|

What's happening in the debt markets and why?

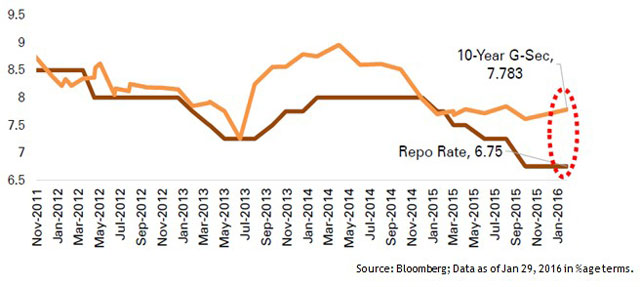

Despite the 125 basis-point cut in the Repo Rate in 2015, yields on Government bonds have been hardening. While the supply of bonds in the market has been high, demand from the banking sector has been weak. A weak rupee and higher-than-expected domestic wholesale inflation data also affected gilts.

G-Sec (Government Securities) bond prices have also been declining on concerns that the Government may not be able to meet its fiscal deficit target if it completely implements the Seventh Pay Commission recommendation.

Losses though, were capped due to foreign institutional investor inflows following the second tranche of hikes in debt investment limits. Better-than-expected outcome of the Reserve Bank of India's (RBI) open market operations' (OMO) purchase auction and expectation of more such OMOs, also boosted demand.

In the money market, rates increased sharply in January 2016 led by deterioration in liquidity conditions. Three-month Certificate of Deposit (CD) rates surged around 90bps while six-month CD rates surged more than 50 basis points.

The road ahead

Going forward we believe that money market rates may come down once liquidity situation improves. We believe that the RBI may consider conducting OMO purchases in the near term to ease system liquidity. The RBI's policy to improve liquidity in the system while maintaining rates, will help in easing short-term bond yields.

We believe that the RBI will maintain status quo on rates till the Union Budget. However, the RBI will continue to maintain an accommodative policy stance in the medium term as growth remains tepid and disinflation continues all over the world. We believe that the RBI may cut the Repo Rate by about 25-50 basis points in the next two to three quarters as inflation is expected to remain in the range of 5%-to-5.5% in 2016 even after implementation of Seventh Pay Commission recommendation.

We continue to see enough scope for yields to fall from current levels as the spread between the Repo Rate and 10-year G-Sec yields remains quite high despite the cut in interest rates by the RBI. This spread is likely to narrow going forward.

.

Implications on duration strategies and recent portfolio action taken by ICICI Prudential AMC:

As we continue to see enough scope for yields to fall from current levels and some improvement in liquidity conditions, we have maintained relatively high duration within the scope of our short- to medium-duration debt funds with an aim to lock-in gains, as and when yields bottom out. We also do dynamic duration management for some our funds-this enables us to take duration calls depending on the prevailing market conditions.

Implications for accrual strategies and recent portfolio action taken by ICICI Prudential AMC:

For accrual funds, we continue to invest in well-researched corporate bonds in order to lock in high yields currently available in the market. We try to ensure that consistency of returns in such a fund is not compromised by taking outsized exposure or by exposing the fund too much to interest rate risk.

Our Recommendations

Aggressive investors with a three-year time horizon can consider:

ICICI Prudential Long Term Plan

The fund that aims to dynamically manage duration in the range of 1 to 10 years based on the interest rate cycle.

ICICI Prudential Dynamic Bond Fund

This is an actively managed open-ended medium-term income fund that intends to generate total return through a judicious mix of accrual income and potential capital appreciation. This fund can dynamically change duration strategy from 1 to 5 years depending on interest rate scenario.

Conservative investors seeking to benefit from accrual and duration strategies can consider:

ICICI Prudential Regular Savings Fund

The fund aims to generate returns primarily in the form of accrual income by exploring opportunities in the credit space, and through potential capital appreciation as it holds papers with moderate duration.

ICICI Prudential Corporate Bond Fund

This Scheme seeks returns in the form of accrual income by investing in corporate bonds with AA and above credit rating, as well as through potential capital appreciation as it predominantly holds debt securities with higher maturity.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

All data/information in this material is specific to a time and may or may not be relevant in future post issuance of this material. ICICI Prudential Asset Management Company Limited (the AMC) takes no responsibility of updating any data/information in this material from time to time. The AMC (including its affiliates), ICICI Prudential Mutual Fund (the Fund), ICICI Prudential Trust Limited (the Trust) and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Nothing contained in this document shall be construed to be an investment advice or an assurance of the benefits of investing in the any of the Schemes of the Fund. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Share this article

|