|

Determining the ideal rate

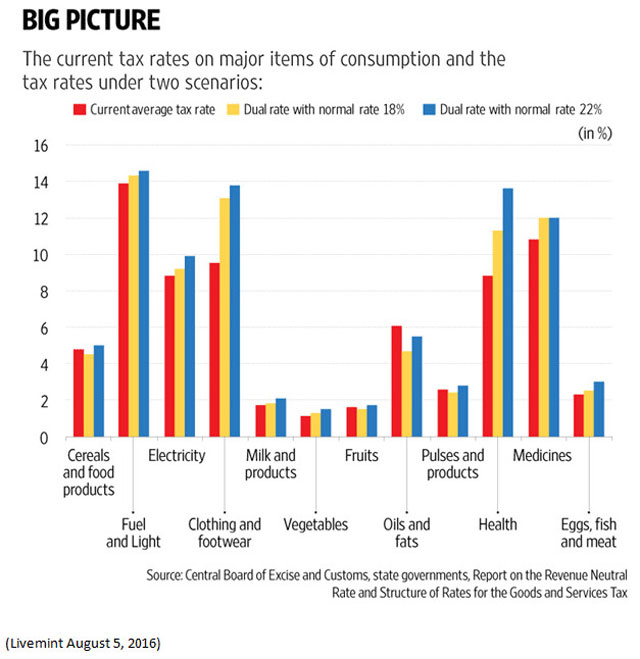

The government is working overtime to get the GST in operation from April 2017 onwards. The Arvind Subramaniam report has suggested that a Revenue Neutral Rate, RNR, of 15% - 15.5% would be ideal. The panel looked at three possible variations of rates. The first model posited a 14% rate with no exceptions. In the next instance, the panel studied a model with a low rate of 12%, a standard rate of 18% and a high rate of 35%. The third scenario differs from the previous one only in that the standard rate is fixed at 22%, the other two being left at the same levels. Since the first option has been virtually ruled out, the chart below shows the impact of the rates under the last two scenarios.

Inflationary fears

Most economists are agreed that even with a rate of 18%, the impact on inflation would be minimal. A Nomura report estimates it to impact headline CPI (Consumer Price Index) inflation by 20-70 basis points (bps) and core CPI by 10-40 bps in the first year of implementation. If the rate is around 22%, Finance ministry officials project inflation to accelerate 30-70 bps. (Livemint August 5, 2016)

In this context it would be useful to know that many countries which adopted GST went in for a period of inflation and slowdown in consumption caused by changing prices of various goods and services. Whether this dismal scenario will play out in India also will depend on the RNR rate the GST Council adopts. "An RNR of anything beyond 15-15.5% will likely result in a standard rate of about 19-21%, which would make India an outlier amongst comparable emerging economies... Our recommendations would still place India at the upper end of the standard rates found across comparable countries. It is worth emphasizing that the GST is intrinsically a regressive tax and the higher the rate the greater the regressivity," says the Subramaniam report. (Livemint August 5, 2016)

Impact on the goods sector

Prices of some items like vegetables, cereals except for oil and fat, are likely to become more expensive. Similarly medicines and health services prices may go up. Tobacco prices too are likely to surge. Commercial vehicles, print media, jewelry and cigarettes could become costly.

GST on manufactured goods will be lower than the present excise duty rates. Currently these goods suffer about 25% tax. The new GST rates will almost certainly be lower. Hence prices of automobiles two-wheelers, fridges, air conditioners, electric fans, televisions and other electronic items will fall. Even cinema tickets may see reductions since GST rates will be lower than entertainment taxes.

Impact on service prices

The present Service tax is about 15% and the GST is likely to come in at between 18% and 22%. Many services prices could go up. Eating out, telephone charges, travelling, hotel stays could all become costlier. Insurance products such as life, motor and health, will also get costlier. Fund management fees charged to the schemes will go up as service tax is passed on to the scheme and therefore to investors. For fund distributors however, a GST rate of between 18-22% will represent a dent in their revenues as service tax incidence is not passed on to the schemes. Fee based financial advisors will be able to pass on the higher levy in their invoices, provided their agreements are based on fees exclusive of taxes.

"Services companies are looking at the GST as you would look at a snake," told Amit Kumar Sarkar, head of indirect tax at Grant Thornton to Reuters."Insurance solutions will begin to cost more starting April 2017 as GST will increase the current tax structure by 3 per cent, which means taxes will go up by 300 basis points," said Anil Chopra- Group CEO & Director, Bajaj Capital.

Higher GST on services will be inflationary

Services now form a big percentage of the consumer basket and any increase in prices due to GST would hurt middle class customers."While services comprise a very small share in CPI, they account for almost 50 per cent of the total consumption basket in the economy. Thus, while the impact of GST may not be visible in the official inflation measures, it will certainly pinch consumers, as the share of services has been rising," said Motilal Oswal securities in a research note. (Business Today, September 3, 2016). This additional burden will be offset for consumers by a drop in prices of manufactured goods, since GST is likely to be lower than the current levels of excise duty in most cases.

Financial sector concerns

At present, trade in securities is outside the ambit of the indirect tax regime. With the implementation of the GST this could change. The GST Model law indicates that securities in dematerialized form would be treated as goods. Derivatives and fund based activities are also likely to be liable for GST.

Further, for determining the place of supply of banking and insurance services the location of the service recipient is taken. This is not so for intermediary services and stock broking. The Model GST law provides some guidelines in this matter. The place of supply of banking and other financial services is taken as the location of the service recipient on the records of the supplier of services. It would be taken as the location of supplier of the service, where the service is not linked to the account of the recipient of services. The above scenario presents yet another difficulty, in view of the fact that there are many organizations that sell financial products online. Under the GST system, e-commerce companies are mandated to withhold tax. The place of supply rules will critically affect the organizational structure of existing service oriented businesses. Financial service providers may have to invest time, effort and money by reorganizing their businesses, like centralizing, closing branches, or by adopting new methods of marketing, to comply with the GST tax regime.

Conclusion

On the brighter side, most economists reckon that the implementation of GST would give the economy a boost of about 2%. Such an increase would be welcome at a macro level, whatever the travails of individual sectors. Nevertheless, it is hoped that given the salience of the financial intermediary services in raising capital, the government will take a sympathetic and realistic view of the difficulties that the sector faces even as it frames rules and decides rates under GST.

Share your thoughts and perspectives

Do you have any observations or insights or perspectives to share on this issue? Did this help you understand the topic better? Do you disagree with some of the observations? Please post your comments in the box below ..... it's YOUR forum !

Share this article

|