|

Part I : Investing in debt through mutual funds (Click here)

Part II: Types of debt mutual funds (Click here)

Part III: Important aspects of debt mutual funds (Click here)

Part IV: Points to remember before you invest in debt funds (Click here)

|

Are there any risks associated with investing in Debt Mutual Funds?

As with any capital market related investment, debt funds too face certain risks from the investor's point of view. A fixed income investment like a deposit or bond would give a pre-determined and steady return to the investor. As against this, a portfolio of debt securities whose market prices continuously change based on demand and supply of the debt securities and prevailing interest rates will give investors varying returns.

While close-ended schemes generally provide returns based on the prevailing market interest rates and / or the securities in which they invest, open-ended schemes are unpredictable. The two key reasons for this are: i) the size of the fund would vary on a daily basis due to fresh investments and redemptions and ii) the debt securities are valued based on their market prices each day.

There are predominantly two kinds of risks that debt funds are exposed to:

Credit risk & Interest rate risk

Credit risk refers to the possibility of the borrower not making interest payments or repaying the principal amount when the debt security matures and has to be repaid. Credit rating plays the role of assigning objective grades to the credit quality of a particular debt issue. The highest rating of AAA implies maximum safety and indicates the highest probability of prompt payment of interest and principal. The lowest rating of D is quite at the other end of the risk spectrum. These are generally termed as junk bonds and have a high likelihood of default. And correspondingly, the interest offered by a borrower is inversely related to his credit quality. This means, a debt security with the highest credit quality would offer a considerably lower interest rate than would a security with a lower credit rating. This is the reason that government securities typically offer the lowest interest rate amongst debt securities. Credit risk is not present in case of government securities and therefore, gilt schemes, which invest in government securities don't carry this risk.

Interest rate risk: This refers to the change in valuation of debt securities in response to any change in the market interest rates. In other words, there is a capital gain or loss made on the value of a debt security whenever there is a change in the market interest rates.

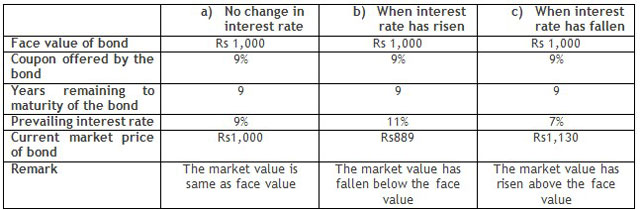

Consider this: Suppose you have invested, at the time of its initial issue on 1st Jan 2013, in a bond with a face value of Rs.1000, a coupon of 9% and a tenure of 10 years. The following illustration shows the price of the same bond on 1st January 2014 under three circumstances namely

when there is no change in the interest rate when the market rate has increased subsequently and when the market rate has fallen subsequently.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This article should not be considered as 'investment advice'. We request the Reader to make informed investment decisions and consult their financial advisors to determine the financial implications with respect to investing in Mutual Funds.

Share this article

|