|

Like most financial services professionals, the first (absolutely unnecessary) thing we

do in the morning lying in bed, is scroll through e-mails and messages. On one such

bleary-eyed morning, there were three messages vying for attention. The first was a

newswire alert on Facebook acquiring Whatsapp for a whopping USD 19 bn. It was

followed by an overjoyed text message from a batch mate who owns a Silicon Valley

start-up that smacked of vindication of her decision of not joining an investment

bank from campus. The third from a colleague bemoaning the loss of capital

discipline and how everything was a bubble that would come crashing down. Rather

than taking sides, what we were amazed by was how a financial transaction had

evoked equally strong and opposite reactions from financially knowledgeable people.

If there was a universally accepted right way of valuing companies or assets and

everyone knew it, why would transactions occur? Well it’s got to do with the

untaught ‘art’ part of finance where, as our two friends showed, one group of people

does things that another group simply cannot comprehend. Professor Aswath

Damodaran of Stern School at NYU neatly segregates the two camps into investors

and traders1 – the former believe in value, the latter in price and he cautions that

it can be dangerous to think that you can control or even explain how the other

side works. Another interesting way of splitting the investing tribes comes from

Ben Hunt, the author of Epsilon Theory2 – those that speak the language of mean

reversion and others who speak the language of extrapolation. The mean reversion

tribe believes that no variable can deviate for too long from its long term average reading – be it GDP growth or Price Earnings ratio. So the philosophy then is to buy below long term average and sell above that number and as one would expect, many members of this tribe are avowed value investors. The extrapolation tribe likes to spot trends early and jump on to the bandwagon fully knowing that what they are buying may look ridiculously expensive on current numbers but mentally they have drawn a straight line or better still, an exponential J-curve for the trend that they have caught on to.

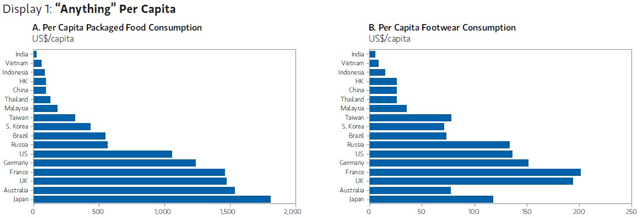

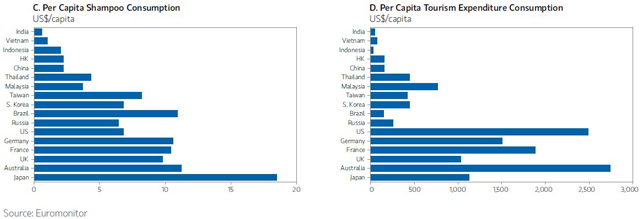

Rewind to circa 2006 when the extrapolation trend was at its peak in India. We believed in the inevitable growth of savings, investments and GDP. Every research report we read during that period had ‘a per capita statistic’ of India versus other economies within the first few pages (Display 1). When you have a billion plus in the denominator and generally a miniscule numerator, justifying the rise and rise of anything from cement consumption to mobile penetration is easy and convincing. Almost every company and sector became a secular growth story in that narrative and if you took the extrapolation sufficiently further out into the future, even the economy became one of the largest in the world (Display 2). Or consider the newest darlings of extrapolators – quick service restaurants and online shoppers – looking at current valuations it seems that in a few years everybody in India is going to order pizza online. The mean reverters complain that investors who invest in these businesses are off their rockers while the extrapolators urge them to open their minds to the new reality.

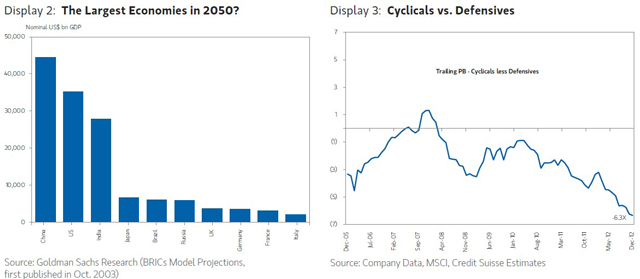

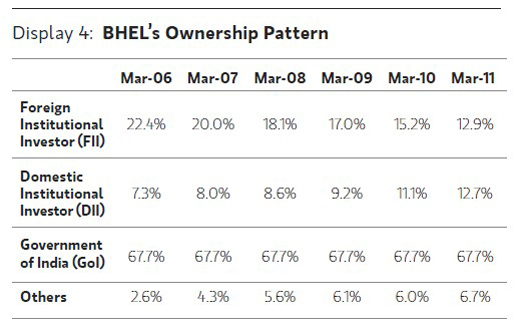

The jury is still out on who is going to win that debate but we know that there are enough cautionary tales in the histories of both tribes. Going back to the middle of last decade, some of the companies that wore the mantle of secular growth were associated with power generation, software assisted education and micro-irrigation for farms. When the neatly laid out trend of extrapolation faltered for whatever reason (usually hubris), the investments exposed themselves to significant losses. It was like seeing a Bollywood starlet without the make-up and flattering lights. On the other hand, the mean reversion crowd has been calling for poor performance of defensive sectors like consumer staples and pharmaceuticals and resurrection of beaten down ones like capital goods for a few years now but the valuations continue to defy their credo of mean reversion (Display 3). Ownership patterns can reveal which camp a stock is appealing to. Foreign Institutional Investors (FIIs) owned over 22 percent of

Bharat Heavy Electricals Ltd. (BHEL) equity in March 2006 but that number had dwindled to less than 13 percent by March 2011. The Domestic Institutional ownership over the same period had however risen from about 7 percent to almost 13 percent (Display 4). While it is difficult to draw generalizations, the FIIs have looked at Indian stocks from a growth lens while domestic institutions have had a value bent. It’s not difficult to infer that the dominant investment rationale on BHEL today is that of mean reversion and not of extrapolation.

As we outlined in one of our earlier essays, the markets resemble a Keynesian beauty contest where guessing what the median opinion would be is more important than your own perception of beauty. While one might be perplexed by things that look ridiculously priced or an outright steal, it is important to bear in mind that there is another group of individuals who might be thinking the exact opposite. The tug-of-war of these two opposing groups will decide which investing style will succeed in markets.

Important Disclosures:

As a part of Compliance disclosure, Amay Hattangadi and Swanand Kelkar hereby declare that as of today, [including our related accounts] we do not have any personal positions in the securities mentioned above. However, one or more Funds managed by Morgan Stanley Investment Management Private Limited may have positions in some of the securities mentioned in the missive.

The opinions expressed in the articles and reports on the website are those of the authors as of the time of publication. We have not undertaken, and will not undertake, any duty to update the information contained above or otherwise advise you of changes in our opinion or in the research or information. It is not an offer to buy or sell any security/instrument or to participate in any trading strategy. The value of and income from your investments may vary because of changes in interest rates, foreign exchange rates, default rates, securities/instruments prices, market indexes, operational or financial conditions of companies or other factors. Past performance is not necessarily a guide to future performance.

Investors are advised to independently evaluate particular investments and strategies, and are encouraged to seek the advice of a financial adviser before investing.

Charts and graphs are provided for illustrative purposes only.

1Retrieved Mar. 10, 2014 from http://aswathdamodaran.blogspot.in/2014/02/facebook-buys-whatsappfor-

19-billion.html

2Retrieved Mar. 10, 2014 from http://www.salientpartners.com/epsilontheory/pdf/7_14_13-The-Marketof-

Babel.pdf

© 2013 Morgan Stanley

Share this article

|