|

There are some decisions in life which are best taken through plain logic. There are others where logic perhaps has no place. And then there are those which could go either way.

Think back to your school days

Think back to your school days, when you had to simplify complex equations in your math class to solve a problem given to you. You really had no option but to go logically from step 1 to step 2 and then to step 3 and find the answer in the most logical manner. Was there any room for creativity or innovation or imagination in arriving at the solution?

Now think of another situation in your school days. It's a surprise painting competition, and you set out to depict on canvas, the most delightful experiences you wish to have. When you turn in your work of art, your teacher notices in your painting a little boy flying high, with magical wings that appear the moment he flaps his arms, and a look of sheer delight written all over his young face. Did your teacher rap you on your knuckles for this illogical painting or pat you on your back for a task well accomplished?

It was the same you who made those little decisions back in school days - some which were guided by pure logic and the others where you let your imagination run wild. What makes a person decide how he or she is going to take a decision?

Why does the same person think so differently?

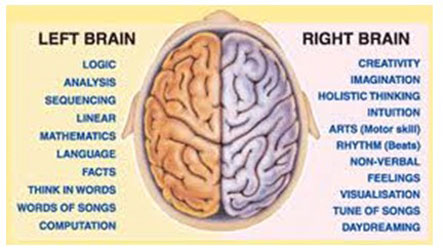

The answer comes from a study of the human brain. From the point of view of making decisions, the human brain is divided into two parts : the left brain and the right brain. Here are the kind of decisions that each part drives :

The left brain is the analytical and logical part of the brain. It processes facts and figures, sequences them and takes logical decisions based on this process. The right brain on the other hand is the one that gives you your creative and emotional impulses. It is the one that is able to visualize a big picture of the future as you see it. It is the one that provides you that "gut-feel" on which so many important life decisions are actually taken.

Often, you need both

In many decisions, you ideally need a bit of both to help you take a good decision. Think of the time you were looking to hire somebody for a critical job in your office. You saw the CV, noted the experience, matched it against the requirements of the job, looked at the references provided, did a quick background check - you took, in other words, all the logical steps to help you decide whether to short list a candidate or not. Then you met 2 short-listed candidates. You took an instant liking to one within the first couple of minutes, but didn't have that "connect" with the other candidate. What made you decide that you "connected" better with the first candidate? It was clearly a right brain decision, based on your feelings. In all probability, you hired this person because you got a green signal from both sides of your brain. And in all probability, the hiring decision turned out to be a good one.

On the other hand, if you didn't bother to go through the CVs, didn't match experience with job requirements, didn't do a ref check, but just called everyone to meet you and hired a candidate purely on "connect", chances are that you took a risk on the job fitment aspect. The candidate may well turn out to be a good hire after all, but you may want to ask yourself whether covering off the logical aspects as well could have reduced the risk of bad hiring.

How are investment decisions actually taken?

Why is all of this relevant to you as an advisor? Its not just relevant, but perhaps critical for you as this will in all probability be your first step towards understanding how your clients actually make their investment decisions, and why they take the decisions they take.

Investment decisions can be taken by your clients purely using the left brain or purely using the right brain or by using a judicious combination of both. Some investors are more left brain oriented when taking investment decisions, the larger proportion - especially those who are not very well versed with financial markets, tend to be more right brained when taking investment decisions. It usually is the case that for most of us, one part of the brain tends to be the dominant one - and therefore exerts its influence in most decisions - including financial decisions.

It is often said that the primary drivers of most financial decisions are greed and fear. Why do more investors invest into stock markets after seeing a strong rally in the previous months? Why is it they didn't invest a few months earlier, at lower levels? Surely, it couldn't be logic - as logic would say that they are buying into the market when it is more expensive than before. That's when an emotion of greed takes over from a logical impulse that asks you to look at valuations. The desire to make a fast buck in a runaway bull market is often too hard to resist.

Why is it that when markets have crashed, there are so few investors who logically come to a conclusion that markets are wonderfully attractive to buy into now? The fear of markets going down further, and the pain of losses they are currently nursing keeps most investors away, even if logic and all the facts and figures suggest that these are great levels to buy.

Is left brain investing better than right brain investing?

Before we come to a conclusion that left brain investing is therefore better than right brain investing, let's hasten to add a caveat. Investing is often about visualizing the future and buying into the picture you see. Risk taking is often about backing your gut feeling, after considering all the facts. These are not typical left brain functions - but are clearly in the domain of right brain decisions.

A majority of the most successful entrepreneurs would never have taken bold decisions to set up their businesses if they went solely by spreadsheets and discounted cash flow analysis. Pioneers who created new businesses - think of Google, Facebook, Apple - certainly had a strong right brain element to their decision making when they took the plunge and often invested their life's savings into their dream projects.

Research suggests possible outcomes of the two styles

Research does not conclusively prove that one is superior to the other. Research however does suggest that investors who primarily use their left brain in taking investment decisions are usually the more cautious ones, and therefore may see lower volatility in their financial portfolios, even at the expense of missing out some big opportunities that occasionally come our way. Right brain investors on the other hand tend to have more volatile portfolios, are more exposed to risk, but also have better prospects of capturing outsized gains that occasionally may come our way.

You can argue that a blend of both can help you avoid costly blunders that you might otherwise make. In any case, knowing what kind of an investor your client is, is critical to help him understand the typical pitfalls of that pattern of thinking. Avoiding those pitfalls is something you need to help your clients with, whether they finally take finely balanced decisions or prefer the style they are most comfortable with.

What kind of an investor is your client?

To help your client become a successful investor, you need to help him understand who he really is. How is he wired naturally when taking investment decisions? Is he more left brained or more right brained? If he naturally veers too far to either side, the first step would be to recognize the virtues and the pitfalls of that style of thinking. Help your clients leverage the virtues and guard against the pitfalls - you would then enable your clients to maximize the potential of a style of investment decision making that comes most naturally to them. You can alternatively also discuss the merits of adopting a more balanced decision making process : one where your client trains himself to look at the left and right brain aspects of a financial decision before finally taking the plunge.

It all therefore starts with understanding first whether your client is a left brained investor or a right brained investor. A good advisor would help his client do this by encouraging a conversation on what really went on in the client's mind when he took the last few investment decisions. What were the considerations that really influenced those decisions? Were these considerations more left brain impulses or right brain impulses?

What were the decisions involving money that he took other than investing in financial markets? How did he decide on his real estate investments? How did he decide on the biggest spends of the last year? What factors drove his decision on the car he last bought? Going through these incidents and playing back the decision making process can give you a good insight into how your clients really take investment decisions. If the decision making process is sub-optimal, its best to address the issue at the root and help correct the decision making process rather than forever correcting sub-optimal investment decisions after the investments have been made.

A successful investor is one who protects himself from himself

Protecting your client from himself is the first step towards becoming a successful investor. Use MasterMind's article series to understand where investors often go wrong when making investment decisions, why they do what they do and how you can help them correct these thought processes to become successful investors.

All content in MasterMind is created by Wealth Forum and should not be

construed as an opinion of Sundaram Mutual Fund.

Share this article

|