|

Year gone by has been a revelation in terms of investor behavior & participation during a volatile equity market year. As Mr.Sundeep Sikka mentioned in his recent interview with WealthForum (Click Here):

Unlike in the past, where exuberance or abject pessimism led to volatile fund flows, we are now witnessing more measured investor participation. As I mentioned earlier, today SIP flows alone account for nearly USD 4 bn per year, which is one-third of the total net flows into equities. Another one-third comes into balanced funds and the rest into diversified funds. The flows tend to be structural and spread over a period of time. Very clearly, there is a trend of household savings moving into financial assets, away from physical assets, which augurs well for our Industry. We need to keep up the good work going - which is emphasizing on the benefits of long term investing, while ensuring that the messaging is as simple as possible.

Though this is the step in the right direction & a lot of credit should go the Advisory community, we have still not touched the Tip of the Iceberg as to make investments in Mutual Funds the First Recall for investors. Household savings in India are as high as 30% plus with very low participation of that house hold savings going into Financial Assets (equities, debt, mutual funds etc.)

What are the key communications which the industry should focus in the current Year to strengthen this new found behavioral change of the investors (for the better & for their own benefit)? We need to keep this momentum going & ensure that we create Happy Investors who in turn become the Brand Ambassadors for our Industry & start looking at Mutual Fund investments as their First Choice. MF schemes should become PULL products rather than PUSH products.

For that investors need to understand what is best for their financial health. We need to address these issues in the current year. Following are the two main themes for communication:

Rule of 30:30 & Rule of 72 & its implications on Savings

Communication # 1: Rule of 30:30

One of the most important communications that we fail to deliver to the investors is the Rule of 30:30. Rule of 30:30 is that an investor has 30 years of professional life (Golden Period) & 30 years of retired life (Golden Years). They need to be aware that they only have 30 years during which they have to achieve the following & much more:

Provide for day to day living Provide for medical emergencies Provide for material needs like cars, houses, holidays, etc. Save & invest for kids education & marriage, Save & invest for their own retirement & Also, during this period create a second source of income

If the investors take these 30 years lightly, then they may not be able to achieve some or all of their goals & aspirations. Hence, they need to have discipline, patience & remain long term investors to achieve all the goals.

Within this Rule, we need to communicate the following:

i) Create SILOs for different goals & do not subsidise one goal with the others:

We fail to communicate that the investors should not subsidise one goal with other goals. Investors need to create different investment verticals for different goals like education/marriage of the kids, retirement goals, short term goals like buying a car, etc. & not dip from investments for one goal to finance/fund their other goals. Most Indians get emotional when it comes to their kids & their requirements. Investors in such cases dip into their retirement corpus that they may have built through say PPF & take loan against the same to fund their kids' education/marriage etc. (ideally they should have created separate investments for these goals). This situation is very aptly shown in the movie starring Amitabh Bachchan & Hema Malini titled "BAGHBAAN". A must see for every investor.

Reason why Insurance industry & products are popular is because they create Emotional Attachments with the products by creating different schemes for different goals of the investor like Child's Education Schemes, Child's Marriage Schemes, Retirement schemes, etc.

ii) How to Create Second Source of Income from small investments:

When I conduct Investor Awareness Programmes (IAPs) for young students & with those who have just started their careers, first excuse is that they don't have money to invest or they have very limited capacity to save & invest & hence, it does not make sense for them to get into the habit of saving & investing. I have to then show them the mirror in terms of their spending habits & show them how they could have saved by becoming prudent in their spending habits, saving that amount, investing the same & creating wealth for them over a period of time. I have to ask them "Are your excuses greater than your Dreams?"

Following example open their eyes & clears their myths on what small amounts of investment can achieve in their lives by saving from their day to day expenses & investing the same: (assuming that the investor is 25 years of age)

New Phone every 6 Months= 12,000* 2 = 24,000 = 2,000 pm.

= Rs.6 lacs in 25 years = Rs.54.49 lacs @15% p.a.

Dinner Outings & Entertainment = 1,000 to 2,000 per outing = 1,500 p.m.

= Rs.4.50 lacs in 25 years = Rs.40.87 lacs @15% p.a.

Fees & Penalties = 6,000 p.a. = 500 p.m.

= Rs.1.50 lacs in 25 years = Rs.13.62 lacs @15% p.a.

Credit Card Interest on O/S Balances= 15,000 p.a. = 1,250 p.m.

= Rs.3.75 lacs in 25 years = Rs.34.06 lacs @15.p.a.

Retail Therapy : Full Price v/s Discounts= 6,000 p.a. = 500 p.m.

