|

GLOBAL

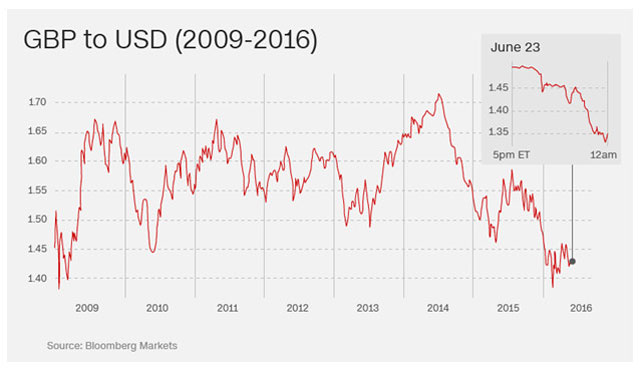

Quite unexpectedly, Britain opted to leave the European Union, EU, in the referendum conducted on 23d June. Known as 'Brexit', the event has had catastrophic effects on the value of the pound. Moody's the ratings agency lost no time in downgrading UK's credit rating from stable to negative. Uncertainty caused by Brexit has worried investors about liquidity drying up in the international financial markets.

The Bank of England said that it was well prepared for any volatility that might be generated by the British vote against the EU. "The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward," Bank of England Governor Mark Carney said. Others central banks like the European Central Bank, the Bank of Japan and the Reserve Bank of India echoed Carney and said that they had made preparations for all eventualities.

The pound slumped an unprecedented 9% against the dollar, to its lowest level in thirty years. The Swiss franc surged, as investors sought safe havens, requiring the Swiss central bank to intervene to stabilize the currency. The yen too appreciated. "Britons delivered a bombshell to the markets," said Chris Gaffney, president at EverBank World Markets, a firm headquartered in Florida. "This is the biggest risk to markets right now -- a possible lack of liquidity like we got during the Lehman crisis." (CNNmoney.com, June 24, 2016)

Meanwhile European leaders put a brave face on the stinging rebuke delivered by the British public to pan-European aspirations. "We regret this decision but respect it," European Parliament President Martin Schulz, European Council Chief Donald Tusk, EU Council President Mark Rutte, and European Commission Head Jean-Claude Juncker said. "We now expect the United Kingdom government to give effect to this decision of the British people as soon as possible, however painful that process may be," they said."Any delay would unnecessarily prolong uncertainty." (RTT News, June 24, 2016)

NORTH AMERICA

US

US CONSUMER CONFIDENCE - The Conference Board revealed that US Consumer Confidence Index had leaped unexpectedly in June. The index reached a reading of 98.0 in June from a revised reading of 92.4 in May. Analysts were looking for a figure of 93.3.

Consumers' views of current economic conditions were optimistic, as the present situation index grew to 118.3 in June up from 113.2 in May. Consumers who felt that business conditions were 'good' moved up to 26.9%, while consumers who felt that conditions were 'bad' were 17.7%. These figures were 26.1% and 21.4% respectively in the previous month. Consumers were upbeat about the economic outlook in the short term. The expectations index soared to 84.5 in June from 78.5 in the earlier month. The percentage of consumers who expect business conditions to improve over the next six months increased to 16.8%, up from 15% in May. Consumers who expect conditions to deteriorate fell to 11.4% in June, down slightly from 11.7% in the prior month.

On the labor market, the survey revealed mixed opinions. While the percentage of consumers who thought that jobs were 'plentiful' dropped to 23.4% from 24.5%, consumers who felt that jobs are 'hard to get' also decreased to 23.3% from 24.5%. Consumers expecting a favorable jobs market in the months to come moved up to 14.2% in June from 12.5% in the earlier month. Consumers who foresee fewer jobs also declined to 17.9% from 18.2% in May.

"Consumers were less negative about current business and labor market conditions, but only moderately more positive, suggesting no deterioration in economic conditions, but no strengthening either. Expectations regarding business and labor market conditions, as well as personal income prospects, improved moderately," said Lynn Franco, Director of Economic Indicators at the Conference Board. "Overall, consumers remain cautiously optimistic about economic growth in the short-term, "she added. (RTT News, June 28, 2016)

US ECONOMIC GROWTH - The US economy grew faster than previously estimated in the first quarter of 2016, the Commerce Department said. GDP growth was revised up to 1.1% from the 0.8% growth estimated earlier. The increase compares well with the 1.4% growth witnessed in the fourth quarter of 2015, while beating economists' forecast of 1.0% growth. The increase is attributed to increase in exports and non-residential fixed assets. Core inflation, stripped of food and energy prices rose sharply at 2.0% in the first quarter, compared to the more modest increase of 1.3% in the previous quarter.

EUROPE

EUROZONE ECONOMIC SENTIMENTS - European economic sentiments held steady in June reveals a European Commission survey, taken before the Brexit vote. The Economic Sentiment Index, ESI, moved down slightly to 104.4 in June from 104.6 in May. Analysts were expecting a figure of 104.7. The fall in the ESI indicates that the European Central Bank, ECB was likely to continue its policy of easing into the second half of the current year, according to Stephen Brown, Capital Economics.

