|

Click here to know more about percentiles and the colour codes

What do percentiles and their colours signify?

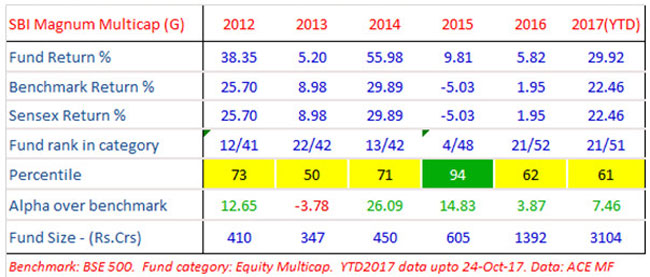

Fund performance is typically measured against benchmark (alpha) and against competition.

Performance versus competition is measured through percentile scores - ie, what

percentage of funds in the same category did this fund beat in the particular period?

If a fund's rank in a year was 6/25 it means that it stood 6th among a total of

25 funds in that category, in that period. This means 5 funds did better than this

fund. In percentile terms, it stood at the 80th percentile - which means 20% of

funds did better than this fund, in that particular period. If, in the next year,

its rank was 11/26, it means 10 other funds out of a universe of 26 did better than

this fund - or 38% of funds did better than this one. Its percentile score is therefore

62% - which signifies it beat 62% of competition.

Most fund managers aim to be in the top quartile (75 percentile or higher) while

second quartile is also an acceptable outcome (beating 50 to 75% of competition).

What is generally not acceptable is to be in the 3rd or 4th quartiles (beating less

than 50% of competition). Accordingly, we have given colour codes aligned with how

fund houses see their own percentile scores. Green colour signifies top quartile

(percentile score of 75 and above), yellow or amber signifies second quartile (percentile

scores of 50 to 74) and red signifies 3rd and 4th quartile performance. A simple

visual inspection of colour codes can thus give you an idea of how often this fund

has been in the top half of the table and how often it slips to the bottom half.

A great fund performance is one which has only greens and yellows and no reds -

admittedly a tall ask!

WF: How do you see the Government's recent announcements on bank recapitalization and road building? Is the macro position becoming vulnerable due to this booster dose or do you see this as finally getting the economy into a higher growth orbit?

Anup: Re-capitalisation of weak PSU banks and acceleration of road construction are positive decisions. The intent of the recapitalization is to resolve the bank NPA problem, which may lead to higher growth over the medium term. The extent of impact on economic growth will depend upon whether the corpus is distributed thinly among a large number of banks or it is allocated disproportionately to banks with better credit history. Many PSU banks with weak balance sheet have not been able to recognize all their NPAs because they run the risk of falling short of regulatory norms for capital adequacy. Delay in recognition of bad loans makes investors wary of investing in them which in turn, prevents these banks prevents them from raising equity capital. The impact of the exercise on bond yields will depend upon whether the bonds are given SLR status. Government's fiscal position will deteriorate, at the margin, because of this exercise.

Road construction in areas with poor connectivity leads to higher economic activity in such areas. The benefit goes beyond the amount spent on construction. Macro position will definitely not become vulnerable because of these measures.

WF: Your fund has an enviably consistent track record of healthy Y-o-Y alpha generation and 2nd/1st quartile performance vs peers. What are the factors that are contributing to this consistency in performance?

Anup: The fund has been able to consistently deliver excess return because of consistency in investment philosophy, a unique way of portfolio construction and because of superior risk management. The portfolio is constructed based on high conviction stock-ideas of the in-house research team. We have 10 equity analysts in the team. The team focuses on identifying stocks that have a fundamental investment thesis and offers visibility over the next 3 years. A new stock is added to the portfolio only if it offers a strong double digit. The portfolio stays away from taking large macro-calls or sector allocation calls. We don't enter into short-term trading calls.

WF: Is your multicap mandate a dynamic one or do you maintain exposure to each cap size within pre-defined bands? How has the actual allocation between cap sizes moved in the last 3 years, in response to changes in relative valuations across large and midcaps?

Anup: The portfolio has the flexibility to scale up position in largecaps, midcaps and smallcaps, within a specified band for each the two categories. We can invest up to 10% of the portfolio in small caps. We can invest upto 40% of the portfolio in midcaps. The portfolio must have at least 10% exposure to midcaps. It invests 50-90% of assets in to largecaps. We scale exposure between these bands depending upon availability of attractive stock ideas. We don't decide the allocation purely based on relative valuation of largecap or midcap indices. We put higher emphasis on the attractiveness of individual stock ideas. We focus more on the relative valuation of stocks , rather than relative valuation of largecap or midcap indices.

WF: Some fund managers advocate largecaps now due to relative valutions while others continue to favour bottom-up ideas in the midcaps space. What is your position on the large vs midcaps debate?

Anup: Mid-caps and small-caps have had a spectacular run over the last few years. Broadbased indices for the two capiatlisation categories suggest that their valuation premium to largecaps is close to historic highs. However, we neither benchmark such indices nor do we invest in mid-caps and small-cap ETFs. Each idea is evaluated on its own merit. We believe that there are money making opportunities among midcaps or smallcaps if one invests one's time in under-researched names and if one takes a 3-5 year call on businesses.

WF: Which sectors and themes are you significantly overweight on and why?

Anup: We have invested in the theme of migration of market share from unorganized SMEs to organized players, migration of market share from PSU banks to private banks and NBFCs, consolidation in telecom. We don't take large sector allocation calls. Our internal investment template allows us to move active weights on sectors between -2.5% to 2.5%. We are overweight on construction, telecom and metals while we are underweight on IT and financial services.

WF: Some fund houses are advocating multicaps as the lead retail product, ahead of the traditional orientation towards large caps for new investors, on account of superior returns at the same level of risk. Do you think multicaps deserve to replace large cap funds as the default retail allocation?

Anup: We believe that there is no universally correct allocation strategy. The mix between largecaps and multicaps should be decided based upon the risk-appetite, life stage and financial needs of an investor. There is substantial diversity in risk appetite among retail investors. We encourage financial advisors and investors to use allocation tools on our website for deciding the mix.

Share this article

|