|

A decade ago, financial advisors in the US focused on technology based client engagement only for their younger clients, and relied on the good old face-to-face mode for older clients. Traditional engagement methods are costlier, are not scalable - but what do you do if a set of clients simply do not want to engage with you online? The data these financial advisors saw on internet usage among senior citizens was consistently pointing towards low adoption.

What happened over the last 10 years in the US however, caught almost everyone offguard. Most financial advisors didn't latch on to the big trend change that happened. And those who didn't latch on, missed a big opportunity to build a far lower cost and more scalable engagement model with their senior citizen client base.

Consider these statistics from the US

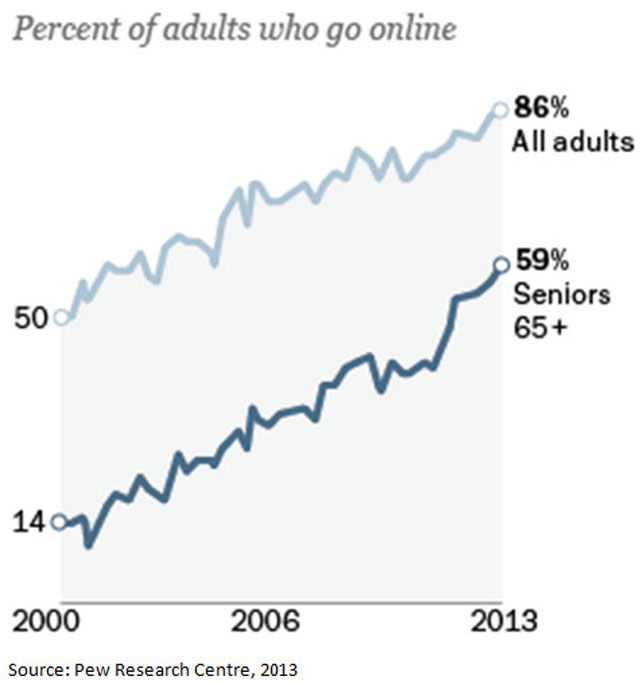

15 years ago, it was true that senior citizens would largely stay away from the online world, with only 14% going online vs the 50% mark for all adults (including seniors). But, what's happened in the last 15 years is truly remarkable: seniors have taken to the internet in a big way, with as many as 59% getting hooked to the online space by 2013.

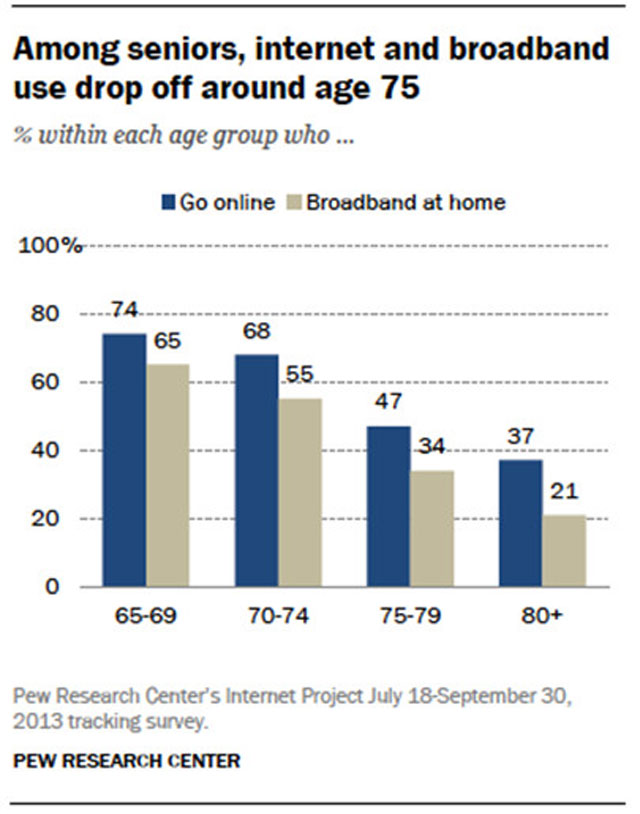

What's even more telling than the 59% number is the break-up within the seniors group. The younger segments within the seniors group are just about as tech savvy as the non-seniors. The percentages really begin dropping off only in the 75+ age group.

