|

Fund Focus: MOSt Focused 25

Fund Focus: MOSt Focused 25

Betting big on insurance plays to maintain its winning ways

Siddharth Bothra, Sr VP & Fund Manager, Motilal Oswal MF

|

|

In a nutshell

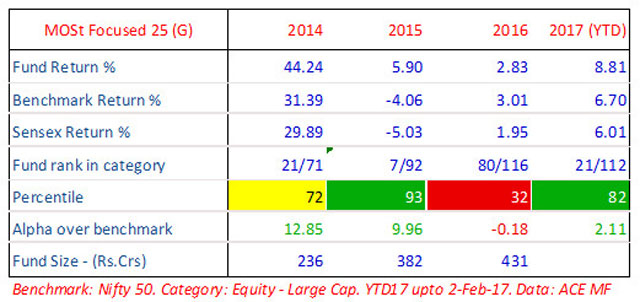

CY16 was a relatively difficult year for this highly focused large cap fund that has built up an otherwise strong performance track record in its short history so far.

Siddharth believes the performance divergence between mid and large caps is set for a mean reversion on the back of expected earnings momentum in the large caps space

He is betting big on financials - and within this, on the insurance sector, which he believes is set for multi decade growth ahead.

|

|

Click here to know more about percentiles and the colour codes

What do percentiles and their colours signify?

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

WF: After 2 strong years of performance, CY16 seems to have been a relatively challenging year in terms of fund performance. Its early days yet in CY17, but the month gone by seems to suggest that fund performance is coming back on track. What were the challenges you faced in CY16 and what steps have you taken to steer the fund back to its winning ways?

Siddharth: We would partly attribute the break in our outperformance in CY16 to factors such as our underweight allocation in oil and gas to challenges emanating from continued performance divergence of mega/ large companies versus the rest of the market. Over CY14-CY16, Nifty returns has been 9.1% CAGR, while Midcap 100 Index returns has been 21.1%, resulting in 12~% performance divergence between the two (Source: Bloomberg data). Given the leaning towards mega cap that our fund had, it was impacted by the trend. Going forward, we believe one of the key external catalysts for mean reversion of large caps would be revival of earnings growth for large caps which has been an anemic -1% for Nifty Index stocks, over FY13-17E (Source:MOSL estimates).

In the context of this fund, it is perhaps pertinent to note that only ~3% of Total Equity AUM in India practices focused investing i.e, has <25 stocks. F25 has only ~17 stocks and is one of the most concentrated large cap funds in India.

WF: Have any of the Budget announcements prompted you to change your views on stocks and sectors that you own or track?

Siddharth: This budget 2017 was very positive for financial assets and is likely to further facilitate the savings shift from physical assets to financial savings. We believe the fund is well positioned to benefit from this secular trend with 42% weightage in the BFSI space, which includes 15% weightage in insurance sector. Apart from this the budget also had several key measures aimed towards the agriculture sector and rural India, with a stated aim at doubling farmer income in five years. Some of our recent stock additions could be key beneficiaries from this rural push.

WF: IT and pharma are bearing the brunt of the market's fear on Trump's recent actions and intentions. What are your views on these two key sectors and how have you calibrated your exposure to these sectors in recent weeks?

Siddharth: Notwithstanding the fear around both these two sectors emanating from the external environment, we believe they remain one of the most promising hunting grounds for identifying multi bagger bottom up investment ideas. Our effort is to separate genuine concerns from noise and identify these investment opportunities.

WF: Financials are a key theme across your portfolio - with some "mainstream" names like HDFC Bank, Kotak Mahindra Bank and SBI and some "offbeat" ones including Max Financial Services, ICICI Prudential Life and RBL Bank. Can you please take us through your thinking on this sector and the selection of some of these offbeat ideas?

Siddharth: We remain positive on the financials as the sector provides tremendous opportunities to bottom pick stock ideas. The winners in this sector emerge across various themes such as value migration, companies creating new markets or exploiting low penetration areas etc. One of our high conviction bets within the financial space is in insurance vertical. Insurance sector in India has very low penetration with mortality protection gap of 92% (Source: Swiss Re study). It is also witnessing value migration like private banks from PSU to private insurance players. Within the private players we are witnessing increased consolidation by top players coupled with sharp improvement in margins and persistency. We believe, this sector has a multi decade long growth run way ahead, it is also one of the few financial plays which also has a wide moat around it given the relatively high entry barriers and brand relevance.

Share this article

|