|

WF: What is the investment strategy of Edelweiss Dynamic Equity Advantage Fund?

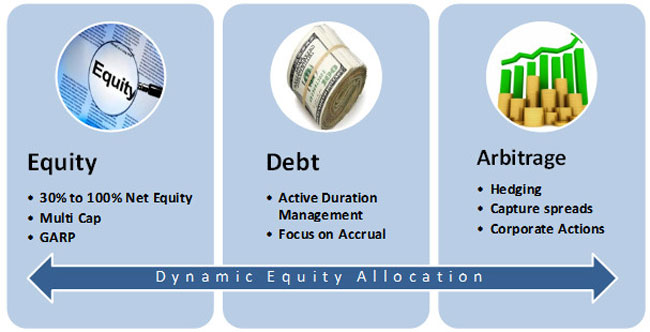

Radhika: It is a Dynamic Equity Asset Allocation Fund which manages net equity levels according to market cycle in 30% to 100% range out of which, the core portfolio will run 30% to80% Equity levels and remaining 20% will be invested in arbitrage opportunities including special situations.

The asset allocation in the fund is decided based on a proprietary model which gauges health of the equity market.

WF: In what ways is your asset allocation model different from the valuation based models that are popular in this category?

Radhika: Primarily there are two approaches to Asset Allocation, counter cyclical and pro-cyclical. A counter cyclical model is a fundamental model based on PE, PB and Dividend yield. This approach aims togradually reduce equity exposure in a bull market and increaseequity exposure during bear market cycle. Most asset allocation models today run on this approach.

On the other hand, a pro-cyclical approach based on quantitative factors coupled with fundamentals aims to have higher equity exposure during bull market and lower equity exposure during bear market cycle.

This pro-cyclical approach allows investor to create wealth during bull markets and protect wealth during bear market. This is how our model isunique as compared to other models.

Three key benefits of pro-cyclical model are:

Superior upside participation in sustained bull market and better downside protection in a sustained bear market Changes in equity allocation is swift and more dynamic It encompasses all facets of equity investing like Macro, sentiments, liquidity and valuations.

WF: What are the factors that you consider in this model? How do they enable you to increase andcut allocations to equity in a timely manner?

Radhika: Edelweiss Dynamic Equity Advantage Fund manages equity allocation based on in-house model - Edelweiss Equity Health Index (EEHI) that incorporates market directions, volatility and fundamentals.

Factors considered in the model

The main principle of the model is increasing exposure on winning side and reducing exposure on losing side.

WF: What does back-testing of this model suggest in terms of equity allocations through market ups and downs in recent years?

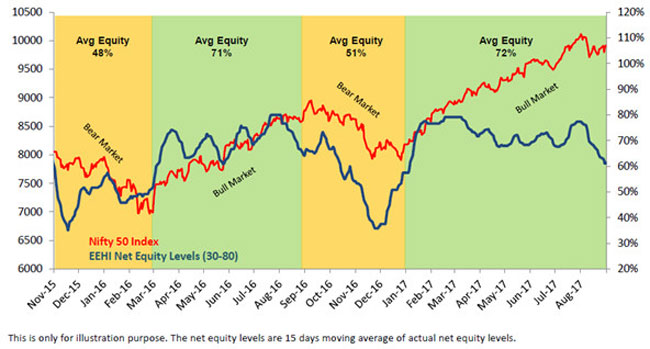

Radhika: In last 2 years we have witnessed two brief bull and bear cycles. Below chart shows how the model has managed net equity levels during these periods.

Net Equity Levels of the Model vs Nifty:

Average equity levels were high during bull cycles and low during bear cycles

WF: What equity allocation does your model suggest at present and how much of leeway has the fund manager exercised towards an override based on fundamentals?

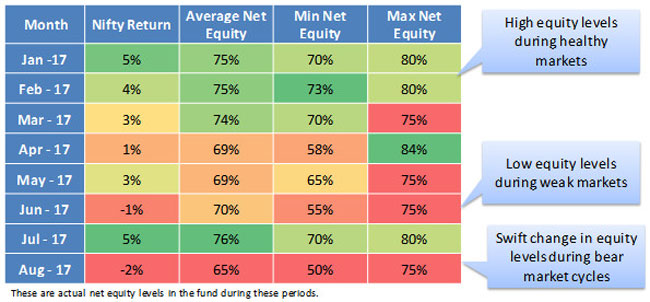

Radhika: As on August end the fund's net equity investment was around 65%. If you see in the below table the net equity levels have been very dynamic and in sync with market conditions.

During Jan'17 to March'17 when markets were healthy, average net equity levels were high. While during June'17 and Aug'17 when markets were weak equity levels were reduced to almost 50% to limit the downside.

The fund has swiftly changed net equity levels based on market conditions

The overriding factors come into play mainly during extreme situations like US Election outcome, Demonetisation, Union budget, etc. Also when forward valuations are not in sync with growth prospects the Fund manager may adjust equity levels to reduce overall risk of the portfolio.