Businessmen were upbeat about the level of their order books and were looking forward to higher production. Yet, the level of export orders and stocks of finished goods were viewed negatively. The Industrial Confidence Index grew to an unanticipated -2.8, while analysts were expecting a figure of -3.4. Yet consumers took a different view as the consumer sentiment index dropped to -7.3 in June. The figure was -7.0 in the earlier month. The services sentiment index slid to 10.8 in June, from 11.3 in May, while retail trade confidence slumped to 0.8 in June, from 3.3 in the prior month. This is the lowest level in twelve months.

Europe is set for 0.3% growth on a quarterly basis in the second quarter. However the relevance of this figure must be called into question since this data was collected before the hugely disruptive Brexit vote.

GERMANY

June consumer prices in Germany moved up 0.3% on an annual basis. This is the second consecutive month of price inflation. The harmonized index of consumer prices, calculated for Europe wide comparison, increased 0.2% annually, while growing at 0.1% on a monthly basis. Analysts were looking for a 0.1% annual increase and 0.2% monthly increase.

ASIA

CHINA

Economists polled by Reuters said that the Chinese economy would likely have slowed down in June. They expect the official Purchasing Managers Index, PMI, to drop marginally to 50.0 from the 50.1 reading posted in May. The dividing line between expansion and contraction is 50.0, with a reading below that signifying a slow down. This is disconcerting news for the global economy as well. The Chinese economy had declined for seven straight months before expanding in the last three months. The fresh slowdown could exacerbate the uncertainties engendered by the Brexit vote.

Economists noted that the expansion had occurred on the back of strong government stimulus measures. Now perhaps more such moves may be necessary."Fixed income, investment, trade and output data all pointed to the fact that growth in the economy has slightly eased," Zhou Jingtong, a researcher with Bank of China said, adding that a drop in commodities would drag on the PMI reading in June. (Reuters, June 27, 2016).

According to Ruchir Sharma of Morgan Stanley, "China is getting hurt because it just relies so much on exports to try and grow." In the long term China faces the problem of shrinking population, while in the short to medium term it has to deal with the mountain of debt it has taken on to stimulate, so far futilely, an anemic economy. "China continues to face the 'kiss of debt' situation," he added. (Moneycontrol.com, June 7, 2016)

JAPAN

JAPANESE ECONOMIC GROWTH - Despite many measures taken by the government and the Bank of Japan, the Japanese economy continued to face headwinds in June. The Markit/Nikkei Japan Flash Manufacturing PMI came in at a seasonally adjusted 47.8 in June, roughly the same as the reading of 47.7 in the previous month. This is the fourth consecutive month of contraction. The index of new orders moved up from 44.7 in May to 45.6 in June, while still continuing its fall of the last five months. Any reading below 50.0 indicates contraction.

The economy is likely to slow to 0.5% growth in the second quarter, compared to the 1.9% growth witnessed in the earlier quarter. Growth in employment too was at its lowest level in nine months. The economy was buffeted by falling exports. Further, Kumamoto the manufacturing centre in southern Japan suffered a massive earthquake in April that continues to affect production and disrupt the supply chain. The Yen has gained 15% against the dollar so far this year. This could affect exports and reduce corporate earnings."Latest survey data pointed to a further deterioration in manufacturing conditions in Japan. Both production and new orders declined at marked rates, led by a sharp drop in international demand," Markit said. (Reuters.com, June 22, 2016)

JAPANESE RETAIL SALES - The slowdown in the economy was amply reflected in the numbers for retail sales in May. Retail sales are an important indicator of inflation and consumer spending. Sales decreased for the sixth time in seven months, despite the government's decision to defer a proposed hike in sales tax, according to Economic Calendar. Retail sales fell 1.9% on an annual basis, more than the decline of 0.8% in April. This was also more than the median expectation of economists for a fall of 1.6%. The economy has fallen back to deflation in April, after managing to avoid a recession in the first quarter.

AUSTRALIA

The Australian economy posted its 25th straight year of growth in the fiscal year ending June 30. However the prognosis for the rest year remains murky. Central banks around the world have done their bit by pursuing an easy money policy. Yet, the power of such stimulus measures is waning. Demand in general is weak and in any case the supply of goods and services, which are now globalised, is much more. The Australian economy is already affected by China's slowdown, while new fears about Brexit are likely to impact adversely as well.

The unemployment rate has been steady at 5.7%. But this piece of statistic hides more than it reveals. Low growth in wages and salaries, high individual indebtedness and continuing questions over job security have made consumers cautious. Wages have not seen much increase, due to technological advances and globalization. There has been a shift from regular high paying manufacturing and mining jobs, to poorly paid jobs in tourism and healthcare.

