|

Consider this scenario. You have an HNI client who wants you to manage the equity component of his wealth. He has enough property and other assets which he personally manages, and wants you to look after only the equity component of his assets. He has a long term horizon of at least 10 years, if not more. You accordingly suggest a clutch of equity funds which you are very convinced about and promise to conduct quarterly reviews of his portfolio. During the next few quarterly reviews, when discussions come up about underperformance of some of these funds, you reiterate why you remain convinced about them and showcase to your client, with facts and figures, how even the best of fund managers have their share of ups and downs and how remaining with high conviction funds allows you to truly reap the benefits of long term investing. You also remind him that investing is not about rear-view mirror driving, that funds should not be selected or dumped on the basis of recent performance. He is unable to say much against your logic, but you know that he is not happy. Over the weekend, he meets a friend who tells him how he smartly invested in a US equity fund in 2012 and made a lot of money. Another friend tells him how his recent bet on an IT sector fund is working wonders, despite the market remaining flat. He comes back home, questioning your wisdom of staying invested in diversified equity funds for the long haul. Within the next few months, you learn that he has moved his business to the advisor who recommended the US equity fund to his friend. You lost a client - not because you did the wrong thing for his portfolio - but because you were unable to strike a fine balance between managing and catering to his expectations.

Consider another scenario. You have got your client to sign up for long term SIPs in equity funds that you have conviction in. You have clearly communicated that these should ideally be held for 10 years or more, to enjoy the true benefits of long term investing in diversified equity funds, and your client has agreed to this plan. Two years down the road, equity markets continue to be flat and your client begins to get restless with no returns from his SIPs. You try to remind him about the agreement to take a 10 year view and reiterate your conviction in these equity funds. He reluctantly agrees, but a couple of months down the road, he stops his SIPs, redeems his funds and moves on to an alternative investment that promises quicker results. You lost a client, not because you miscommunicated at the outset, but because the client perhaps never fully bought into a 10 year horizon in the first place.

In both cases, you were not really at fault in what you advised your client to do. But the reality is that while most advisors may continue to preach goal based investing and long term investing, many investors do tend to look at capital markets as short term opportunities. It may take a long time for us to collectively shape investor behaviour towards solely a long term approach. The reality is perhaps that a middle-of-the-road approach is perhaps the best way forward in such cases. One such middle-of-the-road approach is the construction of core and satellite portfolios.

The core and satellite approach

In a core and satellite approach, you agree with your client that a large portion of his portfolio will be considered the core portfolio - the portion that is ideally either linked to specific goals or is tied to a strategic asset allocation based on his risk profile. This portion is ideally to be held for the long term - in other words, this would be the "boring" part of the portfolio.

At the same time, you will agree with your client that markets do throw up interesting opportunities from time to time and that you would want him to participate in some such tactical opportunities, when you believe they exist. You will agree with your client to carve out a small portion of the portfolio (say 10-20%) towards such tactical allocations - or satellite allocations. You would thus have a large core holding and a few satellite holdings that comprise his portfolio at any point of time.

Set different expectations for core and satellite portfolios

Most investors are absolute returns oriented, and many will want to review their portfolios frequently based on performance, simply because traditional fixed income alternatives produce a defined annual return that they can easily benchmark against. It is indeed an uphill task to get clients to completely move away from a periodic returns analysis and start appreciating the merits of a pure goal based approach, when the goals are several years down the road. What the core and satellite approach does is to split the portfolio into two parts - with the satellite portion being the component that will be actively reviewed in terms of performance - absolute as well as relative. Once you create a satellite portion, you may be surprised to see your clients now much more willing to hold the core portfolio - the larger proportion - for the long term, through different market cycles.

In such an approach, you as an advisor, do have a responsibility to actively manage the satellite portion. You will need to understand markets well and decide for example whether you think a US equity fund is worth investing tactically, or may be even from a slightly longer term perspective. You will need to keep a watch on and decide whether a mid or small cap fund should now be bought with a 1-2 year view, if you believe that a big valuation gap has been created between large and midcaps and that momentum is now coming into midcaps. You will need to for example see whether there are sectoral funds - like IT - which need to be included tactically, because you sense better days ahead for the sector over the next couple of years. You will, in other words, be trying to generate advisor driven alpha in the satellite portion - which in a way, is what many of your HNI clients anyway expect of you.

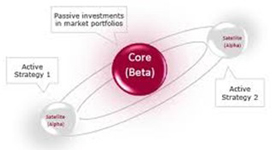

You can argue that if you are striving to deliver advisor generated alpha through satellite holdings, the core can as well be just a beta play - low cost passively managed index funds and fixed income funds. This allows the core to be clearly monitored only on a goal driven basis, as there is no expectation of market outperformance from this portion. The effort is to ensure discipline which will allow the investor to at least capture the market's beta over the long term - which itself will help create significant wealth over time.

The core need not be a pure beta play - that is just an option. You can always include within the core, a set of actively managed funds which you have strong conviction in, which you want to hold for the long term. Ultimately, how you populate the core and the satellite portions is really upto your own convictions.

One reason why some advisors prefer to gravitate the core increasingly towards beta, is the increasing choice and complexity available for the satellite portion. If as an advisor, you actively track and advice on direct equities, derivative strategies, commodities, international investments, and alternate investments, you may land up with a larger satellite proportion, which you drive on an active basis. In this case, you might just prefer the core to remain in passive strategies and have that portion sharply focussed on what it is meant to do : stay invested for the long haul. Having passive strategies at the core allows you to add risk in the satellite component, without adding too much risk at a portfolio level.

Client gets what he is looking for; you get behaviour that you seek from your client

A core and satellite approach is thus a manner in which you can try to address both sets of expectations : your expectation that your client should remain committed to his investments for the next 10-20 years, irrespective of market cycles; and your client's expectations that he must see something in the form of returns from his portfolio - at least the satellite component, even as he conditions his mind to avoid reviewing returns from the core portion very frequently and taking decisions based on near term performance.

To the extent you manage the satellite portion well by seeking investment opportunities from a wide canvas and delivering results on that, you will find your client a lot more willing to hold on to the core - which is a much larger part of his portfolio - exactly as you would want him to : for the long term, through market cycles. The onus is clearly on you as an advisor to strive for alpha on the satellite portion - but as investment opportunities keep widening, you can perhaps find opportunities in some asset class in some geography. Rather than losing clients because of a mismatch in your and your clients' expectations, it may just be a better idea to look for a middle-of-the-road solution that helps you serve clients better and grow your business consequently.

All articles in the Sell Well - Grow Well section are created by Wealth Forum. These are not to be construed as opinions given by SBI Mutual Fund.

Share this article

|