Alpha Comes From Right Beta

Dear Vijay, Thank you for the opportunity to present my views. WealthForum is a great platform to express one's ideas and since I have always been a salesman I love to get instant feedback. Comments on WealthForum are an instant feedback mechanism and that is what I love the about your platform. I urge all our readers to give their thoughts and express their views on this article too because it has not much to do with my company or my work, it has everything to do with our IFA friends' business and practice management. The idea of this expression - Alpha Comes From Right Beta came to me from comments during the QnAs at the WealthForum conference in Mumbai and also from some questions raised at the recent MFRT conference in Hyderabad. Basically, Alpha as we know it means the outperformance generated by the active manager over and above the returns delivered by the underlying index representing the broad asset class itself which we call as Beta. So Alpha - Beta is outperformance. As an industry we focus a lot on Alpha generated by fund managers but we ignore that there is larger Alpha that should be generated by the advisor or the distributor. And this alpha comes from the advisor's choice of asset allocation, the choice of right asset classes that one needs to be in; in order to fulfill the client's investment objectives, returns expectations and risk tolerance.

So coming back to what I was talking about the conference experience; IFAs in these conferences raised queries on why AMCs give calls to push sales and AuM in a certain segment of the market or an asset class. And a lot of these calls have failed to live up to expectations. There was good amount of ire related to these calls which on a lighter note we might say were "missed calls". Please note that I have also been party to these patterns in our industry since I started in 1999 and I am sharing my observations. I am in no position to blame or critique anyone, because I myself am a party to it. Please view this effort as one that is trying to share some learning and suggest a way forward!!!

Also it is worth noting that "missed" calls not only impact performance on the segment or asset class that has gone wrong, they also result in huge opportunity loss because invariably there is some other segment or asset class that does very well. So for instance, since mid 2012 till early 2013 there was a conviction call on Income Funds. Not only has this not worked, the fact is that International Funds as an asset class has worked very well. So investors lose returns on Income Funds and they also miss the opportunity of looking into International Funds which could have had high positive returns.

Also, there are some "calls" which either did not come or came across but in isolated fashion or selectively to some distributors or from selected AMCs only.

The other common query that IFAs raised in these conferences was that there is no "pull" from investors for Mutual Fund products.

It is worth noting that the "pull" comes after the "call". In the beginning of 2013 there was a pull for Income Funds and AMCs also gave a "call" for income funds starting mid 2012. The "call" comes with the returns or at the beginning of a returns cycle and the "pull" comes after returns have starting coming in.

Ultimately it's the IFA friend who is left holding the baby because he or she has to handle investor grievances. The sum and substance of this discussion and IFAs' feeling on this would be somewhat like this…

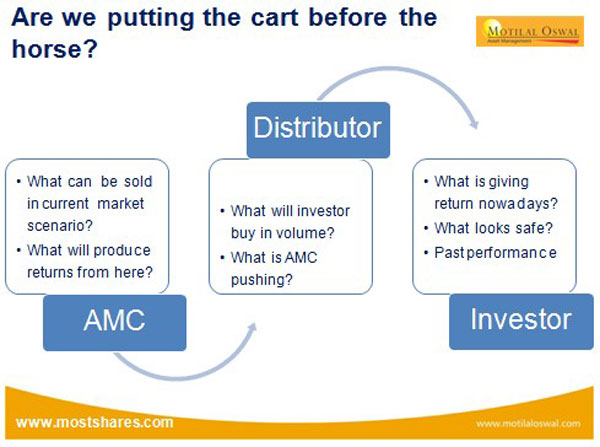

This entire situation begs one question….is this the right way to operate? Aren't we putting the horse before the cart? Let me share a pictorial representation of what I am trying to say. We seem to be working as shown in the chart below:

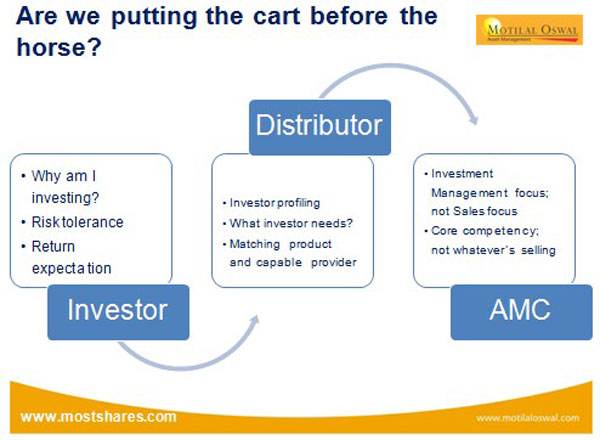

In an ideal world, we should be working as per the chart below:

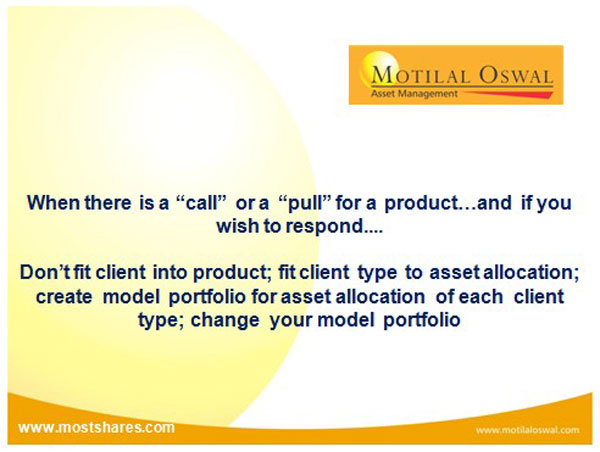

Keeping this in mind, you will notice that the entire debate on AMCs giving a call or product generating a pull is quite futile.