In Australia the real net national disposable income, which reflects the residents' portion of the country's productive output slipped 1.3% in the twelve months to March, 2016, even as the GDP expanded 3.1%. Clearly, the government, households and companies are producing more but receiving less. "There is a lot of confusion about the Australian economy because production is strong but incomes are weak," AlphaBeta.economist Andrew Charlton said. "That's why we can simultaneously have record export growth with falling company profits, strong employment growth with low wages, and strong GDP growth with a crippled budget deficit."(Sydney Morning Herald, June 30, 2016)

SOUTH KOREA

South Korea posted a handsome 2.5% monthly growth in May reversing the 0.8% fall recorded in April. Economists had expected the economy to remain flat. Growth was 4.3% on an annual basis, while analysts had forecast a growth of 1.0%. The industrial index grew 1.7% over the previous month while the growth was 4.8% on a yearly basis. Manufacturing increased 2.6% on a monthly basis, growing 4.5% over the last year. The Services index moved up 0.1% on a monthly basis, while gaining 3.4% year-on-year. The Retail Sales index grew 0.6% over April, while on an annual basis the growth was a hefty 5.1%.The Index of Capacity Utilization Rate moved up 2.1% from the last month while the annual figure came in at 0.7%.

NEW ZEALAND

In New Zealand, business confidence surged in June, with the index leaping to a reading of 20.2, from 11.3 in May. The activity outlook climbed to 35.1 from 30.4, while the forecast for inflation was 1.49%, up from 1.39% in the earlier month.

INDIA

The World Bank in its latest India Development Update, said that India would continue with the strong growth witnessed in the recent past. Growth during the year was pushed by strong urban consumption. In the financial year 2016, the economy grew despite a number growth engines stalling. Two poor monsoons have affected agriculture and rural incomes, while exports and private investments have remained flat. The fall in oil prices has helped consumers to some extent, while it has proved a bonanza for a government struggling to contain a high fiscal deficit. For the first time in five years the government managed to better it revenue targets. The central government stepped up spending on infrastructure, while state governments too played their part, benefitting from the higher devolution of funds recommended by the 14th Finance Commission. In FY 2016, the manufacturing sector witnessed a growth of 7.4% while services expanded 8.9%. This helped create new jobs. The authorities did well to contain inflation, which upped real incomes, while allowing the Reserve Bank of India to cut interest rates.

According to the World Bank, the economy is poised to grow at 7.6% in 2016-2017, while growth in the next year is expected to be 7.7% and 7.8% in 2018-2019.While there are considerable risks to this growth story, a favorable monsoon this year will help mitigate those risks, the Update says. The biggest threat to growth in the near term is the poor state of the banking sector, weighed down by bad debts. Further, private investments are hampered by the uncertain global economic outlook, excess global capacities, high corporate debts and policy and regulatory issues. "There are good reasons for confidence in India's near-term prospects. However, a pickup in investments is crucial to sustain economic growth in the longer term. The recently approved Bankruptcy Code is helpful in this regard, and once it is implemented it will help unleash the productivity that Indian firms need in order to create jobs and become globally competitive," said Onno Ruhl, World Bank Country Director in India.

To reform the financial sector, the report suggests that the current efforts at structural change aimed at making the system more competitive and market oriented must continue. Again, the issue of Non-Performing assets, NPAs, should be tackled head on. Public sector banks would have to be recapitalized, and tools developed to manage stressed assets. The basic causes of the problem, like poor governance of banks and even companies and crony capitalism must be dealt with.

"India's financial sector has performed well on many dimensions and can be a reliable pillar of future economic growth. However, accelerating structural reforms and addressing the non-performing asset (NPA) challenge remain urgent tasks," said Frederico Gil Sander, Senior Country Economist and main author of the India Development Update.

The government has taken a positive step by giving states more funds. State government and local bodies can now spend 57% of expenditure, which comes to 16% of the GDP. Of this about 74% is untied, meaning states can spend them as they like. Thirteen of the fourteen states for which data was available increased spending on health and education. On the average, states increased expenditure on these two heads by 0.4% of state GDP. Rajasthan and Kerala spent over 70% of the additional amounts on health, education and infrastructure.

INDIA GDP HITS $ 2 TRILLION - The Indian economy posted a better than expected growth of 7.9% n the first quarter of 2016. For the fiscal year ending in March 2016, the economy grew 7.6%, among the highest in the world. This has taken the GDP above the $2 trillion mark. Despite poor rainfall the economy was pushed by growth in agriculture, mining, electricity production and manufacturing. Lower interest rates encouraged urbanites to buy more motorcycles, cars, and construct new houses. However the job market continues to be dull, while the start of another investment cycle in nowhere in sight.

"Growth largely comes from MSMEs. Corporates' share in GDP is much lower and even if GDP grows at over 7 per cent, their employment isn't significant. Large firms are increasingly outsourcing. It's the MSMEs that drive growth, but are starved of capital. If this is addressed, we can grow at 10-11 per cent," R Vaidyanathan, professor of finance, IIM-Bengaluru, said. (The Indianexpress, June 1, 2016)

Share this article

|