|

Fund Focus: DSP BlackRock Equity Fund

Fund Focus: DSP BlackRock Equity Fund

Buying growth at a premium better than focusing only on valuation

Atul Bhole, Vice President and Fund Manager, DSP BlackRock

|

|

In a nutshell

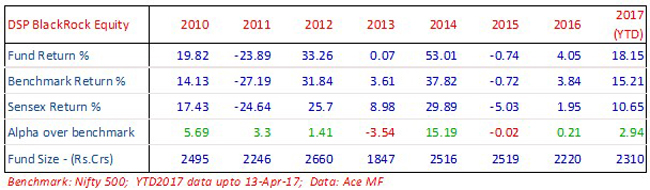

At a time when DSP BlackRock Equity Fund commemorates its 20th anniversary, Atul is busy shifting gears to deliver higher alpha. He believes in the current environment, buying growth at a premium is better than focusing only on optically cheap valuations of slow growth businesses, and has realigned the portfolio accordingly. The other aspect that guides his portfolio construction philosophy is to remain well diversified - irrespective of how high his conviction is, no stock goes beyond 5% of the portfolio, and themes that he believes in find place in his portfolio as a basket of stocks rather than an individual bet.

|

|

Click here to know more about percentiles and the colour codes

What do percentiles and their colours signify?

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

WF: CY15 and CY16 were flat in terms of alpha generation, but CY17 seems to have started off on a promising note. What were the changes you made in recent months in fund strategy or stock selection since you took over this fund, that are driving near term performance?

Atul Bhole: During the last one year, the bias towards buying growth oriented companies (which have superior business models and management) has increased. We are following this approach now for around 70-80% of the portfolio with more of a buy & hold strategy. Accordingly, we have reduced allocation to some slow growing companies even though they were trading at optically cheaper valuations and increased allocation to companies which are growing their profits in a compounding manner.

The fund was doing well in second half of CY16 itself with this approach; however some of these companies got hit temporarily during the demonetisation exercise. However, since then the companies are making a smart comeback, banking on their inherent business strengths and competent management.

WF: Should advisors classify this fund as a multi-cap fund or a go anywhere diversified equity fund?

Atul Bhole: DSP BlackRock Equity Fund is a multi cap fund and shall have exposure to large as well as midcap companies in a measured manner within a broad range with adequate sectoral diversification. Large cap company exposure shall be in the range of 60-65% and 30-35% would be in the mid cap companies. We don't believe in taking cash or market calls and hence would stay invested. At the same time, we don't believe in looking at companies as large or mid cap at the starting point of the investment thesis. Any company is a good company or not-so-good company from investment point of view before it can be classified under various classes. Fortunately there are enough companies in India in each bucket to stay invested.

WF: How do you describe your personal investing style and what are some of your core convictions that influence your fund management philosophy?

Atul Bhole: Companies which can compound their earnings for a foreseeable future are preferred investment opportunities for me . As enablers to achieve the compounding, we look at strength of the business model and industry structure, management capacity and capital allocation history and lastly the opportunity and challenges for growth. If these three tests viz, business, management & growth are passed, then I might buy such companies even at slightly premium valuations. In medium to long term, growth justifies slightly premium valuations also.

Along with this philosophy of stock selection, I very strongly believe in building well diversified portfolios. Even in case of very high conviction stock ideas, it won't be more than 5% of the portfolio. Also any sector or theme where we are constructive, we will try to capture the upside through a basket of companies. This can save the portfolio from price as well as time correction in particular stocks.

WF: How sanguine are you about the pace of the Indian economic recovery and growth in corporate earnings? Is there reason for some worry on any count here?

Atul Bhole: The domestic side of the economy is doing well in parts and we believe it can become broad based over the next 12-24 months. Resilient domestic consumption, falling cost of capital and government resolve to implement reforms and infrastructure would act as enablers for economic growth gathering pace. Direct push from the Prime Minister in areas like 'housing for all' and 'doubling the farm incomes' by 2020, even if met with partial success would be big game changers for the economy.

The export sectors are however facing some sectoral challenges as well as some as common challenges of protectionist policies of importing nations and rupee appreciation.

WF: Which sectors and themes are you most optimistic about now and why?

Atul Bhole: We are upbeat about financials, particularly private financiers given flow towards financial assets is gathering pace and they offer strong compounding earnings growth. We are also structurally positive about the consumer discretionary categories like auto, electrical appliances, other home improvement products etc given rising income levels & low penetrations levels. These categories are also benefitting from reforms like GST and 'less cash economy' which is rendering unorganised players less competitive.

Because of the government reforms and push, we are also having higher allocation to infrastructure, cement, oil marketing & gas distribution companies.

WF: The global context seems to have got a little murky - is it only geo-political tensions or is there an underlying unease on stretched valuations that seems to be playing out?

Atul Bhole: It is always very difficult to say how global events will pan out and more importantly how markets would interpret and react to them. In general, protectionist leaders & governments in developed countries along with higher valuations seemed to be on the mind of many well known investors and strategists.

WF: What is your outlook on Indian equity markets for FY17-18 and what do you see as the key drivers from here on?

Atul Bhole: Giving a near term outlook for markets is always tricky. However if one keeps a reasonable 3-5 years horizon, the outlook appears reasonably bright and worth undertaking the intermittent volatility. The main driver for market is going to be earnings growth, which was elusive for last 3-4 years. Some of the cyclical companies and corporate banks can show higher profits on mean reversal. As mentioned in one of the replies earlier the domestic side of the economy is going to improve from falling cost of capital, government reforms and focus on infrastructure etc and it would benefit companies from financial services, consumer discretionary and infrastructure companies.

Share this article

|