|

Once again media & Twitteratis went to town to create huge noise around JSPL downgrade to D by CRISIL a few days back. As responsible institutions, one should weigh both pros & cons of an event, its impact on markets & portfolios & come up with some sensible solution for the readers & hand hold them instead of only instilling fear in investors' minds who can then take some knee jerk, irrational decisions on their portfolios which in the bargain are injurious to their financial health & injurious to the overall industry as a whole.

One can actually draw a lot of comfort from Amtek Auto/JSPL issues by analyzing the positives of the whole situations. Since most investors understand the language of Equity investing (v/s investments in Debt markets), let me draw some similes & explain the same for readers' benefit:

Understanding fixed income through the equity language

Let us treat G Sec schemes/Dynamic Schemes (investing pre dominantly in G Secs & higher rated Corporate Bond Papers) as equivalent to Large Cap Equity schemes & Accrual Schemes/Credit Call Schemes as equivalent to Mid & Small Cap schemes. This will make life easier for investors & advisors to understand current market situations prevailing in debt markets.

In my earlier articles (Trilogy on Amtek Auto issue) I had highlighted 3 risks involved in debt market investments viz: Interest Rate Risk, Liquidity Risk & Credit Risk:

Interest rate risk can be compared with risk of an equity stock underperforming due to the Company's underperformance compared to market expectations v/s movement in NAVs of Debt schemes due to interest rise/fall Credit risk can be compared to some sectors underperforming like commodity cycle downturn & Commodity stocks underperforming (like JSPL issue) or frauds/scams happening in a Company (like Amtek Auto default), which then can have an adverse impact on the stock market performance Liquidity risk can be compared with maybe lower volumes of a particular stock which cannot be so easily offloaded in the equity markets & hence may quote huge discount to market price if an investor tries to sell bigger quantity of that particular stock

Now coming back to Credit Risk which I have compared to fraud/scam happening in a company (though not strictly comparable in that sense) or a sector going out of flavor as mentioned above; would an investor get out of an entire equity mutual fund portfolio just because one particular sector started underperforming or say when Satyam Computer scam broke out (& maybe this stock was there in a particular equity scheme?) There are many such instances of mid cap/small cap stocks going BELLY UP & eroding values in investor portfolios. Just because of a few rotten eggs, story of huge wealth creation over longer periods by mid cap stocks cannot be ignored by the investors; similarly just because of a few rotten eggs like Amtek Auto (which was an actual default v/s JSPL being a downgrade); investors cannot ignore the potential of earning far better tax effective returns in story of Accrual schemes v/s some of the so called Large Cap (Better credit quality schemes) like G Secs or Dynamic Bond funds.

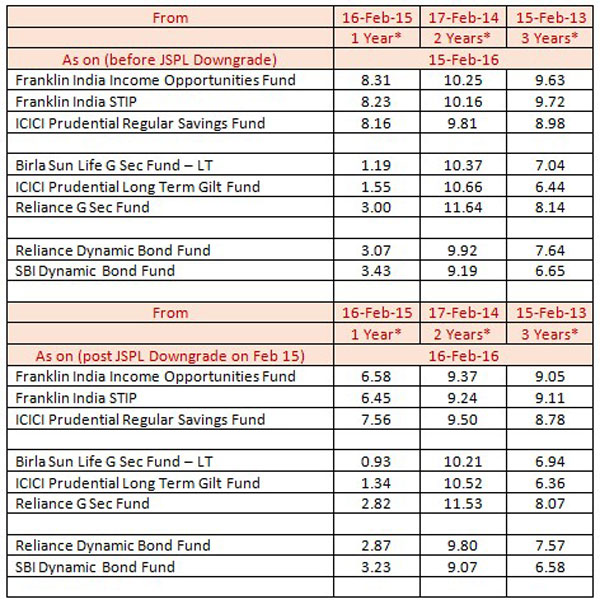

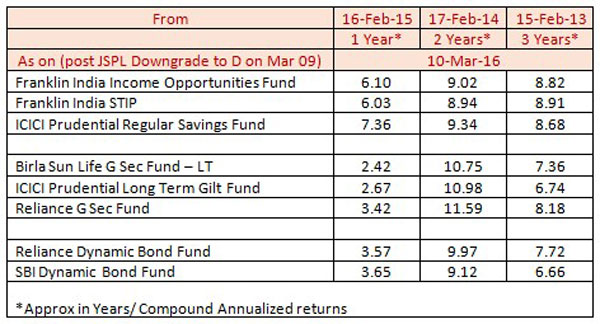

Following returns analysis of some of the G Sec schemes & Dynamic Bond funds (Large Cap in equity parlance) v/s Accrual schemes (Mid & Small cap in Equity parlance) inspite of the JSPL down grade, hair cut in NAVs due to these downgrades, maybe booking of some losses by the AMC in selling JSPL security will explain the importance of staying invested. This analysis demonstrates impact on investor portfolios in some of the schemes which had exposure to JSPL on various dates of downgrades/sale.

