|

Last November, we introduced the inaugural edition of our annual Wealth Forum New Blood Report (Click here), which analysed growth in new ARNs at a city and state level. We now present the 2nd annual Wealth Forum New Blood Report 2016. New blood is critical for any business, any profession. New blood challenges old ways, new blood innovates, new blood raises the bar for the profession. For mutual fund distribution, new blood not only does all of this, but also extends reach of an industry that continues to be extremely underpenetrated in the vast Indian savers market. There are lots of reasons why new blood is critical for the MF industry. And, even as we welcome disruptive new blood in the form of online players, there is no denying the fact that this industry needs a whole lot more of new blood from its traditional route too - the IFA (or should we now say MFD) who sets up practice in his city/town and serves a few hundred investors - personally and diligently.

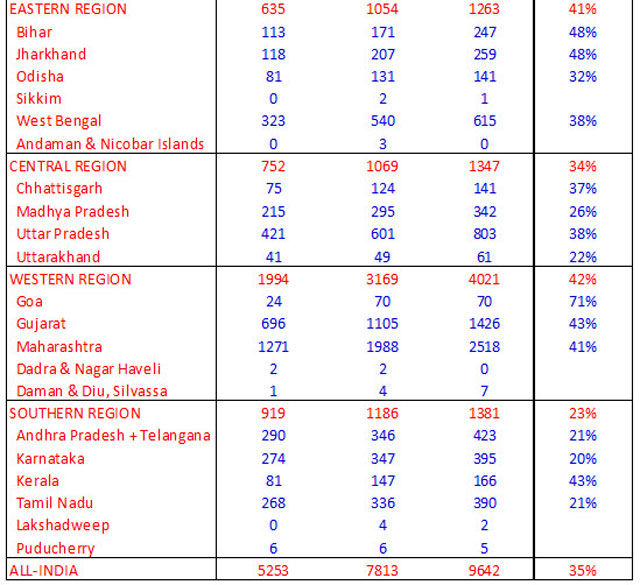

In compiling the New Blood Report, we look at ARNs issued by AMFI over a 12 month period Oct to Sep, and group them at a city and then state level to get an idea of where the new blood is coming in from. We put a spotlight on high growth as well as low growth areas - in the hope that industry leaders will take a cue from this data, and put in more efforts in distributor development in the low growth areas - perhaps also by learning a thing or two from the high growth areas.

Heartening growth trends in new blood across the country

United Forum estimates that there are presently around 46,000 active ARN holders in the mutual fund distribution business. Viewed from this base, albeit small in absolute numbers, new blood coming into this business is showing a very encouraging trend:

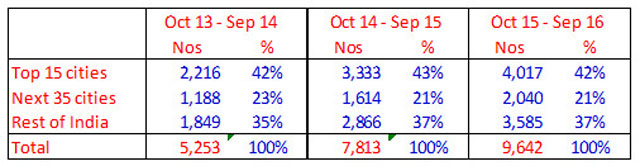

We are witnessing a 35% CAGR growth in new ARNs over the last 2 years, and the good news is that this growth is evenly spread across metros, cities and towns. 9642 new distributors have set up shop in the 12 month period Oct 15 - Sep 16, a healthy increase from 7813 for the previous year and 5253 of 2 years ago. The proportions between T-15, next 35 and rest of India have remained more or less the same through this period of growth, which is heartening.

Heartening because there is nothing in this data to suggest, for example, that higher upfront commissions in B-15 locations are spurring a disproportionate growth in new ARNs there. Nor is there anything in this data to suggest that commission caps which were introduced in April 2015, and which impact T-15 locations more severely, have dented new ARN registrations in metros. Growth in ARNs is happening irrespective of commission regulations, and is perhaps more a function of increasing investor demand for mutual funds and supply rising consequently to meet growing demand.

