|

WF: The fund's mandate is to maintain net equity long position between 15% - 40% of total assets. How is the equity allocation decided and what has been the net equity allocation since Dec 2015, when the fund's mandate changed to an Equity Savings Fund?

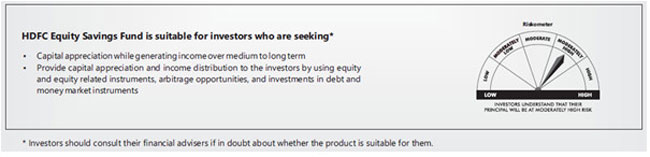

Vinay: HDFC Equity Savings fund is a conservative equity fund that seeks to invest in arbitrage opportunities, equity / equity related instruments and debt / money market instruments.

The un-hedged equity exposure of the fund is capped at 40% ensuring lower volatility while the combined exposure of Equity + Arbitrage offers the tax efficiency of equity oriented funds. The equity allocation is dynamically managed based on the overall fund house viewof the current market situation.

WF: What is the strategy adopted for the equity portion?

Vinay: The equity portion of HDFC Equity Savings Fund follows a multi-cap strategy. Currently, fund has invested in predominantly large caps with growth attributes. There is no style or market capitalization bias when it comes to managing the equity component of the fund. The Fund endeavours to invest in sectors, which are not highly correlated, the objective being to maintain reasonable diversification. Hence, the style could be described as 'growth at reasonable price.'

WF: What is the strategy adopted for the debt component?

Vinay: The fixed income portion is invested in corporate bonds, bank perpetual bonds and GILTS. Currently, Banks perpetual bonds - 100% exposure is to Public Sector Banks as we believe that these instruments offer deep value in the relative market context. The maturity profile of the debt portion is determined by our view on the interest rate scenario, prevalent in the market.

The RBI has acknowledged the possibility of slowing growth; however, it has preferred to wait for more data to ascertain if the decline in growth is due to transient factors such as GST rollout or due to other factors. In case the incoming GVA growth data for the second quarter FY18 (due 30th Nov'17) is below expectations there could emerge some space for easing in our view.

Even with the slowing growth scenario, benign inflation outlook and ample liquidity, room for fall in yields, especially long term yields, is limited. Hence the maturity profile of the fund is geared towards the lower end of the maturity spectrum.

WF: What have been recent yields from arbitrage? How much lower are they compared to what you may have got had you invested this amount in debt markets? Does the tax advantage make up for the shortfall?

Vinay: The current arbitrage yields range between 5-6%. The rationalization of these yields may be attributed to the fall in the debt market rates as well as the large participation of mutual funds and other market participants in this space. However the yields continue to be attractive as compared to short term debt funds on a tax adjusted basis.

WF: To what do you attribute your fund's strong performance vs benchmark and vs peers over the last 20 months in its new avatar?

Vinay: As discussed earlier, the fund has a dynamic allocation to unhedged equities, with in the overall equity allocation. The dynamic allocation coupled with superior stock selection has led to strong performance.

WF: Some advisors believe this category has immense potential but is not being adequately marketed. Do you share this view? What are your plans to promote this fund and its category?

Vinay: Multi-asset class investments increase the diversification of the overall portfolio by distributing investments throughout several classes. This reduces risk (volatility) compared to holding one class of assets. Hence, the robust structure of the product itself ensures that the fund performs well across market cycles.

We believe that this fund is an ideal investment solution for investors with limited risk appetite. The name itself epitomises a savings fund. The attributes of this fund give investors the benefit of higher potential returns (as compared to traditional savings instruments) while reducing the volatility risk associated with equities all this while ensuring tax efficiency.

Rightly so, the category has seen steady flows due to the low rates offered by traditional savings instruments. On our part, HDFC MF has been running sustained campaigns to highlight this fund to investors. We have also conducted roadshows across the country where the fund managers have spoken at length about this fund.

DISCLAIMER: The views are expressed by Mr Vinay Kulkarni, Fund Manager - Equities of HDFC Asset Management Company Limited (HDFC AMC), as on 10th October 2017. The views are based on internal data, publicly available information and other sources believed to be reliable. Any calculations made are approximations, meant as guidelines only, which you must confirm before relying on them. The information given is for general purposes only. Past performance may or may not be sustained in future. The replies are given in summary form and do not purport to be complete. The views / information provided do not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this information. The information/ data herein alone are not sufficient and should not be used for the development or implementation of an investment strategy. The statements contained herein are based on our current views and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Stocks/Sectors referred above are illustrative and not recommended by HDFC Mutual Fund / AMC. The Fund may or may not have any present or future positions in these sectors. HDFC Mutual Fund/AMC is not guaranteeing any returns on investments made in the Scheme(s). Neither HDFC AMC and HDFC Mutual Fund nor any person connected with them, accepts any liability arising from the use of this document. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

Product Labelling

Share this article

|