|

Mr. Dependable

Mr. Dependable

4 words that guide you towards success

|

|

We are going to be talking here about core values. Core values can either become the foundation of successful businesses when you actually live by them, or can just be a collection of words put up in your office and in your marketing material to make your business sound good. Before we go into the 4 words which we believe can propel you towards success in the financial advisory business, let's look at core values gone horribly wrong.

|

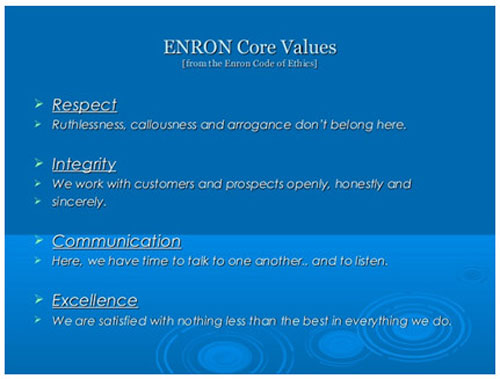

Most management workshops around core values usually begin with one of the most extreme examples of a business that made a mockery of its stated core values: Enron.

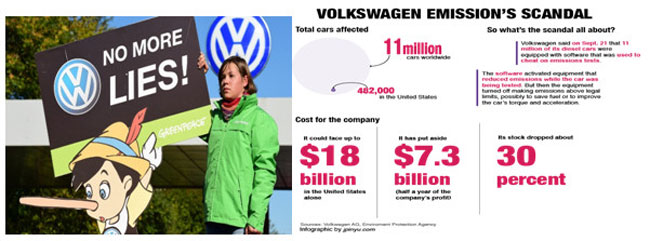

Enron is an extreme example, but there are many well respected brands which somehow lose their way when they sacrifice values at the altar of growth. One of the biggest recent examples is Volkswagen - a venerated German car manufacturer, one of the most trusted auto brands, which was so blinded by its goal of becoming No.1 in the world by 2018, that it refused to fix and in fact actively cheated about the excessive emissions from its cars - as this would derail its ascent to the top. The scandal blew up in its face in 2015 and not only caused a huge financial loss, but also eroded consumer trust in the brand very significantly.Volkswagen's core values by the way are: Sustainability and Responsibility.What it did was certainly not a very responsible way of dealing with the problem. And the irony is that the problem strikes at the very root of sustainability which is all about being eco friendly.

Importance of core values

Core values are the set of principles and beliefs that you as an entrepreneur define for the way your business will be run, the way your firm will engage with clients, and the basis for all decision making in your firm. In the financial advisory business, gaining your clients' trust is everything, and to gain your clients' trust, you need to be seen first as a DEPENDABLE ally and friend by your clients. Mr.Dependable - a joint initiative between Invesco MF and Wealth Forum, articulates these 4 pillars of dependability: Consistency, Integrity, Responsiveness and Diligence.

All of these are without doubt necessary for success as a financial advisor. However, merely acknowledging them is not going to get you sustainable success - living them will. Its easy to go the Volkswagen way when growth becomes your only mantra. Its important, especially when business tailwinds are strong and markets are favourable, for you to maintain your growth momentum without sacrificing your core values.

4 core values that can guide you to success

Here is our take on the 4 characteristics we chose as the pillars of dependability. Check them out and decide for yourself whether these deserve to be embedded as your firm's core values:

Consistency - demonstrating consistency in your deeds and actions, through various market phases. Consistency begets credibility and credibility begets trust. Challenging times are when consistency of actions get sorely tested. Your ability to stay on course - whether it be the broad financial plan you agreed on, or down to execution consistency of reviewing portfolios at the frequency agreed and sending portfolio information on schedule every time - all of these actions, big and small, add to the confidence of your clients in the consistency of your advice and service delivery.

Integrity - being absolutely and uncompromisingly honest and transparent in all your dealings with your clients. Always putting their interests above your own. Always doing what is right for them, even when you know there are situations where you can get away without doing so. Upholding business ethics as an uncompromising way of life. Putting yourself in a position where your clients will take your word at face value, every time.

Responsiveness - always being there for your clients, whenever they need you. Always responding to their requests promptly, even if you are not always able to resolve all issues immediately. Always making it a point to reach out to them more during periods of market volatility, and giving them the much needed reassurance during trying times. Communicating turn around times for all your deliverables and sticking to them at all times.

Diligence - doing your homework carefully, before making any investment recommendation to your clients. Never getting swayed by sales pitches, but insisting on applying your independent mind before coming to any conclusions on investment opportunities. Asking product providers all the questions to satisfying yourself about the products, as if it was your own money that is being invested. Monitoring portfolios regularly and acting proactively and promptly to ensure that they are in tune with changing times. Being watchful and diligent about your client's money, as if it were your own.

Whether you articulate these 4 virtues as your core values or something else, its important for you as the leader of your team to do 3 things for your values to propel you towards success:

Own the process: Defining your firm's core values cannot be a collective and consensual effort to make it an inclusive exercise. Your firm's core values are an extension of your personal values - and your job is to ensure that these are articulated clearly to everyone in the firm. Ultimately, the buck always stops with you - its important for you to believe 100% in every value that you articulate, else your decisions will be inconsistent with the stated values. And once that happens, your values statement becomes a pointless exercise. Weave your values into everything your firm does: If responsiveness is a core value you believe in, how are you equipping your service team to deliver on this value? Have you invested sufficiently in technology? Are your processes and turn around times clearly spelt out? If diligence is a core value for you, how are you making sure that you and your team strengthen your research capabilities every year? How are you making sure that no recommendation is ever made by any team member which is outside your research short list? Be ruthless in implementation: Core values by definition can never be compromised - under any circumstances. You need to not only lead by example, you also need to be ruthless with team members who wilfully violate your core values. How will you deal with a high performing RM in your team who you find out wilfully violated the norms of integrity in your office, by pushing sales of a particular fund (which is in your recommended list) on the basis of a private "arrangement" with the fund house's RM?

Core values are the foundation of any firm. Stronger the foundation, taller is the structure that emerges from it.

Share this article

|