Spare a thought for these 9642 distributors

Lets spare a moment to think of these 9642 new ARNs - a majority of whom are individual distributors spread across the country. Like I mentioned earlier, they have chosen this business with the full knowledge of commission caps being in force, which dissuades fly-by-night operators and encourages only those who are willing to build a business on trail commissions over the long term. Of these 9642 new ARNs, 4595 were issued in the period Oct 15 - Mar 16 and 5047 were issued during Apr 16 - Sep 16. The new commission disclosure regulations were announced in March 2016. There is no change in momentum of ARNs issued in the 6 months prior to this announcement and 6 months post the announcement.

We have 9642 new entrepreneurs who have chosen to make MF distribution their business in the last 12 months, after all the regulatory intervention on commissions. They have taken a call to build long term business models on trail commissions. Now, SEBI tells them that they have only 3 years to build a trail income, after which they will have to switch to a fee based model and give up commissions!

We are seeing an encouraging trend of growth in individual distributors coming into this business year after year, in response to growing investor demand for distribution services. And we now have to tell them that they made the wrong choice. We have to tell them that though they accepted all the changes in commission regulations, the regulator now believes that commissions itself are a bad thing, and that they should, in hindsight have opted to become RIAs in the first place - because that's what the regulator really wants.

The regulator ought to be happy seeing the growing trend of new ARNs across the country - and should be patting themselves on the back that their regulations on commissions are not really deterring new talent from embracing this business. When you have completed your "clean up" on commissions and sales process regulations, and new talent is coming in under the new rules of the game, why change the game again?

One can only hope that the regulator will see merit in not going ahead with large chunks of its RIA consultation paper, and will support the encouraging sign of new blood coming into the MF distribution business, with all its present checks and balances that discourage short term thinking from such entrepreneurs. In the hope that distribution as we know it now, will continue as a business model, let's proceed further with the analysis of the Wealth Forum New Blood Report, 2016.

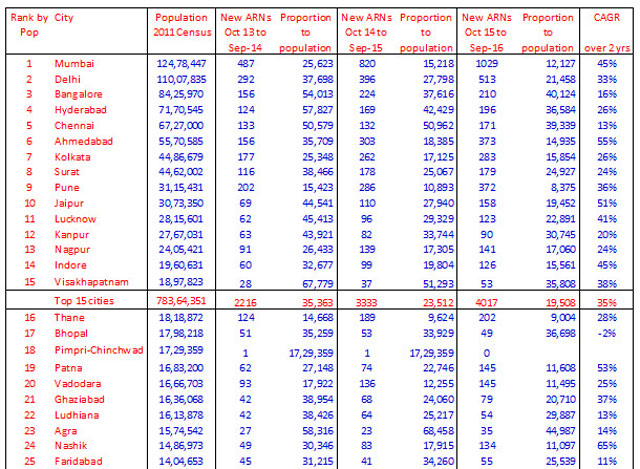

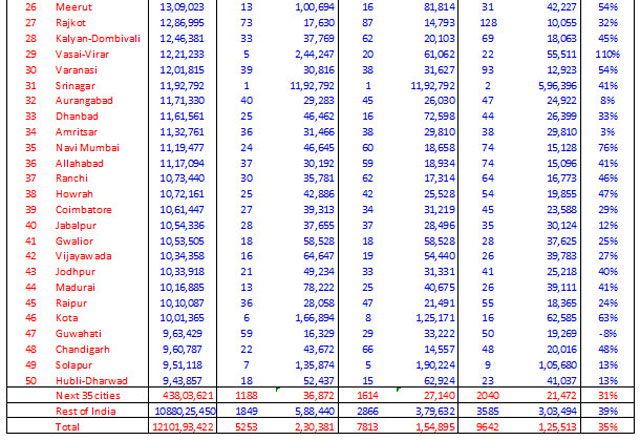

Encouraging ARN growth in T-15 cities, despite all odds

At an aggregate level, T-15 cities are seeing new ARN growth in line with the national average - which is encouraging considering they are probably the most impacted cities by multiple factors including commission caps, heightened competition from online players and increasing appetite for direct plans. What this probably means is that demand is growing sufficiently rapidly to offer opportunities for all. Growth in Ahmedabad and Mumbai being higher than category average will not surprise anyone - what will perhaps surprise many is growth in ARNs in cities like Jaipur and Indore. On the flip side, it is disappointing to see the three big Southern cities - Chennai, Bangalore and Hyderabad continue to lag in terms of new ARN growth. We know that South is generally regarded as more conservative in terms of investment profile and is also seen as relatively less entrepreneurial - which is what perhaps accounts for the lag. With financial assets increasingly occupying centre stage in household savings and with interest rates falling, one should expect increasing appetite for market risk products in these big cities to grow rapidly. Perhaps, by the time we file next year's report, we will be able to talk about encouraging growth trends from the Southern majors too.

