|

Click here to know more about percentiles and the colour codes

What do percentiles and their colours signify?

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

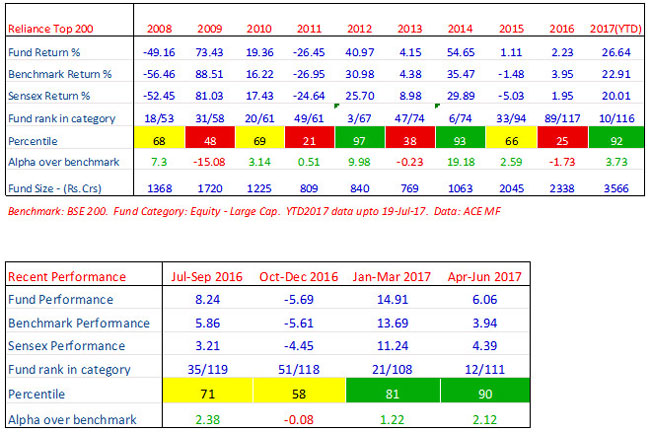

WF: A look at long term and recent performance numbers suggests that an otherwise strong performance since 2014 was interrupted twice in 2016 (beginning and end of 2016) - on both occasions when markets corrected and your fund corrected more than benchmark, post which your fund has come back into top quartile this year. What caused relative underperformance in weak markets and what steps are you taking to reduce fund volatility in weaker markets?

Sailesh: Reliance Top 200 Fund has registered consistent performance across market cycles and has outperformed the benchmark approximately in 70% of the calendar years since inception. The fund despite its large cap orientation has created meaningful alpha in reasonable growth years, like 10% alpha in 2012 and 19% alpha in 2014. Since Aug 26, 2011 (when the fund strategy was changed) till date (July 25th 2017) Reliance Top 200 Fund has delivered compounded returns of 18.5% versus 14.1% of the benchmark.

2016 began on a volatile note on the back of global growth worries, rate hikes by US Fed and similarly the last couple of months of the year, were impacted due to the Demonetization effect. During this period the Growth orientation of the portfolio or focus on economic recovery themes impacted the fund performance, higher than the benchmark. For example, we were early in Corporate Banks anticipating improvement in economic outlook at start of the year, which initially underperformed before recovering later.

Reliance Top 200 is focused on Large companies & market leaders from smaller industries with dominant industry standing, long operating history and sustainable profit growth. Hence given the positioning, we believe the fund is well suited for investors seeking to generate reasonable alpha while participating in a high-quality portfolio focused on market leaders. While the fund continues to have high conviction investment approach to create alpha in our endeavour to generate superior alpha with higher consistency of return we have awell-defined range for sector deviations. This will help the fund to continue to create alpha while reducing the return volatility.

WF: What does your attribution analysis suggest as the key drivers of outperformance this year?

Sailesh: Our focus on beneficiaries of domestic growth like Corporate lenders, Insurance, Discretionary Consumption and Product engineering space has helped the fund performance during the year. The performance was driven by strong recovery in key plays like leading corporate lenders, fast growing retail banks, insurance, discretionary spend themes like Hospitality, Two Wheelers and product engineering plays. Also our valuation-oriented plays like shift towards rural focused themes post demonetization and increased allocation to Healthcare segment post the recent correction also contributed to the fund performance.

WF: Concerns around market valuations continue to be voiced even as markets work their way higher. What is your perspective on current valuations and what is a sensible portfolio strategy in such times?

Sailesh: The recent run up in the equity markets has led to the large caps now trading at 10% premium to 10-year average PE multiples. However, these valuations should be seen in the light of cyclical low base of earnings over the last 5 years and expectations of the likely earnings improvement (higher double digit growth)expected over the next few quarters supported by uptick in cyclical demand.

Further events like GST, Demonetization and factors like low inflation, lower interest rates have created a strong platform for long term sustainable growth in India. We believe India is likely to witness a structural growth trajectory for the next 8-10 years.

The focus is to avoid frothy valuations & companies where the growth is uncertain or well-priced in current prices.

WF: Among pharma, IT and telecom, which sectors appear as attractive contra opportunities and where would you be most wary about value traps?

Sailesh: All the mentioned sectors have seen significant price correction for varied reasons. The current valuations seem to be factoring in the challenges and hence appear attractive, especially viewed from the context of the overall market,where many sectors appear to be fairly- priced at today's levels. In fact we have increased our allocations to the Pharma space over the last couple of months given the attractive while maintaining a neutral weight to IT sector. We continue to actively monitor all these segments, given the relatively attractive valuations, for possible investment opportunities

WF: Which are the sectors you are significantly overweight now and why?

Sailesh: We remain focused on domestic growth opportunities We are optimistic on domestic recovery themes which can benefit significantly from lower interest rates, higher disposable income and policy reforms. Some of the key themes include:

Corporate Lenders

NPA cycle peaking and resolutions underway

Beneficiaries of shift to Financial Assets

Post demonetization there has been significant acceleration in shift of investment preference from physical to financial assets

Consumer Discretionary

Increased Rural plays - Rural demand expected to pick up on good monsoon, Urban demand remains robust. Near term demand may be impacted by GST implementation

Short cycle capex

Benefit from Replacement demand and Government Capex spends Can gain significantly from private capex revival

Apart from the above given the attractive valuations we have increased our allocations to an overweight position in the Healthcare space.

WF: What is the key reason for an investor to consider Reliance Top 200 Fund now, especially given that markets are at all-time highs?

Sailesh: As mentioned earlier, we believe India is in a structural growth phase supported by lower inflation, falling interest rates, lower oil prices and policy actions like GST, banking sector reforms, JAM trinity etc. Given this context, we believe India's economy can potentially double from the current USD 2 trillion, over the next 6 - 8 years. Also, earnings growth which is yet to unfold, can be an important trigger for the markets, going forward. Thus, we remain positive on equity growth prospects over the next 3 - 5 years.

Reliance Top 200 with its focus on Market Leaders and Domestic growth themes is well positioned to capture this growth revival. We believe the fund can form part of core portfolio for investor given its superior quality and focus on consistent performance without compromising the alpha possibilities.

Share this article

|