Let's start from the client facing side. If we have to enable the client to think through their goals and objectives and gain an understanding of their return expectations and risk tolerances we need a great understanding of their profile. But how does one get an understanding of client profiles and how can one manage to advice dozens or hundreds of clients if your client base looks like this?

If you wish to accomplish what's written above, your client base actually needs to look like this:

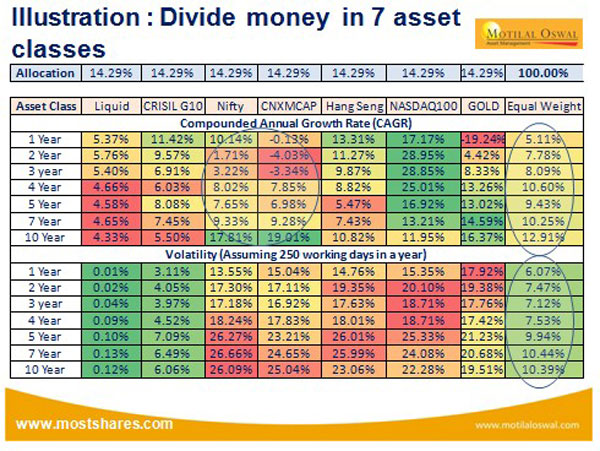

You need to arrange clients by profile into homogeneous groups and devise model asset allocation portfolios for each client. Instead of trying to manage portfolios of dozens or hundreds of unique clients; which is actually IMPOSSIBLE, one needs to manage 4 or 5 model portfolios by client type. So let's take an example, for some client type let's say you made a model portfolio which had asset allocation across 7 asset classes and for sake of simplicity you allocated equally across asset classes.

At the outset, do take note that the multi-asset portfolio presented below fares better than any individual asset class consistently and at the same time it is better on volatility too.

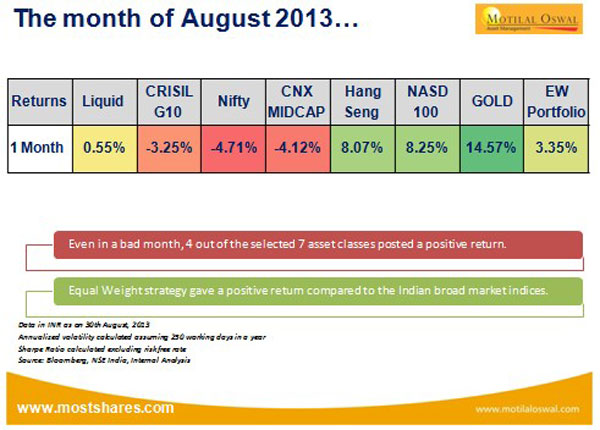

Secondly, we all know that August 2013 was one of the worst months in history where liquid funds, debt funds, large equity funds and midcap equity funds all gave negative returns. If you had followed a model portfolio allocation by client type, instead of responding to calls of AMCs or waiting for pull from customers this is what your experience would be…

Now, let's just think, in the month of August 2013 if all your money was invested in India and you had NIL allocation to dollar assets or gold, then within India how did it matter which fund you had invested or who managed your money? Are we focused on the right ALPHA? If the BETA you find yourselves in itself is WRONG, is the ALPHA going to help you? Do all your clients have a multi-asset portfolio first or are you first focused on giving them the best equity fund / best debt fund / best FMP?

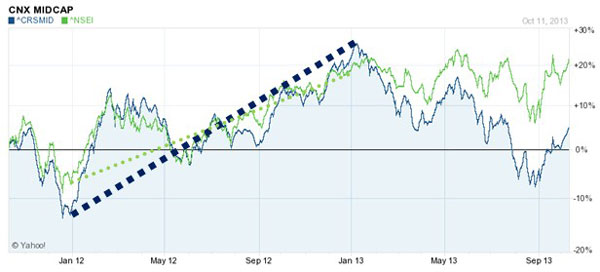

Just to elaborate see chart below, in CY2012, Nifty index was up 27% and CNX MidCap Index was up 40%. If you were with the best performing large cap fund in the country you could have got 30,31,32 or may 33% return. But when it came to midcaps just being in the index itself would have fetched you 40% return! If you are in the wrong bus, how does it matter how fast you go? If you identified the best performing large cap fund in a year when the midcap index gave 50% more return, basically you found a tall pygmy!!! Would you be happy with that?

Similarly, in 2013, as can be seen from chart below, the Nifty hasn't changed much, while the NASDAQ 100 has appreciated sharply. In a year like 2013, how does it matter who manages the money in India, if you did not have money in NASDAQ, half the battle is already lost!!!

So the clear message that comes out is that, we need to focus on the ALPHA that comes from the asset allocation done by an advisor / distributor. As an advisor / distributor you would be benefited by focusing on the following steps:

Get client profiling in place

Model portfolios by client type

Manage model portfolios for right asset allocation and populate them with right products

The ALPHA generated by advisor is greater than that generated by any fund manager

Next time an AMC gives a call or you see pull from Investors, go and revisit the model portfolios that you have made for each client type, and if you believe in the call or you wish to respond to the pull, change the weightage of the segment or asset class in question.

And remember....

Share this article