The "Next 35" category's 2 year CAGR of new ARNs at 31%, is lower than the national average of 35%. That's a telling statistic, since these are the cities that are seen as the biggest beneficiaries of the B-15 commission structure. Yet another affirmation that the industry's remuneration structure is not really attracting opportunistic short term players. Yet another case for stability now in the remuneration structure for intermediaries, rather than an urgent need to fix a perceived problem that perhaps doesn't exist.

And, the icing on the cake is the growth in ARNs in towns below the top 50, where new ARN growth at 39% CAGR over last 2 years, is higher than the national average of 35%. The regulator is extremely keen to see this number growing, to enhance the industry's reach into every part of the country and not just its largest cities. When this is now happening the way we all want it to happen, the regulator really needs to ask themselves whether they are unnecessarily jeopardizing a welcome movement that has only just begun, by bringing in regulations that make distribution completely unviable to existing as well as new players.

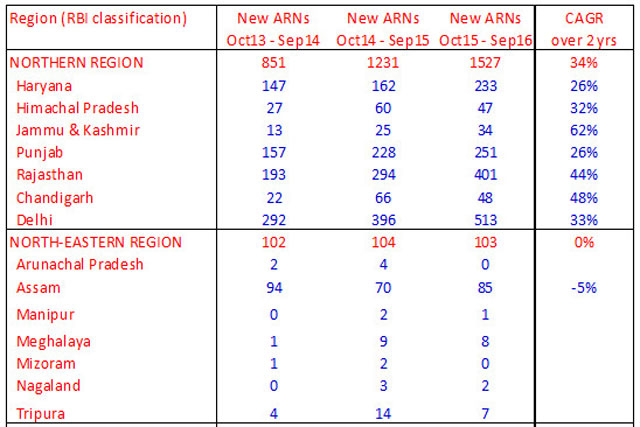

Eastern region is a pleasant surprise

The surprise package in state and region-wise analysis of new ARN growth is the Eastern region - in particular, the states of Bihar and Jharkhand. East is growing as fast as market leader West, while South is seeing ARN addition far slower than the national average. North-East has demonstrated virtually no acceleration in new ARNs, averaging only around 100 per year for all 7 states put together. I highlighted this in last year's report, and I would like to reiterate this year as well: it will be really nice if one of the big 6 AMCs decides to take up distributor development in the North East in right earnest. Why not take on a target of creating 200 new distributors in the North East over the next 12 months?

To conclude

We can feel happy that 9642 new entrepreneurs have come into this business - a healthy growth over previous years - despite a tighter regulatory environment for the business. SEBI can pat itself on its back that despite the tightening of distribution and commission regulations, growth in new distributors is accelerating. But while it pats itself on its back, SEBI will do well to spare a thought for these 9642 entrepreneurs who have just entered this business, accepting the tighter regulations that have only recently been introduced. Is it fair on them to tell them that a dramatic change in on the cards and that in hindsight they should not have opted to become distributors, because the regulator prefers that distributors migrate to a fee based RIA environment? Will SEBI spare a thought for the dilemma that these new entrepreneurs find themselves in?

Is SEBI's recent thinking on RIA going to derail distribution expansion that has only just begun to gather momentum on the back of increasing investor demand? When data is demonstrating that there is a growing trend of new entrepreneurs entering a business that has just seen regulatory tightening, shouldn't the regulator feel content about a job well done, and not rock a boat that is clearly sailing in the right direction?

Share this article

|