|

Click here

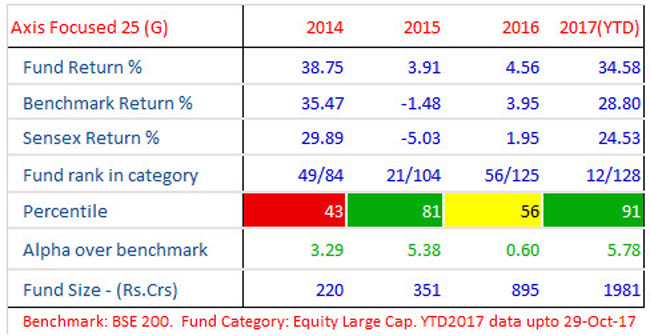

to know more about percentiles and the colour codes

What do percentiles and their colours signify?

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

WF: What is driving the top decile performance of your fund this calendar year?

What's changed from CY16 to CY17 to aid this sharp upturn in performance?

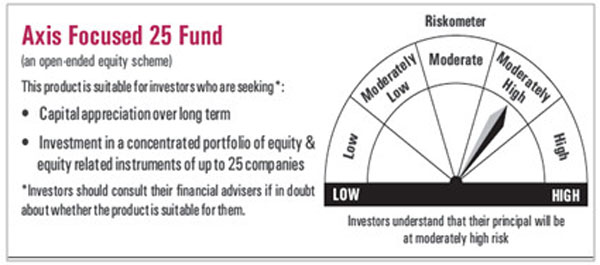

Jinesh: Axis Focused 25 Fund is a compact yet diversified portfolio with 25 stocks

that is focused towards higher ROE and low Beta. We target for companies that deliver

ROE / ROCE's over the medium to long term on a continuous basis.

Given the cyclical nature of equity markets, fund performance tends to vary over

different phases. In 2016, the market was not conducive for quality businesses which

formed the core part of the portfolio. The quality names lagged the cyclicals and

high beta stocks in this period. However, quality stocks are back in terms of performance

over beta stocks. Along with that, addition of strategic opportunities in quality

cyclicals along with the core quality portfolio worked well for the fund.

WF: Do you restrict yourself only to the large caps space or do you have a wider

mandate in search of your 25 best ideas? What has been the mix between large and

mid caps in your fund now and how has it moved in the last couple of years?

Jinesh: The portfolio has a large cap bias with more than 90% of the portfolio invested

within the top 200 stocks by market capitalization. Currently the fund has 65% in

large cap companies (Top 100 companies by market capitalization). Over the last

2 years, the large cap exposure has been in the range of 65 - 75%.

WF: You have large positions in two leading private sector banks and sizeable exposures

to a clutch of NBFCs, but no exposure to corporate/PSU banks. Why do you have a

vote of no confidence in corporate banks, in the context of the market's enthusiasm

around prospects of NPA resolution and pickup in corporate credit offtake amidst

an expected economic recovery?

Jinesh: In the last decade, the sector allocations in the market indices have changed

drastically. In 2003-2007, economy saw huge boom and heavy capex leading to cyclical

sectors prosper. While in the last 10 years, consumption related sectors have picked

up. The finance sector weight which was around 11% 10 years back, is now around

33%. We are playing the structural growth story linked to low credit outstanding,

GDP growth and market share gains for better quality players. We believe that niche

NBFCs would be able to take advantage of specific market opportunities.

We have typically avoided highly cyclical stories and highly regulated sectors.

We have also steered away from the stocks which have any type of regulatory problems

or the stocks with questionable corporate governance. With PSU banks, the NPA problem

is continuing and that is affecting the overall earnings growth.

WF: Your portfolio does not seem to be geared for an imminent sharp cyclical recovery.

Is that a fair statement? Are you circumspect on the cyclical recovery story as

a macro theme?

Jinesh: The fund maintains a compact yet diversified portfolio of up to 25 stock

ideas. This focused approach allows us to take a sizeable exposure to the high conviction

bets. Having said that, it is critical for a concentrated portfolio to have a longer

term view on the companies that form the portfolio. The portfolio strategy is hence

designed for risk adjusted returns over market cycles.

We look at 3 broad buckets while constructing the portfolio. The core portfolio

consists of steady compounders that can generate reasonable returns with low volatility.