WF: How is the equity component of the fund managed?

Radhika: The universe is top 500 market cap stocks. We filter this universe for Quality, Growth and Value and then decide best 50 to 55 ideas for investment.

WF: How is the debt component of the fund managed?

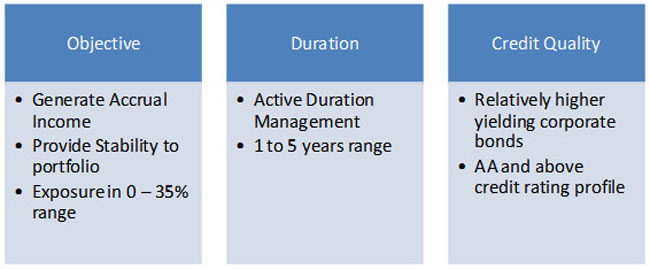

Radhika: On debt side the aim is to provide better risk adjusted returns.

WF: We are at an interesting point when trend indicators continue to paint a healthy picture while fundamentals suggest overvaluation vs history. What is your call on markets from a 12-18 month perspective in this context?

Radhika: Trend indicators are painting a healthy picture owing to high demand for equity in the backdrop of low global yields and expected recovery in global growth, primarily driven by US markets.

On valuations front one should also consider where we are in the growth cycle. Probably we are at the bottom of the growth cycle and during such period valuations may look stretched. As growth recovers and earnings start improving markets will continue its upward run. Valuations will then look more reasonable and realistic.

WF: How is Edelweiss Dynamic Equity Advantage Fund positioned?

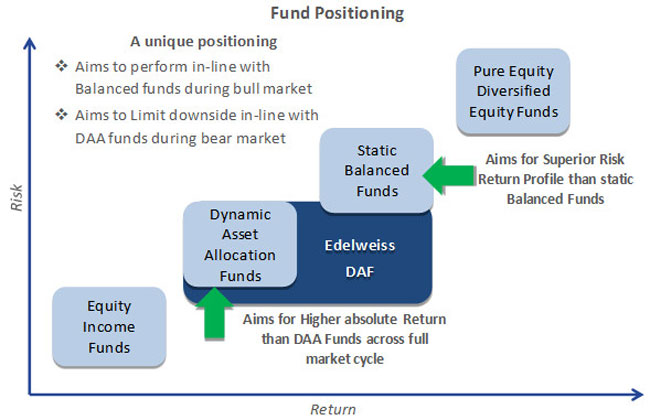

Radhika: The fund is actually best of both worlds - Balanced and Dynamic Equity Asset Allocation Funds. Since the approach is pro-cyclical, during bull cycles the fund will have relatively higher equity levels and will aim to perform in-line with balanced funds. And during bear cycle the net equity levels will be relatively lower and hence, downside protection will be in-line with Dynamic Equity Asset Allocation Funds.

WF: What has been the performance of the fund since you adopted this strategy in Nov 2016 and how does it compare with the category of dynamic equity asset allocation funds?

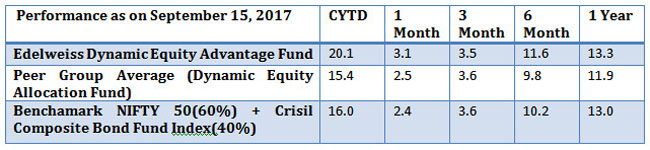

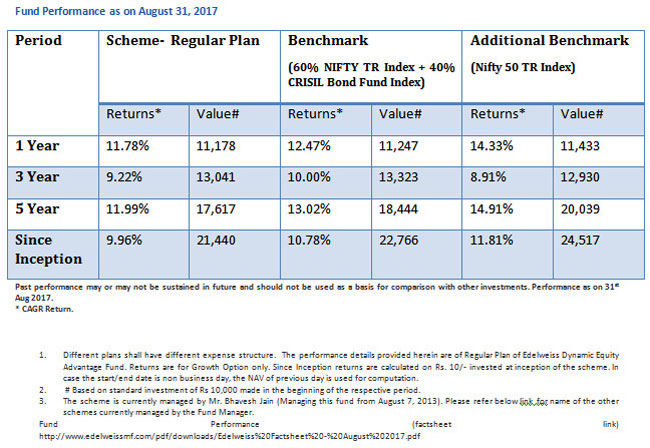

Radhika: The fund has performed well compared to its peer group since the time it was repositioned.

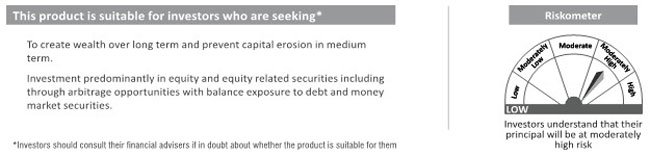

Riskometer:

Ms. Radhika Gupta is the Chief Executive Officer of Edelweiss Asset Management Limited and the views expressed above are her own.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Share this article

|