|

I had recently attended Wealth Forum Conference in Mumbai where one of the Topics for discussion was the current fad of dividend declarations by the AMCs in their Balanced Funds and making it their sales USP to garner AUMs. There was a much heated debate between some of the CEOs sitting on the dais and the IFAs who were part of the audience. Finally an instant Audience Poll was conducted on whether this is a good practice or not and the pleasant surprise was that 90% of the audience voted against using monthly dividend declaration tool to lure investors funds into these schemes - and rightly so.

According to me this is gross mis-selling to lure investors to invest funds into such an asset class which is extremely volatile (be it balanced funds or pure equity funds). Sales staff of some of the AMCs have gone to town in promoting their Balanced Funds based on the huge Reserves (accumulated from actual profit bookings as dividends can be declared only from realized gains) of the past.

Unfortunately the unsuspecting Investors don't realise the following:

Dividends cannot be assured (they have been told otherwise) Dividends can be declared only from realised gains (I don't think they can understand implications of this) When markets go into correction mode, even if the AMC declares dividend from their Reserves created from past realised gains; the same maybe coming from their principal i.e. Investors may actually be getting their own principal back in the form of dividends Once, these reserves get depleted, the AMC may not be in a position to declare dividend in falling market scenarios One of the AMCs skipped declaring all 12 monthly dividends in their MIP during 2008-2009 market melt downs Those investors who need regular cash flows will then be at a total loss under such circumstances Even Fund Managers have to per force book profits from time to time to declare dividend instead of holding onto these equities for future growth Also, my understanding is that profits booked at scheme level get apportioned to both Growth as well Dividend Payout options in proportion to their scheme corpuses; which means that there is profit booking happening (for no rhyme or reason) even for Investors under Growth Option Those who opt for regular dividend pay outs; lose on the opportunity of creating future wealth as power of compounding is lost on the funds repaid as dividends Many times, Investors may get Dividends more than their genuine requirements and hence lose out on Wealth creation going forward

Ideal and better way to guide your investors is to opt for Systematic Withdrawal rather than dividend pay outs

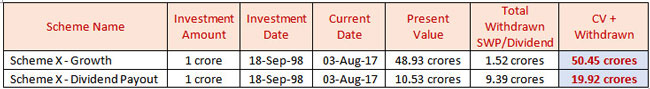

Following is actual data of one of the Equity Schemes- Dividends paid from the date of investment v/s SWP @8% from the same date of investment and their final values under both the strategies:

As can be seen from the above table, there is a huge difference in wealth creation by the Investors under both the strategies:

Under SWP, investor has withdrawn @8% p.a. (Rs.8 lacs p.a.) which is Rs.1.52 crores over this period from 1998 to 2017 Same Investor under Dividend Payout has received Rs.9.39 crores (which is almost average of Rs.49.42 lacs p.a.) As one can see from the above, Investor whose requirement is not more than 8-12 lacs p.a. is receiving on an average Rs.50 lacs p.a. which is way beyond what the Investor actually needs Since, funds have flown out of the Investor's portfolios (and assuming the same are not invested again), CV of the said Investor under Dividend Payout Option is Rs.10.53 crores v/s CV of the same scheme under Growth Option is Rs.49 crores (almost 5 times) From the following table it will be evident that how Inflows through Dividend Payouts can be a) Erratic and many times b) Excess Investor has received no dividends in at least 3 years since 1998

Conclusion

Do not get swayed by assured monthly Dividend payout stories and sell Balanced or Equity schemes based on the same This tantamounts to mis-selling and should be avoided at all costs Explain the pros and cons of Dividend Payout option v/s SWP and guide your investors accordingly For regular cash flows + Wealth creation; SWP as shown above is a far superior strategy

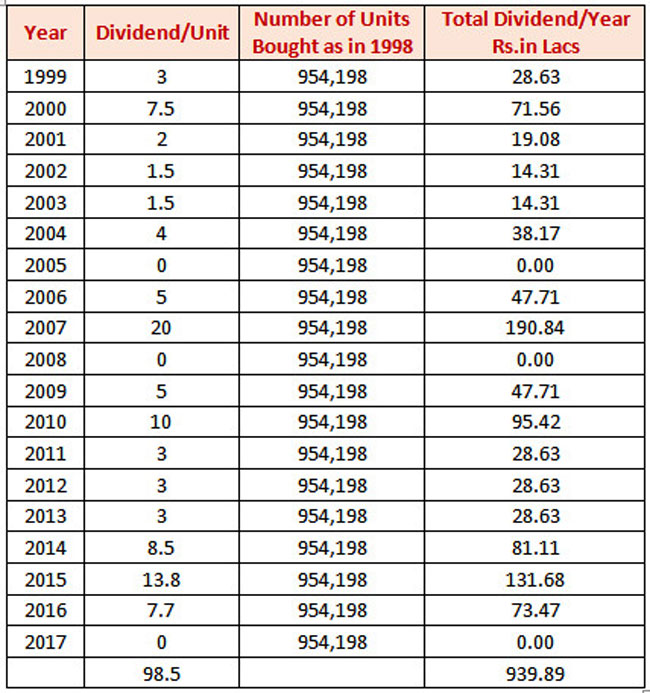

Let us now analyse Erratic and Excess inflows through Dividend Payout/Year

In the table above, we looked at an investor who invested Rs. 1 crore in Sep 1998 in an equity oriented fund, and summarized his total dividend receipts upto 2017 at Rs. 9.39 crores. Here is how the annual dividend flows actually came over the years:

Not only did he sacrifice huge upside from the growth option (with an SWP @ 8%), but the wide fluctuations in annual dividends received renders any cash flow planning extremely difficult. What benefit does the investor really get when we recommend monthly dividend option instead of an appropriate SWP? Time for us to do some soul searching.

I have been vocal with most AMCs to do away with Dividend Payout options altogether. Though it may look like a bitter pill; but a pill which is good for the Financial Health of the Investors. This way we will be able to guide the investors on the right path. Also, imagine one of the Fund Houses which believes in BUY RIGHT SIT TIGHT philosophy of investing. Where can they generate reserves to declare dividends? Not declaring dividends will not only help investors but also Advisors (to guide Investors on the right Track) and Fund Managers (who will not have to book profits unnecessarily just so that they can declare dividends).

Share this article

|