Mr. Aashish Somaiyaa had mentioned in the chapter of Equity Investing in my book "Pearls of Financial Wisdom" that "WAQT HAR ZAKHAM KA ILAAJ HAI" & longer you stay invested lesser the volatility; same is the case with debt markets; especially in accrual schemes wherein they post better tax efficient returns over 3 year periods v/s shorter periods & smoothens out any such aberrations which keep on cropping from time to time. Kindly look at scheme level performances rather than focusing on individual securities in a portfolio.

It is very evident from the table below the importance of having Mid Cap stocks (Accrual schemes) in an Investor's portfolio for both stability as well better tax efficient returns over longer period (3 years in case of debt investing) as well as better returns potential v/s G Sec & Income schemes which have underperformed grossly inspite of better credit quality.

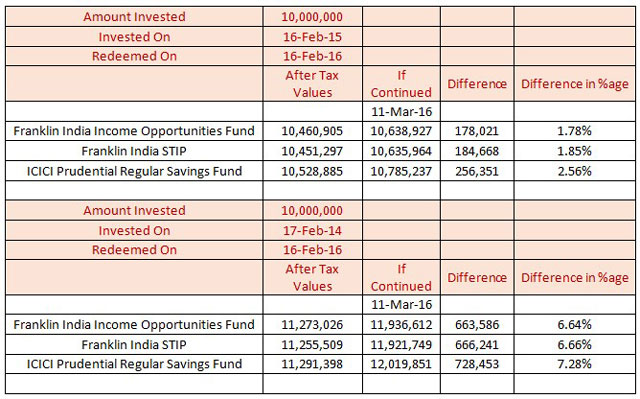

Following table will explain the implications for those investor who had not completed 3 years in some of the schemes which had JSPL exposure & impact of short term gains tax if redeemed (based on media noise on JSPL) v/s holding it till date :

As can be seen from the above table, those who exited & paid short term gains tax (for holding period of less than 3 years) would have stood to lose lot more (even after NAV haircuts on 2 occasions).

The way we do not look at individual stocks in an equity portfolio but broadly follow say Value Strategy or Momentum Strategy & leave stock selections to the Fund Managers, one should have similar approach in selecting debt schemes like Duration, Dynamic or Accrual & leave security selection to Fund Managers.

Also, Downgrades are only an opinion of one of the rating agencies & as I had pointed out in the past, how much can we actually rely on these Rating Agencies who are now trying to become extra proactive in their ratings just to save their backsides.

Now, look at the possible upside

For any new investors or an existing investor wishing to invest additional funds, this adversity of JSPL downgrade in any debt portfolio is an opportunity to make money. Due to downgrades & lower valuations of JSPL security, YTM of this security has gone up beyond 20%; thereby increasing overall Net YTM at the scheme level as well. For example, due to some small exposure to JSPL in say ICICI Prudential RSF, net YTM at the scheme level has gone up by almost 0.50%.

Also, those who understand the concept of Roll Down, and further assuming that JSPL pays some or all of their dues to these MF schemes on their respective maturities, Roll Down concept will pull the price of the security upwards; thereby generating huge capital gains in the portfolio. If a bond is trading at a discount, then Roll Down effect will be positive i.e. the roll down will pull the price upwards towards par & vice versa.

Positives to take from these incidents & Lessons to be learnt

Benefits of diversification through the Mutual Fund route Concentrate on overall scheme performance rather than concentrating on analyzing underlying securities. Due to benefits of diversification, impact on overall scheme performance is negligible Benefit of long term investing with lower standard deviation Ignoring media noise & not taking irrational & knee jerk reactions Let us not kill an asset class called Accrual Schemes which follow certain strategies & are all Seasons schemes which can compete with most popular investment vehicle called Fixed Deposits (FDs) Even in Amtek Auto issue, the concerned AMC could actually manage to salvage & recover almost 85% of the exposure to the said security As seen from returns table above, in case of some of the schemes which had/have exposure (Franklin Templeton has sold off the entire exposure of JSPL held in various schemes) in JSPL, inspite of first haircut in NAVs in February & the second one post downgrade of the security to D in this Month; last 1/2/3 year returns are far superior to the so called Large Cap (better Credit quality schemes like G Secs & Dynamic Bond funds) Readers & investors will then have to decide what is best in their interest after analyzing above points & then coming to some logical conclusion v/s taking irrational/knee jerk reactions For those investors who redeemed before completion of 3 years; gains from holding the same for more than 3 years far exceeded what they would have lost due to hair cut in NAVs post downgrades & paying short term gains tax simultaneously

Share this article

|