= Rs.1.50 lacs in 25 years = Rs.13.62 lacs @15% p.a.

TOTAL SAVINGS p.m. = 5,750 = Rs.17.25 lacs in 25 years = Rs.1.57 crores @15% p.a.

This amount when the investor turns 50 can generate second source of Income during his life time by being financially prudent in his younger days.

Communication # 2: Difference between Savings & Investing: Rule of 72

Another aspect which we do not communicate effectively with the investors is the importance of investing. Investors are under the belief that saving is equivalent to investing. Have we told the investors that based on Rule of 72 (which helps them understand in how many years their money will double if they know the rate of return on their investments) if money that is saved but not invested will halve in value based on the inflation number? If inflation has been say 8%, based on Rule of 72, investors' money will halve in 72/8 = 9 years' time.

This Rule clearly outlines the importance of taking into account the impact of inflation. Hence, following sub points should be communicated to the investors to get them into habit of a) Savings & Investing with impact of Inflation in mind ,b) Virtues of Patience & Power of Compounding, c) Importance of Riding Volatility & d) Benefits of starting early to generate Inflation beating returns, create wealth & come out on top:

a) Impact of Inflation:

Sir John Templeton said: "Invest for maximum total real return". This means the return on invested dollars after taxes & inflation.

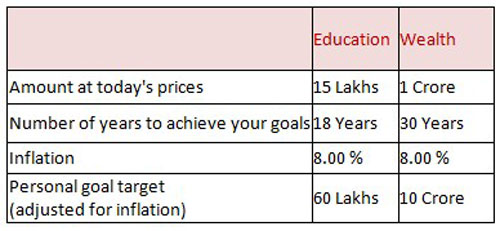

When I conduct Investor Awareness Programmes (IAPs), I show the audience following goals & figures which they wish to achieve over various time horizons. One such example is that they consider themselves wealthy if they amass Rs.1 crore at current value at their retirement time which is say 30 years away. Then I ask them whether they will start saving & investing through different means to amass this Rs.1 crore over next 30 years. Invariably their answer is in the affirmative. This amount as all of us know will be dismally short of their target if adjusted for inflation at say @8%. Actual figure (inflation adjusted) which investors should aim to amass over next 30 years (assuming they were happy with Rs.1 crore in wealth at current costs) is a staggering Rs.10 crores. Hence, they needed to save & invest over next 30 years to amass Rs.10 crores & not Rs.1 crore.

Similar mistake is made while taking life insurance cover. 30 years back a term insurance of Rs.25 lacs was a huge sum of money. However, if the insured is no more (post 30 years), value of that term insurance in terms of actual purchasing power in the hands of the beneficiary (adjusted at 6% inflation) is as low as Rs.2.48 lacs. This person needed to accumulate over this a period a term insurance of Rs.2.50 crores (adjusted for 6% inflation).

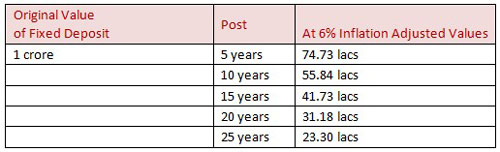

As soon as the investor turns 60 & becomes a senior citizen, only asset class that is recommended to them is Debt/ Fixed Deposits. Do these senior citizens know the Rule of 30:30? Rule of 30:30 as stated above is that there are 30 years of your professional life (known as Golden Period) & 30 years of your Retirement Life (which is known as Golden Years). Can the senior citizen depend on income from only debt instruments to survive through their retirement life? Income stream will start going down, expenses will mount during this period & purchasing power of their original investments will erode due to impact of inflation. Then why not encourage them to have some flavours of equity even during their retirement period? If equities as an asset class has worked during your professional life & helped create wealth, than why not equity during retirement period of similar tenor 30 years? (read my two articles on Why Fixed Deposits or only debt investments is not the ideal retirement planning for senior citizens & what strategies should they adopt for the same).

b) Virtues of Patience & Power of Compounding:

I want to cover long distance, I go by a bicycle, I want to cover short distance, I go by a plane. Sounds illogical? Unfortunately investors do exactly the same. For long term investments they prefer FDs or Tax Free Bonds & they invest in equities for shorter periods. We as an industry need to change this mind set of investors & work towards changing Investor Behaviour & Biases. For that we need to create right data points & explain the importance of long term investing & power of compounding.

"It does not look like much in the beginning. The power comes in the last 10 years from compounding the money saved in the previous 20" - Duanne Meek.

