|

It's that time of the year again, when we look back at the year gone by and review the

markets. For those readers who did not see the 2012 edition of Simhavalokana, here

is a quick synopsis of what the term denotes. Indian philosophers use the Sanskrit

term Simhavalokana to denote the retrospective gaze of a lion. It is said that as the

lion traverses some distance in the jungle, he looks back to examine the path he chose

and how he covered that distance. Not surprisingly, investors spend a disproportionate

amount of time trying to predict the future, but we might as well spend some time to

reflect upon the lessons that history teaches us. In short, keep that crystal ball away,

and take a peek in the rear-view mirror to learn the lessons that Mr. Market taught us

this year.

1. The power of reflexivity:

The long held belief is that while there may be short-term deviations, financial

markets eventually tend towards equilibrium. However, what is often

underestimated is that in the real world, such deviations can be self-reinforcing

and may actually alter the fundamentally driven equilibrium level. The Indian

currency was the worst performing currency in the MSCI All Country World

Index from May 21st to August 28th as it got caught in a downward reflexive spiral,

depreciating almost 20%.

2. Fasten your seat belts during turbulence:

The best course of action when the markets are in a phase of extreme volatility is to

hold on to one's nerves. While the popular opinion on India oscillates from extreme

euphoria to total despair, the general operating template should be that the truth lies

somewhere in the middle. Investors should avoid a knee-jerk reaction to short term

fluctuations.

A recent article in a business daily highlights how leading brokerages were quite accurate in their forecasts of the year-end Sensex level at the beginning of the year (Display 1). However, when markets hit turbulence between July and September, many revised downwards their year-end Sensex targets. In hindsight, that was a wrong move. As they say, sometimes the best course of action is inaction.

3. There are always some bright spots:

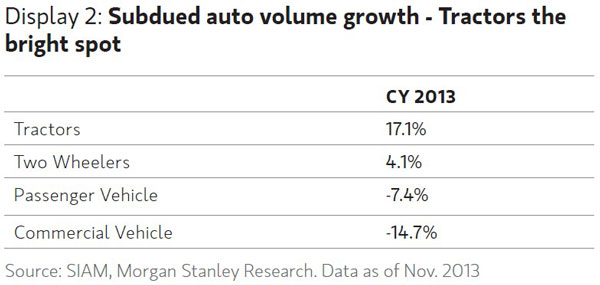

Despite the gloomy macro economic environment, there will always be bright spots of buoyant growth to invest in India. Often we find that sitting ensconced in Mumbai we get lost in the echo chamber of negative 'breaking news' and pessimistic expert opinion. But if you step out of the big cities, the story is not as bad. This year the bright spot in the automobile industry was buoyant growth in the tractor segment, handsomely outpacing the other segments (Display 2).

4. Beauty lies in the eyes of the beholder:

High quality stocks with superior earnings growth, high standards of corporate governance and the ability to withstand the overall slowdown in the economy, continued to get disproportionately rewarded by the markets. The composition of foreign investors has tilted in favour of global rather than India-dedicated investors and that has created a natural bias toward large capitalization stocks with a better and more predictable earnings profile.

5. Don't waste time on the unpredictable:

Over the last few months, Indian stock market participants seem to have become avid, if not proficient, Fed-watchers and election forecasters. One hears the most unlikely people pontificate on vote share swings and the impact of US payroll data on forward rate guidance. The obsession with binary events whose outcome is often impossible to predict occupies disproportionate mind space for investors. The risk is that event based investing becomes a mugs game. More often than not the popular outcome is quickly priced in, leaving little scope for playing the popular trade.

6. Don't sway toward the popular consensus:

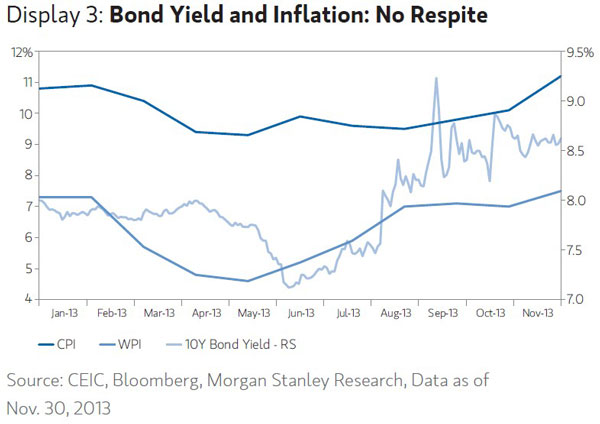

At the beginning of the year most economists predicted that inflation will ease during the year from a high base, and that RBI would respond by easing interest rates. The popular trade was to buy long-dated bonds or bond funds in the hope of handsomely profiting from falling bond yields. The exact opposite has played out. Inflation remains high and entrenched, while we are ending the year with the ten year sovereign bond yield higher than at the beginning of the year (Display 3).

