|

Product suitability can be a big long term growth driver

Regulators around the world - not just in India - have been putting increasing emphasis on ensuring that distributors and manufacturers make more efforts to ensure that only those products are offered to an investor which are suitable to their needs and circumstances. In India, the recent colour coding norms are a step in this direction. We all know that this may not be sufficient, and should be seen only as a starting point in helping an investor understand product suitability. The job of the distributor is to help the investor complete the process which the colour coding started off. By diligently helping investors buy products that are suitable to them, the distributor will be taking a big step forward in helping the investor hopefully get a satisfactory investing experience. We know that ultimately, the industry will grow only on the back of happy investors recommending the industry's products to many more prospective investors. Doing a good job on product suitability is therefore a great long term business driver.

It's also a sword hanging above you

There is another dimension here. This job is no longer a "nice to do" aspect of a distributor's responsibilities, but has become a "must do" aspect, ever since SEBI made mis-selling a fraudulent practice, which will invite severe penalties, if established. If an investor complains that you misled him/her into buying a product that was clearly not suitable for his/her needs and circumstances, the onus may fall on you to prove that you didn't mislead. This therefore raises the issue of documentation - what records do you need to keep with you to protect yourself in the event of a mis-selling claim?

What is the right sales process?

In an ideal world, it would have been great if you were provided a sales process guide - a must do list which prescribes the minimum acceptable sales process to qualify as a "good sale". If you don't adhere to all the steps prescribed, it could be termed as a "bad sale", which then opens you to mis-selling claims, if your client believes that he has suffered on account of you misleading him. But, we are not yet in an ideal world. We do not have a prescribed sales process for mutual fund distribution. But we do have penalties in place for doing the wrong thing. Perhaps the distribution SRO may decide to take up as a priority, the prescription of a minimum approved sales process. But till then, we are in uncharted territory.

What do the due diligence guidelines say on this?

The due diligence guidelines for large distributors gives us some clues about what the regulator would ideally like to see. But that too, has some inconsistencies that need to be ironed out. All distributors who are under the purview of the due diligence guidelines must have a well defined fund selection process through which they determine products that will be recommended by them. These products need to be placed into suitability buckets. For example, your suitability policy can state that your firm will offer sectoral and thematic equity funds only to investors with a high risk appetite, as shown in their individual risk profiles. Your policy can also state that all equity SIPs for first time investors will be done only in diversified equity funds or in large cap equity funds. These are examples - not suggestions - of how your suitability policy will be drafted and implemented. These steps are required to be taken whether you are offering an advisory or an execution only service.

The guidelines ask distributors to clearly segregate clients between advisory and execution only. For advisory clients, a risk profile has to be drawn up, documented and agreed and an asset allocation has to be agreed on this basis. All products recommended will then have to be in accordance with the agreed asset allocation.

For execution only clients, while one would normally assume that the risk profiling exercise can be given a go-by, there is an explicit guideline which states that even if you are offering an execution only service, you must alert your client about a product being unsuitable to him, based on your knowledge of the client, and must go ahead with the transaction only after you have alerted him and the client has acknowledged in writing your alert and his decision to ignore your alert. The obvious question here is that how will you know that a product is unsuitable, if you have not done a risk profile for him? Are we saying therefore that irrespective of whether you are offering an advisory service or an execution only service, you will anyway have to do a risk profiling exercise for all your clients? This remains a grey area - and one we hope will be clarified by the eagerly awaited SRO.

So, what should you do now?

In the meanwhile, for the vast majority of advisors who are outside the purview of the due diligence guidelines, we are still grappling with what is the expected minimum sales process. Again, in an ideal world, doing your independent fund selection, creating your suitability policy and doing risk profiles for all clients would be a great way forward. In subsequent articles in this series, we will discuss simple ways of doing this. Many IFAs however feel that doing a risk profile and maintaining records of each sale may make a retail distribution business unviable.

In this article, we will focus on what we think should be the minimum that any distributor should endeavour to do, which can not only help him guide his clients towards appropriate choices, which can protect him against mis-selling claims, and at the same time get these jobs done in an economically viable manner. We must reiterate that these views are Wealth Forum's opinions and not a regulatory prescription of do's and don'ts - which we eagerly await.