Key learning: it would be a big mistake to treat all seniors as a single group when thinking of how you should engage with them.

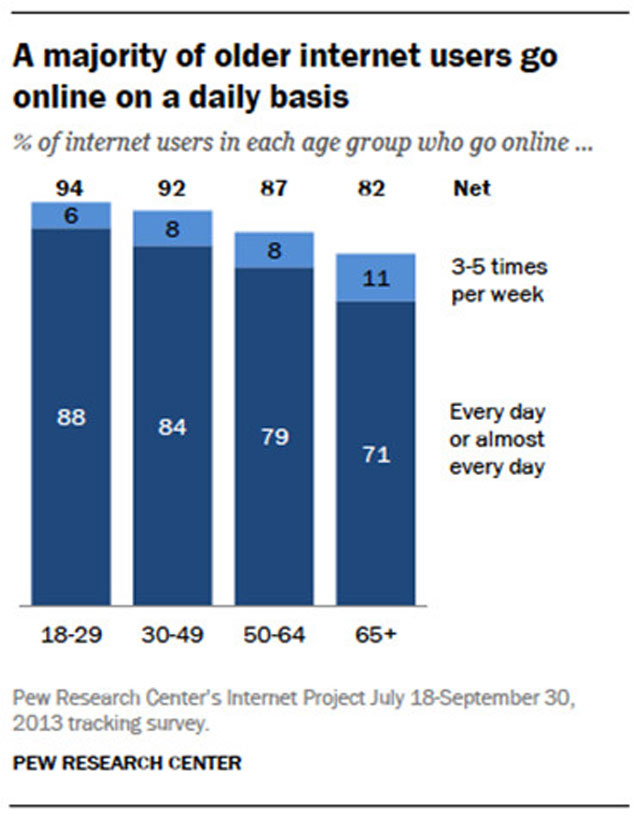

Here's another eye-opener: seniors are about as hooked to the internet as their younger compatriots. It's not as if they just browse the net once a week. So, if you are planning online engagement strategies, you will be very well advised to count your senior citizen clients very much in!

Is this data applicable in India?

Most of the research data now available in India is pointing to trends that existed in the US a decade ago. Indian data suggests that the vast majority of internet usage is from the younger population. It is therefore tempting for Indian advisors to come to the same conclusions that their US counterparts came to a decade ago - that technology based client engagement is not for senior citizens. That only the younger client base can and should be engaged electronically. And that for senior citizens, one cannot innovate much in the tech space to build lower cost, scalable engagement models.

If one were to come to this conclusion, this column believes you will be perhaps making quite a costly mistake. Here is one important reason why: according to the same Pew Research Centre's report, one of the biggest impediments in seniors getting tech savvy is not because they don't want to - it's because they feel the need for someone to hold their hand initially and guide them when they are trying to get familiar with technology. Only 18% of seniors are self-taught when it comes to new technologies - and a huge 77% look for some form of support/guidance.

Great opportunity to create a win-win proposition

Bottom line: most seniors are willing to get tech savvy if someone will help them initially. You have a great opportunity to create a win-win proposition. Set up regular tech sessions in your office exclusively for your senior citizen clients. Get them familiar with e-commerce sites where they can shop from home at their convenience. Help them find great deals online. Get them familiar with smart uses of social media, video calling and other low cost ways they can stay connected with friends and family. Help them reach out to and connect with long lost friends across the world. Help them leverage technology as smartly as you do.

And while you are at it, also get them familiar with your own new age engagement options - through video calls rather than face-to-face meetings, email alerts, webcasts, podcasts, social media interactions and so on. Help them clamber onto the tech bandwagon and derive its multiple benefits, and at the same time, get them comfortable with your new age, low cost, scalable engagement models. It's a win-win proposition for both - and one that's likely to get you a ton of goodwill as well. And, while you are at it, if your tech education sessions are indeed engaging, don't be surprised if your senior citizen clients bring along many of their friends for these sessions - friends who can be invaluable leads for your business.

Content is created by Wealth Forum and must not be construed as an opinion by DSP Blackrock MF.

Share this article

|