|

Global

Government bonds around the world continued to trade at historically low rates in February. Only bonds of stressed countries like Venezuela, Greece or Ukraine posted good rates. In fact about $7 trillion of government bonds showed negative returns. This has led to a strange investing environment where investors go in for low yielding or, even zero yielding bonds for capital gains purposes; while they invest in the stock markets to earn income. Analysts say that investment in stocks is advantageous in contrast to investment in bonds whose rates keep going down.

With the market for government bonds declining, many investors have looked to the corporate world to park their money. This has driven the rates of corporate bonds also lower, which in early 2015 averaged about 2.9%.This has further pushed investors to look at high risk higher yielding non-investment grade bonds and in emerging market debt including many little known issues in Asia and Africa. (Reuters, US Edition Feb 25, 2016).

However the increase in oil prices has boosted sentiments. In recent days, yield premiums on regular U.S. Treasuries over Treasury Inflation Protected Securities, known as inflation breakeven rates, have risen from their lowest levels since early 2009.

The US Federal Reserve, struggling to meet its inflation target of 2% has been wary of falling bond prices. Investors are no longer able to get due value for their investments. This has left them exposed to the risk of higher central bank interest rates. It is estimated that a 1% increase in Fed rate would provoke a 7% fall in the value of a US corporate bond. This contrasts with the 5% loss from such a rise five years ago. (Market watch Feb 25, 2016)

USA

The high yielding or 'junk' bond market was on course for a negative return in February. This is bad news for the stock markets, as share prices have a tendency to track these bonds. The main fear of investors is that liquidity would go down as the Fed raises interest rates. The Bank of America Merrill Lynch U.S. High Yield Index witnessed a negative return of 0.1% for February and a negative 1.7% annually. The index has been in negative territory since September.

According to BofA Merrill, the option-adjusted spread (OAS) over Treasury bonds finished February at 780 basis points, in contrast to 775 basis points at the beginning of the month. This is well off its high of 887 basis points earlier in the month. The historical average is 576 basis points. When investors apprehend higher risk, the spreads tend to increase. Spreads of high yielding bonds expanded 85 basis points on an annual basis.

Data from Dealogic revealed that markets witnessed an issuance of $ 7.4 billion in February and $ 25.4 billion in the new year so far. This is less than the $ 40 billion issued in the same period a year ago.

"While credit spreads have clearly bounced back here in the last two weeks, the pendulum has not swung back to full risk-on, highlighted by weak pure high-yield volumes as well as a report that bookrunners are having trouble selling the $2 billion cross-currency Solera deal," CreditSights analysts wrote in a note.(Marketwatch Feb 29, 2016)

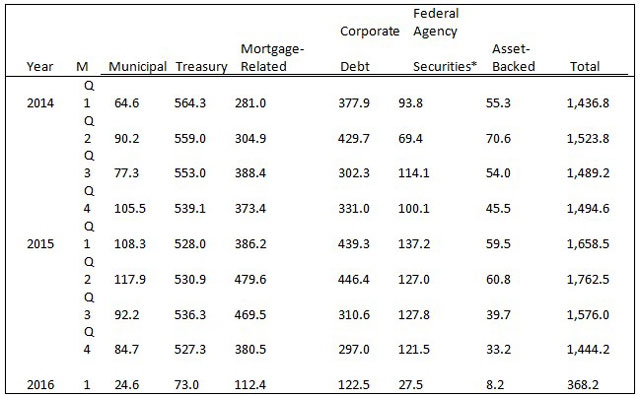

Bonds Issued in US

Europe

European bond markets in 2016 witnessed the worst start to a new year since 2003. European financial institutions have sold just under $45 billion of senior unsecured bonds in 2016 so far, 29 per cent lower than over the same period last year. Sales in February have been a dismal $3 billion. (Financial Times February 15, 2016). Senior unsecured bonds are low yielding debt instruments and are an alternative to other forms of bank borrowings, like customer deposits and short-term interbank debt markets. Funds from these bonds are used for lending to the banks' customers.

The lower sales come in the wake of turmoil in global markets, with many investors expressing fears over bank stocks and bonds, making new issuance difficult. The Euro Stoxx banks index is down 23 per cent this year. It may be noted that bank bond markets were shut on several occasions in 2015, due to turmoil in German markets and fears over Greece. However things looked up slightly in the middle of February 2016, as the Dutch bank ING and the Swedish bank NORDEA issued senior unsecured bonds.

"The market is just not used to having this sort of volatility so early in the year. There's been very few windows of opportunity for issuers given the backdrop," said Nick Dent, head of European and Asian syndicate at Nomura. "The mood is much stronger today," he added. (Financial Times February 15, 2016).