Let's keep the principle in mind

In order to ensure you are on the right side, you have to be clear about the principle behind these requirements. Whatever you do, must adhere to the principles behind the regulatory intention. The principle here is that an investor should have some knowledge of what he is buying and should be able to make out prima facie whether it is suitable to him or not. Risk profiling and other processes are ways in which this can be achieved. But, to start with, we suggest the following simple 3 step process that can be adopted by every distributor - however retail your franchise is :

Step 1 : Product selection

You must have your own fund selection process whereby you short-list schemes from each asset class for recommendation to your clients. You should be able to demonstrate that your recommended list has been drawn up on the basis of product attributes and not commissions. In subsequent articles of this Sell Well - Grow Well series, we will attempt to provide some inputs on this aspect.

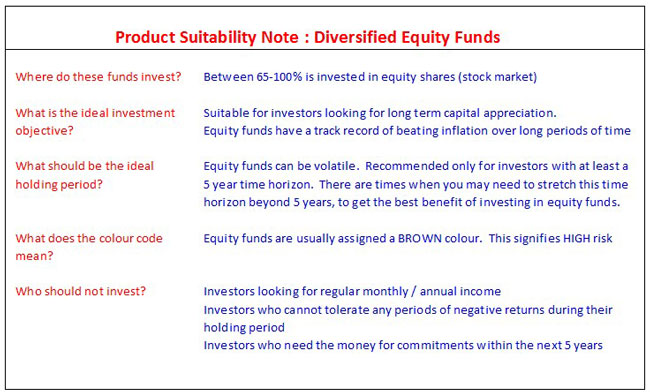

Step 2 : Create simple product suitability notes for each asset class that you sell

While risk profiling of every client may no doubt be a desirable goal, to start with, you can at least create one standard, simple, 5 point product suitability note for each asset class that you sell, and make sure your clients are made aware of this.

If you are selling 6-7 asset classes, you need to take a simple effort of preparing 6-7 such notes, one time - one for each asset class. The 5 questions will be the same, the answers will vary according to the asset class in question.

Once this job is done, you can certainly be peaceful with the knowledge that you have not misled any client on any product category, as long as you ensure that he has read and understood this. You are not getting into the realm of risk profiling of each client, but are in a way, ensuring that he covers off all aspects that are relevant for him to know about a product category, before he buys any product within that category. This thus makes the model retail scalable, while adhering to the principle of ensuring that clients understand what they are buying.

Step 3 : Ensure your clients understand this, keep evidence

Preparing 6-7 short product suitability notes is a good beginning. But you have only completed the job when you ensure that your customers have access to these notes, have understood them, and when you have some evidence of this.

There are several ways you can achieve this. You can create a 4 page branded brochure / pamphlet that carries your product suitability notes, with a small tear-away section where the customer writes down his name and signs as acknowledgment of having received and read the brochure / pamphlet. Keep the tear away section carefully in your records. You have now at least some documentary evidence that establishes that you did alert your clients on what is suitable and what is not. Once this is done, you need not carry out any further documentation at the time of every transaction.

Since this is in the realm of investor education, speak to your AMC partners about creating this material jointly with them, to help defray the costs of this exercise. Alternatively, speak to your local IFA associations, who in turn can organise a joint initiative with some AMCs at the association level, and make available to you a set of printed material for distribution among your clients.

Another way of doing this is to create similar product suitability notes, but attach them to individual application forms. Ask clients to read and sign this in addition to signing the application form, and put a process in place to cross-reference each such completed form with the application number that it came with. This will help you ensure that clients are made aware of suitability each time they buy a fund from you, and at the same time, will help you keep records at a transaction level, of having done your bit on product suitability. Though this is more labour-intensive than the earlier suggestion, it perhaps serves your clients and your firm better - but is still far less effort as compared to a risk profiling exercise for every single retail client.

As mentioned before, these are Wealth Forum's suggestions and should not be taken as steps that have regulatory sanction or approval. However, until we get clarity on what is defined as the minimum acceptable sales process to serve clients well and safeguard against mis-selling claims, one needs to get started somewhere - and this is perhaps a good way to start.

All articles in the Sell Well - Grow Well section are created by Wealth Forum. These are not to be construed as opinions given by SBI Mutual Fund.

All articles in the Sell Well - Grow Well section are created by Wealth Forum. These are not to be construed as opinions given by SBI Mutual Fund.

Share this article

|