|

Interest rates have softened over past 1 year even without any monetary policy intervention by RBI. 2013 was a year when duration call backfired & investors rushed back to either FMPs/FDs or Accrual Schemes with lower durations. Since then interest rates have softened from highs of August/September 2013 till date (as is evident from the table below); even pure accrual schemes with average maturities ranging between 1-3 years also benefitted & generated double digit figure returns. However, current net YTMs of these schemes have come off significantly from 2013 highs.

What are the choices for an investor wishing to invest in debt schemes?

Pure Duration Schemes - either Dynamic Bond or G Sec Funds Pure Accrual Schemes with duration ranging between 1-3 years To start with invest in Pure Duration Schemes & then switch to Accrual Schemes, or Invest in L&T Resurgent India Corporate Bond Fund- which to start with will have higher duration + higher accrual through long bond position with 4-5 year mod duration & then once interest rates stabilise; scheme will convert to accrual theme with 2-3 year mod duration

Pure Duration Schemes

Pure Duration Schemes are either G Sec Schemes, Dynamic Bond Funds or Income schemes with higher mod duration of 5-7 years but lower accruals as they predominantly invest in G Secs with lower yields. Hence, during rate cut cycle these schemes will outperform other themes in debt space over short term period - say next one year. However, thereafter the same schemes will have interest rate risks attached to it with lower & lower accruals through captured YTMs post rate cuts (as mandate of pure duration schemes is to maintain higher mod duration). Also, investors will need to time their exits at an appropriate time-which may or may not be possible. Also, exit from these themes will generate short term gains tax. Hence, investments in these schemes will then become trading calls rather than investment calls.

Pure Accrual Schemes

As these schemes generally have higher accruals, they will also benefit from rate cut cycle over say next one year- though impact of rate cuts & subsequent capital gains generation will be much lower than that in duration themes as mod duration of accrual schemes will be much lower. Hence, with 3 year investment horizon they may not capture investment opportunities in falling interest rate environment. This trend is already evident from the table above which demonstrates how interest rates even at short to medium end of 1-5 years have also come off from their 2013 highs in spite of no monetary intervention from RBI so far (till January 14'2015. Thereafter RBI cut REPO rate by 0.25 bps on January 15'2015- impact of which is not shown in the table above). Hence over next 3 years, post first year performance on higher side, these themes will deliver lower returns.

Pure Duration Schemes to Start with & Then Switch to Accrual Schemes

This strategy has two flaws: a) it is tax inefficient as when one exits within 3 years from duration theme, investor will end up paying short term gains tax & b) timing exit from duration & getting into accrual themes may be difficult for investors to time & comprehend.

L&T Resurgent India Corporate Bond Fund: A New Category in Debt Schemes

This scheme aims to take care of these anomalies which creep into the above strategies of investing in debt schemes under current market conditions. This scheme will endeavor to invest in higher accrual, longer tenor corporate bond to start with. This will ensure the following:

Generate capital gains in falling interest rate cycle by investing in long tenor bonds Generate higher accrual than Dynamic/G Sec themes as they will predominantly invest in high yielding corporate bonds (with some credit play as well) Switch from long duration to accrual theme post the rate cycle coming to a halt & switching to accrual theme with lower duration. This will help in reducing interest rate risk attached to duration post completion of rate cut cycle-switch to accrual theme within the scheme & hence making it tax efficient for investors holding it for 3 year plus investment horizon (instead of investor doing in & out from duration themes to accrual themes on their own)

Hence this is a strategy that can

Maintain high duration to capitalize on softening trend in interest rates Strategically lower duration when interest rates stabilize Capture higher yield pick up over AAA corporate bond Make the investment tax efficient through internally switching from duration to accrual within the scheme Provide stability to investors as it has exit load if exit made within 3 years from the date of allotment

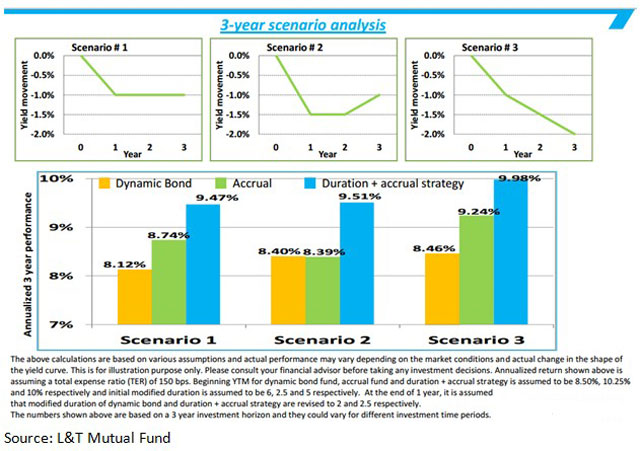

Following analysis of different interest rate scenario over next 3 years will demonstrate how the scheme strategy will be better than other 2 strategies as mentioned above:

Other products in this genre

Some of the AMCs have also started repositioning their schemes in line with the above theme. Franklin India Income Fund has been rechristened & repositioned as Franklin India Dynamic Accrual Scheme. Though strictly not comparable with L & T Resurgent India Bond Fund (as FT scheme can go up to 20-25% in G Secs.)

Conclusion

Instead of being in a dilemma of choosing between accrual and duration schemes, especially since a 3 year holding period will be advisable from a tax and exit load point of view, you can consider choosing products like the L & T Resurgent India Bond Fund and similar strategies that offer flexibility of moving from duration to accrual as well as capturing the higher yields of corporate bonds.

Share this article

|