|

WF: In what ways have you restructured Tata Corporate Bond Fund and why?

Nagarajan Murthy: With interest rate policy stance changing to neutral from accommodative, yields will have stable to rising bias. In such environment, Tata Corporate Bond Fund is positioned around lower duration spectrum with focus on accrual as well as credit quality. The fund would generate accruals by taking exposure to short-term corporate bonds of high quality issuers.

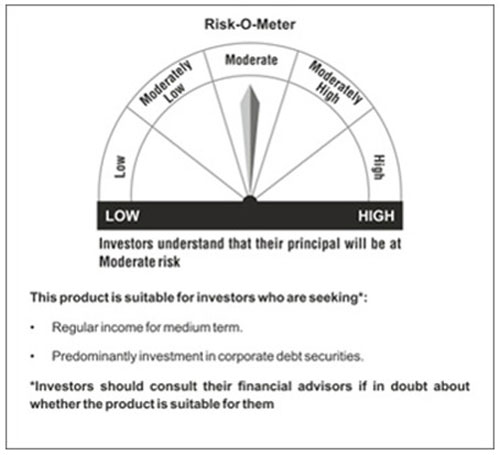

Tata Corporate Bond Fund is suitable for retail investors who have a holding period of more than 3 months. It would create a portfolio of corporate bonds and money market to take advantage of favourable yields present in the short end of the yield curve compared to the current repo rate of 6.25 %. As the maturity of the portfolio is lower, it would benefit investors in a rising interest rate scenario.

WF: Will the fund always maintain a low duration strategy or will duration be dynamically managed?

Nagarajan Murthy: Given the change in monetary policy stance to neutral from accommodative and RBI's continued thrust on maintaining CPI inflation at lower levels, interest rate seems to have bottomed out in current cycle. Further, best of the easy banking system liquidity - driven by ban on SBNs - is behind us, with majority portion of currency making its way back in economy. With interest rate trajectory expected to move up gradually over medium term, lower maturity products focusing on income accruals may outperform duration products.

In a medium term, thus, fund would maintain a low duration strategy. The Fund would not change duration on dynamic basis, unlike Dynamic funds. The fund, however, has flexibility to increase duration when the interest rate cycle changes.

WF: What will be your stance on credit quality in this fund? Will you stick to high quality despite relatively lower yields or do you plan to go down the rating curve in the quest for higher yields?

Nagarajan Murthy: Tata Corporate Bond Fund, as mentioned above, would confirm to the existing SLR framework of Tata Mutual Fund. The Fund would take higher proportion of exposure to Issuers offering higher yields within existing credit framework, relative to other existing Tata Funds. The Fund would not go down the credit curve to increase accrual, and would not invest in any security rated below AA-, by any of the rating agencies. Thus, high credit quality will remain top priority of the fund.

WF: What is the Tata Savings + app and how does it work?

Nagarajan Murthy: Tata Savings+ app is a mobile app developed for existing Tata Mutual Fund individual investors. Currently four of Tata Mutual Fund schemes are available on the app: Money Market Fund, Liquid Fund, Corporate Bond Fund and Ultra Short Term Fund. It shows the portfolio value of the said four funds and provides easy access to purchase and redeem units of these funds.

An investor can make a lumpsum investment into Tata Corporate Bond Fund and then set up a Systematic Transfer Plan facility at a daily or weekly or monthly frequency to move money from TCBF to any of the equity funds of his choice.

WF: Given the continuing sluggishness in credit offtake, why do you believe interest rates will rise in India? Where do you expect the 10 yr gilt yields to go up to by March 2018?

Nagarajan Murthy: Given the change in monetary policy stance to neutral from accommodative and RBI's continued thrust on maintaining CPI inflation at lower levels, interest rate seems to have bottomed out in current cycle. Further, best of the easy banking system liquidity - driven by ban on SBNs - is behind us, with majority portion of currency making its way back in economy.

Bond yields are expected to be stable or have an upward bias as the Indian economy remonetizes. CPI inflation is expected to move up due to the implementation of 7th Pay Commission allowance, increase in minimum support prices and upward pressure from global commodity prices. However, FII flows and insurance demand is expected to be strong which should support bond yields.

WF: A rising interest rate environment is usually not supportive for bond or equity markets. Is your view turning cautious on both markets now?

Nagarajan Murthy: We are cautious on interest rates as stated above and feel shorter duration funds would outperform longer duration fund in medium term. For Equities, rising interest rate are just one of many parameters. Furthermore, the intention of central bank to remain cautious on interest rate is to keep macro-economic indicators stable, which would act as a positive for equity markets in current volatile global environment.

Interest rate has structurally moved to benign as commodity inflation has moderated meaningfully which is good for capital flows in the market.

Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purpose only and do not construe to be any investment, legal or taxation advice. Any action taken by you on the basis of the information contained herein is your responsibility alone and Tata Asset Management will not be liable in any manner for the consequences of such action taken by you. Please consult your Financial/Investment Adviser before investing. The views expressed in this article may not reflect in the scheme portfolios of Tata Mutual Fund.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Share this article

|