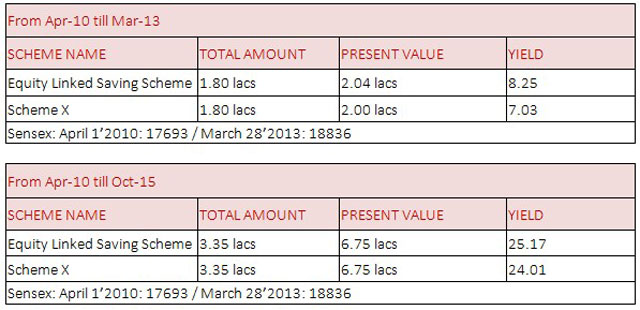

Investors lose patience, get disinterested, panic during volatility & generally take wrong investment decisions. When it is time to invest (like bearish market periods) they sell & vice versa. However, following data points can explain to them the importance of long term investing & power of compounding:

c) Importance of Riding Volatility & Not Panic during Volatile Market Periods:

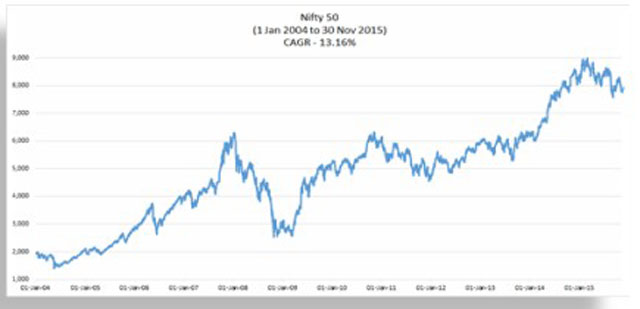

"You cannot reach the mountains without travelling through the valleys"- Brijesh Dalmia. If an investor sees the following graph of NIFTY from 2004 till date, it looks like an ECG of a heart patient. However, NIFTY has generated close to 13% CAGR during this period. Investors need to be sensitized to the fact that these returns will never come in one linear line. Investors needed to stay invested (even during 2008-2009 meltdown) & stay invested or invest more during these periods to come out on top & help themselves to achieve their long term goals.

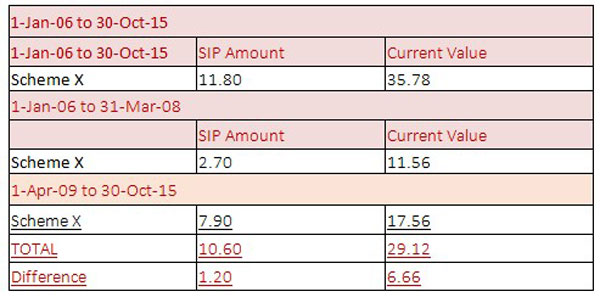

Following data shows the difference in value of investments through SIP by two different investors. First investor did investments through SIP from 2006 till 2015 & the second investor started SIP at the same time as the first investor viz. in 2006, discontinued his SIP during market meltdown of 2008-2009 (for one year) & restarted his SIP from 2009 till date. Difference in value in favour of the first investor on a base of Rs.11.80 lacs is humongous Rs.6.66 lacs. This just goes to prove why an investor should have continued his/her SIP during bearish market periods & in fact increased his SIP value v/s stopping the SIP.

d) Why start Early:

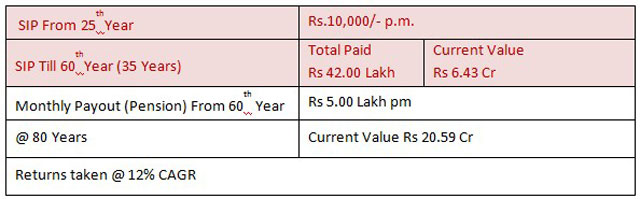

Today's youth only earns, spends & lives for the day. For them it is a joke to think in terms of retirement planning at such an early stage in their careers. They wish to enjoy their life to the fullest, maybe live on borrowed money through various loans & credit cards & have no care in the world for their future. However, if they are sensitized to the need & benefit of starting early for their retirement by showing them as to how they can create their retirement cum pension plan & teach them the importance of not depending on their parents for their every needs then they may start thinking & planning early for their future.

To know more on Effective Communication for Investors, please read 2nd Edition of my book titled: " Make Your Journey a Destination to Remember - Through Financial Planning". This is available on Amazon.in or you may go to my website: www.misterbond.in & place the order for the same.

Also, please read my 2nd book titled: "Pearls of Financial Wisdom - a Handbook for Investment Advisors" which is an ideal read for anyone who is in the Mutual Fund Advisory business. You may order this book through www.misterbond.in or directly from Amazon.in.

Everyone Needs to Understand & Remember

CREATE YOUR OWN WEALTH

Share this article

|