Senior unsecured bonds apart, other debt instruments have higher yields but also carry greater risks. Tier one bonds, which can be converted into capital, have seen big losses in the recent past. European markets have also splintered into separate geographical areas; the so called 'core', where current bonds were issued, and the 'periphery'.

"This year we've seen a bifurcation of the capital structure. Covered bonds have been very active whilst senior unsecured issuance has been down significantly," said Tim Michael, head of European FIG syndicate at Citigroup. He added that riskier types of bonds have not seen issuance in over a month. Another problem that investors are grappling with is new regulations which, when banks fail in their obligations put previously excluded senior bonds on the block. On the whole, bankers were pessimistic about banks expanding their balance sheets in the near future.

Asia

China

As February wound down, China a pulled a pleasant surprise on the investing community by announcing that it was further opening up its $7 trillion bond market to foreign investors. The Chinese bond market is the third largest in the world. The People's Bank of China (PBOC) announced in late February that it would allow certain types of foreign investors to buy bonds in its interbank bond market while scrapping quotas for long-term investors such as pension funds and charity funds. Currently the market is restricted to Qualified Foreign Institutional Investor (QFII) and Renminbi QFII (RQFII) channels, which are restricted by license and quota approvals. (Reuters Fri Mar 4, 2016)

The move is expected to attract big investments and slow the depreciation of the Yuan. Deutsche Bank expects that in five years time, up to 10% of the Chinese bond market would be held by foreigners. Overseas investors now own a meager 2 percent of China's $7 trillion bond market, much lower than South Korea (6.5 percent) and India (4.5 percent).

However, given China's decelerating economy and the pessimistic outlook for the Yuan, foreign inflows are likely to take some time to materialize. Foreign investors decreased their exposure to Chinese bonds by $ 7.58 billion in January, official statistics reveal. Economists expect that the Yuan would fall 3.5% against the dollar in the coming year. Given this scenario many investors might be more interested in off shore bonds, particularly as the central bank cuts rates and eases liquidity.

"Investors are taking a wait and see approach on how the yuan and economy will perform. Inflows to and outflows from my fund are flat so far this year," said a fixed-income fund manager who reported heavy redemptions at the end of last year that left much of his RQFII quota unused. (Reuters Fri Mar 4, 2016)

Japan

The Bank of Japan's, BOJ, decision to charge negative interest rates has unsettled Japanese bond markets. Investors in Japan generally regarded only utilities and railway companies' bonds as safe for investment purposes. Other companies were considered too risky for the long term. This philosophy has been turned on its head by the BOJ's recent decision.

"The pool of investment vehicles with positive yields is shrinking fast, and investors pursuing an absolute value strategy are moving quickly to secure bonds that still offer yield," said Toshihiro Uomoto, chief credit strategist at Nomura Securities.

The Japan Securities Dealers' Association said that total corporate bond issuance fell to a 10-year low of $61.31 billion in 2015. Government bonds with maturity of 11 years, 80% of all government bonds, are trading at negative yields. Companies are eager to take advantage of these conditions, while there is some talk of even twenty year maturities. Such bonds will face severe competition from bank lending, which have become easier due to BOJ's policies. (Reuters Mar 4, 2016)

India

For the sixth straight month, corporate bond issues declined in February. In the six months to February, bond issues fell 27% annually to Rs. 1, 98,515 crores. However, for the April to February period, privately placed bond issues stood at Rs. 4,14 lakh crores, the highest ever since 2007. (Economic Times, 8th March, 2016)

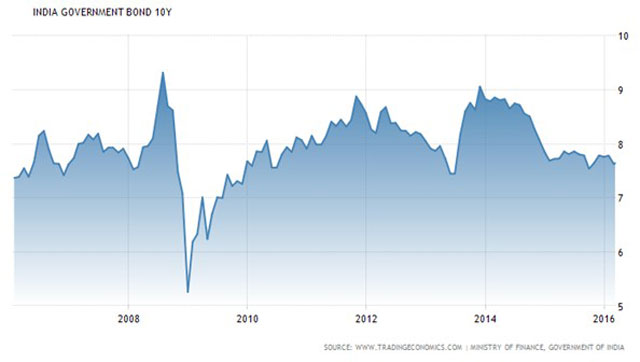

Nevertheless in the first half of February, many Foreign Portfolio Investors have pulled out money from Indian bonds. They feared that a ratings downgrade would follow, should the government not adhere to already announced fiscal targets. Hitherto, Indian bonds have been preferred for their high yields. Indian sovereign bonds yielded 8.1% in 2015.

"The demand-supply mechanics and also the fact that the currency is volatile is the reason for FPIs to move out," said Ashish Vaidya, head of trading and asset liability management (ALM) at DBS Bank. (Business Standard, Feb 25 2016).

This note has been put together by Wealth Forum and should not be construed as an opinion of ICICI Prudential AMC.

Share this article

|