|

Sensex levels on January 01'2016 was: 26161. Sensex on December 26'2016: 26040. Last 52 week high was 29,045 as on September 08'2016. In short, with a Roller Coaster Ride, Sensex delivered practically no returns in 2016.

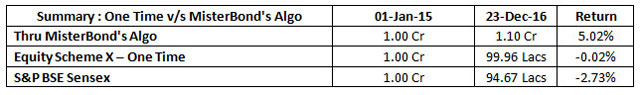

However, if an investor would have invested through Asset Reallocation strategy either through say MisterBond's Algo or a scheme like Motilal Oswal Dynamic Equity scheme or ICICI Prudential Balanced Advantage Fund; returns would have been on the positive side of approx. 5-6 % p.a.

How does this happen & why does this happen? My own Algo has shown allocation of only 40% in Equity over past 9 quarters starting from January 2015. Does this mean that Asset Rebalancing schemes have remained static throughout this last one year period & no movement happens in these Rebalancing schemes?

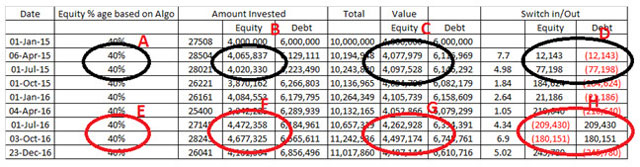

Let me try & demystify this phenomenon. Under Asset Reallocation strategies, let us assume that we are going to carry out this exercise based on certain parameters of PE/PB/Dividend Yield, etc. on a quarterly basis. What this means is that we have to apply the allocation (in this case 40% in Equity) to the combined value of the portfolio (including debt & equity). When we apply this to the closing value every quarter, the reallocation strategy will either add or reduce from equity based on the closing valuation. I have highlighted below 4 different columns to explain this & marked them as A,B,C & D.

A : Shows the % allocation in Equity based on MisterBond's Algo; which in this case in both quarters ending April'15 & July'15 is 40%.

B : Shows current value of Equities as on the above quarter ends.

C : Shows that Equity allocation based on overall portfolio valuation after applying MisterBond's Algo should have been Rs.40.77 lacs as on quarter ending April'15. As against that, current equity valuation was Rs.40.65 lacs ; thereby triggering switch from debt to equity of approx.Rs.12,000/-.

Similarly, current value of equity as on quarter ending July'15 is Rs.40.20 lacs v/s Rs.40.97 lacs based on the Algo calculation; thereby triggering switch from debt to equity of approx.Rs.77,000/-

Portfolio Movement through MisterBond's Algo from 2015-2016:

Now let us look at the other side when the Algo triggered profit booking i.e. switching from Equity to Debt when valuations started going up:

As can be seen from the circles marked in Red as E, F, G, & H, Algo is still showing only 40% in equity allocation for quarters ending July'16 & Oct'16. Value of Equity as on July'16 was Rs.44.72 lacs. However, based on Algo, Equity Allocation should have been Rs.42.63 lacs; thereby giving a trigger to do some profit booking (as Sensex had jumped up from 25400 in the previous quarter to 27,145) in this quarter) from equity & switching to debt of Rs.2.09 lacs. Same was the case in next quarter ending October'16.

As can be seen above, it is a wrong notion to think that no movement is happening in the scheme or Asset Reallocation strategies when these strategies either through some Algo like MisterBond's or Motilal Oswal Value Index (MOVI); Equity to Debt allocation remains constant at say 40 or 55 or some such % for some months or quarters. These strategies are having some movements based on the underlying valuation of the portfolio & they are constantly BUYING LOW & SELLING HIGH which gets reflected in returns even during bearish periods or stagnant periods like 2015-2016.

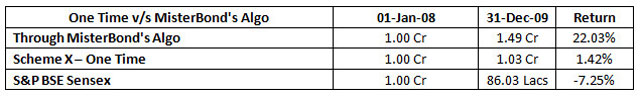

I will share one more data point from different timelines like 2008-2009 bearish period : First the Summary Table:

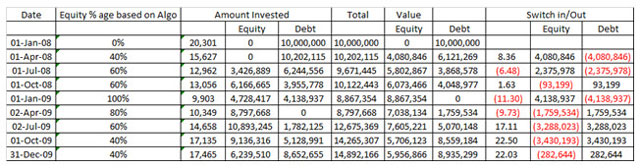

Above sheet shows how the Reallocation Strategy thru MisterBond's Algo started with 0% in Equity in January 2008 & thereafter started increasing allocation to equity when market started collapsing & went to 100% in Equity by January 2009 & then once again started profit booking when markets started bouncing back from a low of 8500 to 17,500 in December 2009 (with allocation of only 40% in Equity at that stage).

Post Demonetization & going into 2017, I expect the Equity markets to be range bound with downward bias for various reasons viz.:

Due to demand contraction, GDP growth numbers for next few quarters will be on lower side Strengthening $, rising US Yields will ensure funds flowing out of emerging markets including India Till now FIIs were selling & DIIs were buying Indian equites. Even DIIs will take a breather at some time in near future In such a scenario, ideal way to invest in equities is through Asset Reallocation strategies which Marry Fundamentals to Equity investing with strategies for profit booking in place (as explained above) & constantly BUYING LOW & SELLING HIGH

Share this article

|