|

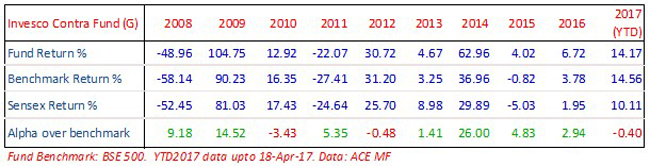

Fund Focus: Invesco India Contra Fund

Fund Focus: Invesco India Contra Fund

Alpha generating contrarian equity diversifier

Amit Ganatra, Fund Manager, Invesco MF

2nd May 2017

|

|

In a nutshell

Top overweight ideas in this fund are very different from what you find in the industry, says Amit, which makes a good case for this fund as a diversifier

Smart contrarian bets while carefully avoiding value traps enables him to consistently generate alpha, which Amit says makes this fund a strong addition to investor portfolios

Recent themes added include industrials, IT and telecom - all of which have gone currently out of favour, but where Amit finds interesting contrarian bets

|

|

Click here to know more about percentiles and the colour codes

What do percentiles and their colours signify?

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

WF: What are some of the contrarian themes or stock picks that you have added in your portfolio in recent months?

Amit: Over last three months, we have added companies like Exide, Rallis, ESAB India, GE Shipping, Karur Vysya Bank, NMDC, Tech Mahindra, KEC International to the portfolio. We have also added exposure to Information Technology sector due to attractive valuations. At the time of buying, there is a preference for companies in a turnaround phase and those trading below intrinsic value.

WF: How do you try to distinguish between a value trap and a promising contrarian bet?

Amit: We have successfully managed to avoid value traps because despite our constant search of value we have avoided:

Unattractive Businesses facing structural headwinds hence trading at cheap valuations Business with huge Leverage (Balance sheet risk)

Over last 10 years, we have number of times added companies with short term weak earnings outlook but have always avoided companies with weak balance sheet and weak business models.

WF: In portfolio construction, advisors usually look for contra funds to move differently from mainstream diversified equity funds, which justifies inclusion as a diversification strategy. How has your fund been performing on this score?

Amit: Our internal research suggests that Invesco India Contra Fund's top overweight ideas are very differentiated from top overweight ideas of Mutual Fund Industry. This gives us confidence that Invesco India Contra Fund is a complimentary diversified fund into investors portfolio.

WF: Should your contra fund be considered primarily as a diversifier or as a high alpha generator?

Amit: We reckon, both. Contra Fund is a diversified multicap fund with a value bias. Over last 5 years, investors have allocated more than proportionate capital to growth oriented strategies. Hence it has served as a complementary product to investors' existing portfolio. Also investors with a long term investment horizon in Contra Fund can benefit not only from Earnings growth but also a likely Price re-rating of multiples thereby creating potential for high alpha.

WF: What are the themes you are currently overweight in your portfolio and why?

Amit: Contra Fund is positioned to benefit from India's macro-economic recovery led by strong earnings growth in Cyclical sectors. Our pro cyclical stance is reflected by our overweight position in Consumer Discretionary sector. In recent months, the fund has also added exposure to Industrial sector taking advantage of de-rating of valuation multiples over last 1 year. The Fund is also overweight Utilities, Information Technology and Telecom Sector due to attractive valuations.

WF: How do you rate telecom and IT sectors from a contra perspective?

Amit: The Fund is overweight Information Technology and Telecom Sector due to attractive valuations. We think the current adverse dynamics in these sectors offer an opportunity to own reasonably good quality companies presently affected by operational challenges. While IT as a sector provides compelling value, telecom is undergoing consolidation, which can considerably improve sector profitability over the next 2-3 years.

WF: What is your market outlook for this fiscal and what do you see as the key drivers?

Amit: We believe the current domestic macro-economic parameters are favourable and will gradually lead corporate earnings growth to accelerate over the next 1-2 years. Simultaneously, we see many indicators pointing to a global economic recovery which should be supportive of India's domestic growth as well. With earnings recovery expected off a nearly stagnant base of the last 3-4 years, steady pace of economic reforms and high political stability, market valuations will likely sustain thereby allowing earnings linked upside from the markets from current levels.

DISCLAIMER: The views are expressed by Mr. Amit Ganatra, Fund Manager at Invesco Asset Management (India) Private Limited. The sector / stock referred herein should not be construed as recommendations from Invesco Asset Management (India) Pvt. Ltd. The portfolio may or may not have any present or future positions in these sectors / stocks or in any other schemes offered by Invesco Mutual Fund. The views and opinions contained herein are for informational purposes only and should not be construed as an investment advice or recommendation to any party or solicitation to buy, sell or hold any security or to adopt any investment strategy. The reference to the Scheme mentioned herein is only in context with the question asked and should not be construed as an investment advice or recommendation to any party or solicitation to buy, sell or hold any Scheme or to adopt any investment strategy. The views and opinions are rendered as of the date and may change without notice. The recipient should exercise due caution and/or seek appropriate professional advice before making any decision or entering into any financial obligation based on information, statement or opinion which is expressed herein. Invesco Mutual Fund/ Invesco Asset Management (India) Private Limited does not warrant the completeness or accuracy of the information disclosed in this section and disclaims all liabilities, losses and damages arising out of the use of this information.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

Share this article

|