|

Global

In March, bonds around the world rallied, wiping out the losses incurred in the previous two months. The Markit iBoxx GEMX Brazil index has returned 9.2% so far this year, gaining 5.5% in March.

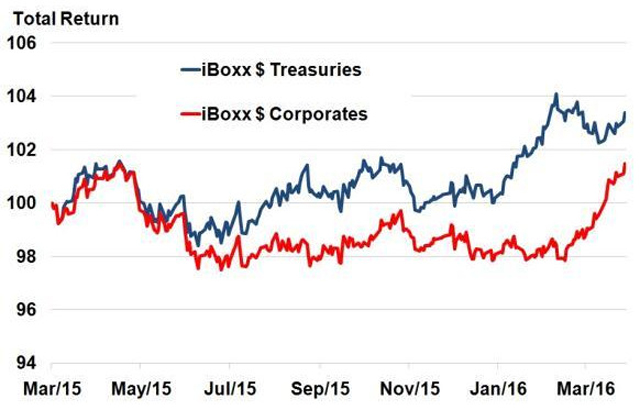

In March, ETF investors have enjoyed a resurgence of corporate bonds as both IG and HY ETFs have seen the biggest inflows. Investors' appetite has been good as listed funds in both North America and Europe have witnessed strong inflows into both types of corporate bond ETFs. IG corporate bond ETFs made up $6.1bn of the $12.9bn of inflows into fixed income ETFs. Inflation-linked sovereign bond funds have received $1.5bn of inflows in the month, double their year to date performance. (SeekingAlpha April 5, 2016)

The European Central Bank, ECB's move to reduce interest rates, while increasing the QE program helped the bond markets in March. This was the best month for bonds since October.The ECB at its policy meeting had said that it would finance twenty billion Euros of bonds every month, including corporate bonds. In tandem, the Fed also announced that its tightening cycle would be in measured steps, while keeping a watchful eye on the state of markets. This combined with the firming of oil prices made this a memorable one for the global bond markets.Risky assets have rebounded solidly riding on the back of these developments.

US

Junk bonds had a good run in March, ending up about 0.5%. Gains hit a plateau during the middle of the month. Junk bonds have mirrored crude oil prices. Even as investors posted gains, and even while many strategists recommend high yield bonds over equities, credit conditions deteriorated noticeably in March.

Moody's Liquidity Stress Index (LSI) jumped to 10.3% from 9% in February, while the energy LSI jumped to a record high of 31.6% from 27.2% in February.Non-energy liquidity stress also rose - to 4.8% in March from 4.1% in February. "The LSI's gains continue to presage a higher US speculative-grade default rate," saidJohn Puchalla, of Moody's. "We forecast the default rate will rise to 5.3% in February 2017 from a current 3.6%."(Barron's April 4, 2016)

Europe

The ECB's announcement of additional 20 billion Euros bond purchases over the current 60 billion Euros purchase has proved a bonanza for European companies. However many analysts expressed doubts over the viability of the easing, since the total of bonds issued amount to 554 billion Euros only.The ECB's scheme may disrupt liquidity in the Eurozone.On the other hand, many new issues are likely to hit the market. Non-bank corporate bond issues hit a high of 50 billion Euros in March, while more are being lined up. This program is having its intended effect of reducing interest yields, while pushing up equity values.

Asia

China

The chief reason for the selloff in US markets at the beginning of the year is the uncertainty that continues to linger over the Chinese economy.

"Chinese companies canceled more than double the amount of bond offerings in March compared with a year earlier, as mounting defaults increased financing costs…The surge in scrapped offerings reflects investors' growing concern about default risks amid the worst slowdown in a quarter century."(Bloomberg)

It is likely that some Chinese companies may not be able tomanage the financial buffeting, entailed by China's move to turn away from export-led growth to a more domestic demand driven growth model.

"China's top corporate bond underwriter said defaults will increase this year, casting a cloud over the market after record offerings in the first quarter helped refinance debt…"There will probably be many credit events caused by liquidity problems," said Huang Ling at the Beijing-based firm, which Bloomberg-compiled data show underwrote the most corporate bonds excluding notes regulated by the central bank in the first three months. "Some external events may trigger withdrawal of lending by financial institutions."(Bloomberg)(Seekingaalpha Apr. 7, 2016)

India

Bond markets broke a jinx in March, when they posted solid gains, the best in thirteen years.

The 10-year yield will drop at least 25 basis points in six months from 7.51%. February had seen a drop of twelve basis points. The median forecast point to a three basis point fall by end of September, though some analysts opine that it could fall further.

"There are more legs to the rally," said Lakshmi Iyer, who helps oversee $8.25 billion as head of fixed income at Kotak Mahindra. "The government adhering to fiscal discipline, reduction in the administered interest rates on savings and inflation remaining subdued has led to a rally in bonds. What's happening is all these have led to anticipation that these factors will lead the RBI to cut rates further.'' (Livemint 08 April 2016)

Share this article

|