2 other buckets consist of companies having a cyclical tailwind and emerging themes

with high growth potential.

WF: In the context of the ongoing concerns around tepid earnings growth and rising

valuations, what is the earnings growth expectation for FY19 from your portfolio

and how does your portfolio's valuation compare with Nifty 50?

Jinesh: We believe that there is still a lot of operating leverage in India with

companies that are yet to see growth. Input costs and cost of borrowing has come

down for domestic companies. Although there has been pain due to GST implementation

in the short term, but from a medium to long term perspective, organized players

are expected to be the beneficiaries as compared to unorganized players. With strong

flows and expected earnings catch over next few quarters or until May 19 elections,

FY 19 earnings can be seen around 19%. On the portfolio, the valuation should be

close to 21x (average for the portfolio).

WF: What is your 12-24 month market outlook and what do you see as the key market

drivers going forward?

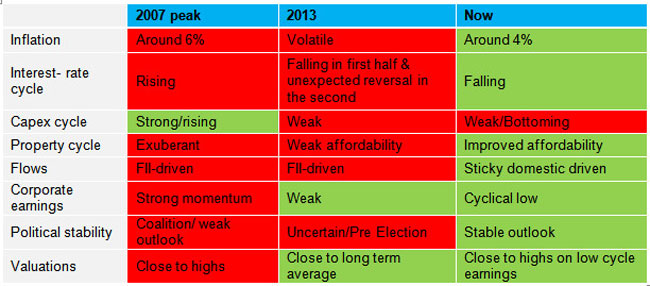

Source: Bloomberg. Axis Internal Anlaysis, Data updated as on September 29th, 2017

Jinesh: The economy is passing through a period of transition and adjusting to the

new normal, primarily on account of implementation of demonetisation and Goods and

Service Tax or GST. Disruptions on account of GST roll out have yet to fully settle

down and are likely to take longer than initially expected further affecting growth

in the coming quarters.

Rising rates in the US is a material challenge. But that is something that has been

known for some time and everyone realizes that the pace of rate hikes is a direct

function of how healthy the US economy remains going forward.

Worries about a domestic growth slowdown present the most serious worry for the

investors. However, even here the issues around GST implementation were not a surprise

even if the extent of impact was unclear. We continue to believe that the economy

has the advantage of a solid macro foundation, which combined with structural reforms

will push growth higher in the medium term. However transition times are always

tricky to estimate, and thus it's easier to have conviction on the 2-3 year scenario

than a 2-3 quarter one. Implementation of the bankruptcy bill is providing the first

signs of resolution of the banking system NPA crisis. If taken to its logical conclusion,

this can transform the corporate environment over the next 12-18 months.

On valuation; Of course the market is not cheap. But Indian markets are rarely cheap

outside of a significant crisis - whether domestic or global. And the current cycle

is peculiar in the sense of the way earnings have remained depressed over the last

few years. Demand revival and operating leverage can transform this situation very

quickly.

Key measures in the near term to be watched out are how well GST implementation

pans as well the government's efforts to bring back growth. Further how the political

scenario unfolds in the next state elections in CY18 can also have an impact on

the overall direction of the economy. We will factor in these and global factors

from time to time.

Having said that, equity markets are always impossible to time in the short term.

That is why it is an imperative for the investor to not over-react to short term

market noise and to retain razor-sharp focus on the long term. Regular investing

into quality portfolio remains the time tested formula for long term wealth generation

and there is no reason to change it due to short term hiccups.

Disclaimer: Past performance may or may not be sustained in the future.

Statutory Details: Axis Mutual Fund has been established as a Trust under

the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to

Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager:

Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited

is not liable or responsible for any loss or shortfall resulting from the operation

of the scheme.

This document represents the views of Axis Asset Management Co. Ltd. and must not

be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis

Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors

or associates shall be liable for any damages including lost revenue or lost profits

that may arise from the use of the information contained herein. No representation

or warranty is made as to the accuracy, completeness or fairness of the information

and opinions contained herein. The AMC reserves the right to make modifications

and alterations to this statement as may be required from time to time.

Mutual Fund investments are subject to market risks, read all scheme related documents

carefully.

Data as on 29th Sep 2017

Share this article

|