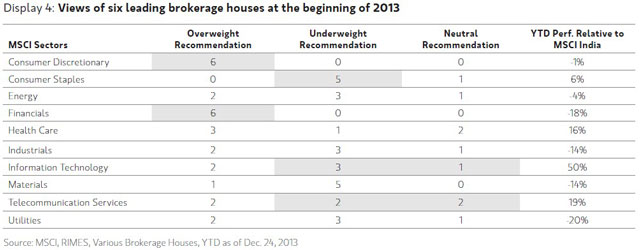

The experience of sell side sector positioning too has not been very encouraging. A quick look at the consensus sector positioning of brokerage houses at the beginning of the year reveals that the favourite overweight sectors were Consumer Discretionary and Financials. While Financials underperformed by a big margin, Consumer Discretionary barely performed in line with market. The favourite underweight sector was Consumer Staples, with the common excuse being that the sector is too expensive. That sector actually performed better than the market. Information Technology and Telecommunications too were far from outright favourites at the beginning of the year, but handsomely outperformed the market (Display 4).

7. Don't invest in beta:

What is worse than missing a stock market rally? Well, its timing the rally correctly, but investing in the wrong stocks. Investors realised that traditional high beta stocks under-performed in some of the rallies, while some of the defensives in sectors like healthcare outperformed. Clearly, one cannot predict forward stock performance based on historical beta. As Seth Klarman1 says "our settings are permanently turned to risk off". In short, do not invest in stocks on the hope that these will be propelled up in a mindless beta rally.

8. Do a pulse check to monitor the imbalances:

It is important to know the macro vulnerabilities, but also realise that it does not help to be constantly paranoid about them. Investors have to learn to identify the triggers that will cause an extreme reaction to these imbalances. In 2013 we realized that the chronic Current Account Deficit issue became front-page headlines after the Fed announced the likelihood of tapering of quantitative easing in May 2013.

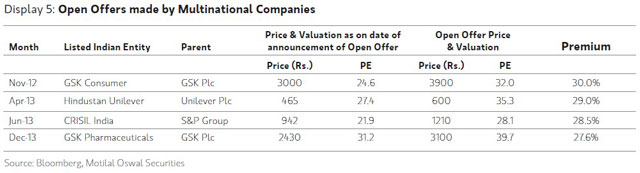

9. Know the intrinsic value to a knowledgeable buyer:

In 2013, Warren Buffett paid a 20% premium to buy a stake in Heinz along with private equity firm 3G in a US$23 billion deal. Value investors felt that this was not in sync with Buffett's typical playbook of investing. This idea of a knowledgeable buyer seemingly overpaying for a stake was in play in India too. Multinational companies increased stake in their listed Indian subsidiaries paying a premium over a market price that many investors already considered expensive on traditional metrics of valuation (Display 5).

A one-year forward Price Earnings ratio should be just one metric while evaluating a stock and shunning stocks only because that number is high may not be the right approach.

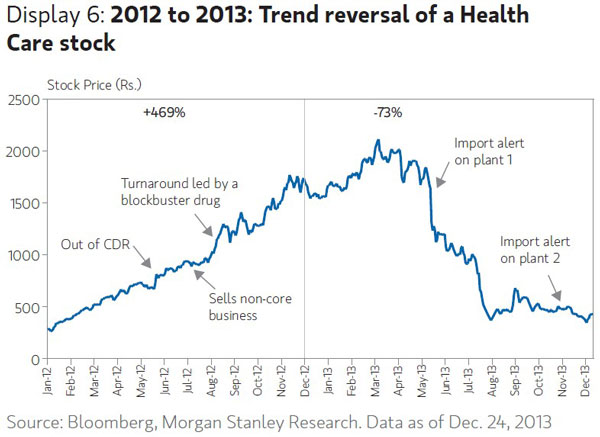

10. There is no last throw of the dice:

Markets are ever evolving. Successes and failures can prove transient. The best performers of one calendar year may be amongst the worst the next year. We witnessed this phenomenon with a stock in the health care sector, which enjoyed a lot of hope and hype last year but came crashing down this year after inspections by the US FDA regulators revealed serious shortcomings (Display 6). One might feel euphoric or depressed depending on how the portfolio is performing for the time-frame under evaluation, but the game goes on...

As investors, we sometimes envy sportspersons who with advanced technology can analyse their last game or race in minute detail, to correct mistakes and improve performance. Until real-time brain mapping is available for investors while making investing decisions, an occasional retrospective glance is the best we have got. Season’s greetings and happy investing.

Important Disclosures:

As a part of Compliance disclosure, Amay Hattangadi and Swanand Kelkar hereby declare that as of today, [including our related accounts] we do not have any personal positions in the securities mentioned above. However, one or more Funds managed by Morgan Stanley Investment Management Private Limited may have positions in some of the securities mentioned in the missive.

The opinions expressed in the articles and reports on the website are those of the authors as of the time of publication. We have not undertaken, and will not undertake, any duty to update the information contained above or otherwise advise you of changes in our opinion or in the research or information. It is not an offer to buy or sell any security/instrument or to participate in any trading strategy. The value of and income from your investments may vary because of changes in interest rates, foreign exchange rates, default rates, securities/instruments prices, market indexes, operational or financial conditions of companies or other factors. Past performance is not necessarily a guide to future performance.

Investors are advised to independently evaluate particular investments and strategies, and are encouraged to seek the advice of a financial adviser before investing.

Charts and graphs are provided for illustrative purposes only.

1Seth Klarman is the founder of the Baupost Group, a Boston-based private investment partnership.

© 2013 Morgan Stanley

Share this article

|