dots denote returns from lows (returns made by investing at the low of the year and selling out in a subsequent high in the same year). Take an example of 2013 - a year that is fresh in our memory as a volatile year which saw a mini currency crisis. Data from this chart shows that in 2013:

- The largest intra-year decline was 12%

- Return from low of the year was 18%

- Calendar year returns were 9%

Few observations from this chart:

In the last 15 years, there are 11 years with intra year declines ranging from -7% (2014) to -29% (2006) and, yet positive calendar year returns! Investors that bought into a correction could have experienced better returns, ranging from "calendar year returns" (shown in the grey bar) up to "returns from the lows" (depicted with the orange circle). Said differently, someone that invested in the correction in 2009 could have experienced returns in the range of 81% to 114%. I am not implying that one should only invest at the start of the calendar year. Just for the scope of this study - out of 35 Calendar years of the Sensex, only 9 calendar years have delivered negative returns

In summary, what is clear is that the market is capable of recovering from intra-year declines and finishing the year in positive territory. Even though markets are currently choppy, the positive story in India has not changed. Investors should stay the course and further, strongly consider this opportunity as another entry point.

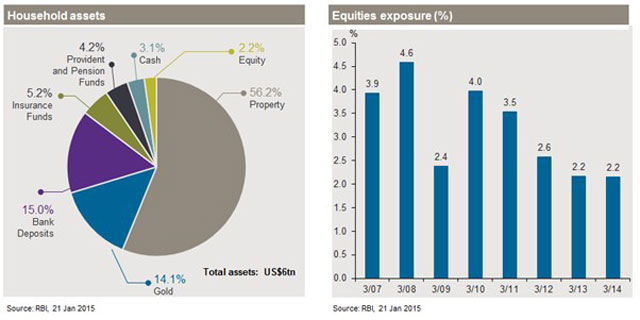

Another point is the gross under ownership of Indian Equities by Indians themselves. The data below will not come as a surprise to any of us since it is a well documented fact

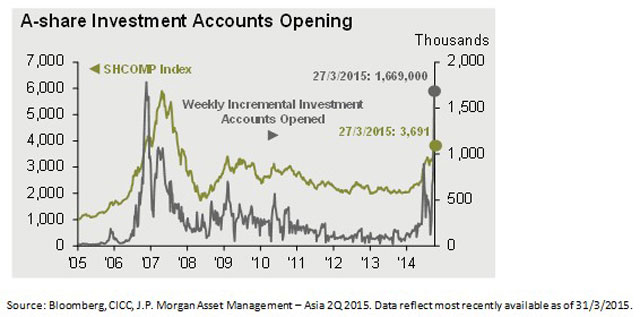

The surprise however came from the Chinese investors in the last 6 months. With property, gold and bank deposits turning unattractive, Chinese investors have been flocking to local stocks and have been largely responsible for the stellar performance of Shanghai Composite Index

Since the 2nd half of 2014, Investment accounts opened by Chinese investors grew exponentially (grey line). The rise of the Shanghai Composite (green line) overlaps the same period implying that the local investors have had a considerable influence over the fortunes of their market.

A similar phenomenon of varying degree, cannot be ruled out for our own stock markets.

Source: J.P. Morgan Asset Management for all data.

Disclaimer: The opinions/ views expressed herein are the independent views of the interviewee and are not to be taken as an advice or recommendation to support an investment decision. The information included in this document has been taken from source considered as reliable; JPMorgan Asset Management India Pvt. Ltd. cannot however guarantee its accuracy and no liability in respect of any error or omission is accepted. These materials have been provided to you for information purposes only and should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein.

The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Investment involves risk. Past performance is not indicative of future performance and investors may not get back the full amount invested. As an investor you are advised to conduct your own verification and consult your own financial advisor before investing.

JPMorgan Asset Management India Pvt. Ltd. offers only the units of the schemes under JPMorgan Mutual Fund, a mutual fund registered with SEBI.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Share this article

|