|

WF: Debt fund investors are concerned about possibility of further credit events, ever since one credit event in an auto ancillary company impacted a couple of debt schemes of a fund house. What is the credit situation on ground? Is it deteriorating due to ongoing global weakness? Are there pockets of concern on credit quality?

Rahul: Our view on credit market remains positive as on an overall basis the credit strength of corporates is improving. We believe credit profiles of companies have improved from the situation a year ago. This can be seen in the improved credit ratio i.e. Upgrade to Downgrade ratio as published by CRISIL has improved sharply in the last financial year which is a healthy sign of improvement in credit profile of corporates. Currently, the ratio is at 1.75 which is a clear improvement from being less than 1 two years ago.

This suggests that Corporate India's credit profile will further improve once domestic economic cycle progresses. We are comfortable in each our holdings across our debt portfolios and will continue to remain vigilant of changing developments in the economy. In fact, for our funds in the credit space, this ratio is far higher; this has translated into reasonable performance of our funds.

It should be noted that the credit ratio (ratio of upgrades to downgrades) of '6' for our credit funds is much better than the average Crisil credit ratio of '1.06' for the last two years. Going forward, as the economy picks up, we expect this ratio to further improve. The consistent uptrend, over last couple of years in the Crisil credit ratio further strengthens this argument.

WF: How should one look at the recent upgrades and downgrades in the credit ratings of some corporates?

Rahul: As mentioned above we have seen sharp improvement in credit ratio over past two years. One needs to understand that rating upgrades and downgrades are part and parcel of this industry. However, while creating a portfolio one needs to ensure that the net number is additive, i.e. upgrades have to be higher and should ultimately aid performance of the funds.

WF: Investors and advisors are puzzled about how a company's credit rating can see significant downgrade in a short period of time. How do you protect your portfolios against such drastic rating moves?

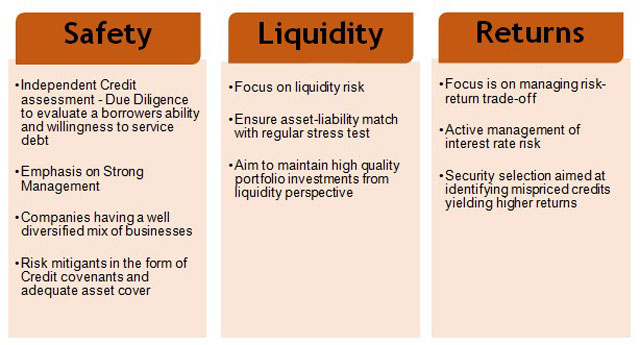

Rahul: At ICICI Prudential AMC (IPAMC) we rely on internal research by conducting bottom-up analysis on the issuer. We believe external rating is just one of the filters while analysing an investment and therefore, we do not solely rely on it. We seek to achieve Safety, Liquidity and Returns (SLR) philosophy in that order of priority while managing a variety of debt schemes.

Managing credit is a very technical function and just as equity funds should be managed by specialist, credit funds should also be managed by a specialist. There are two independent teams involved while investing in corporate bonds - Origination Team and Credit Team. Credit Team is independent of fund management team and reports into Head- Investment Risk who in turn reports directly to the MD & CEO. There is a specialized 10 member team with cumulative experience of over 60 years into credit who evaluate closely each investment into corporate bonds for its credit risk before it is added to the Scheme portfolio.

At IPAMC, we have built a structured process around our asset selection exercise and we avoid concentration risk by adhering to the investment limits and tenor restrictions approved in case of each issuer.

WF: Many fund managers tell us that when investing in less than AA+ papers, they often take additional security of shares of the company. When credit events occur, shares collapse rapidly, often rendering this security meaningless. How do you deal with such situations? Does a regular review help point out imminent danger sufficiently in advance, before it gets too late?

Rahul: In the Indian context, equity shares are the most liquid collateral one can have relative to other available collaterals. At IPAMC, while investing in such structures we accept shares only from the main operating company and with significant cover. This limit is monitored on daily basis so that if there is any fall in share price, necessary action can be initiated and implemented at the earliest.

WF: Advisors have often expressed concerns on the liquidity aspect of corporate bond funds, as the underlying papers are often very illiquid. The recent credit event and the ensuing bout of nervousness brought these issues to the fore. How do you manage this key risk in your corporate bond funds?

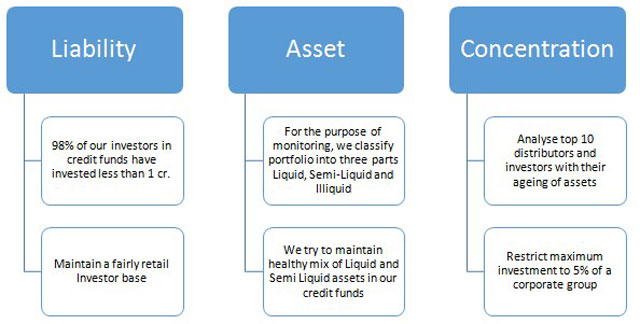

Rahul: Corporate bonds are less liquid as compared to equity and gilts, hence, liquidity must be closely tracked. At IPAMC, we manage liquidity risk in three ways

WF: What message would you like your distributors to give to investors who are concerned about recent developments in corporate bond funds?

Rahul: We believe that performance is a function of risk. Therefore, it is important to manage the three critical risks- Credit risk, liquidity risk and concentration risk. While credit and liquidity risks can be analysed by tracking the portfolio and most advisors do consider it, concentration risk is also something which one should look at.

With lower concentration risk one can reduce the impact of any uncertain event that can occur due to un-avoidable circumstances. Advisors should educate the investors to not only be concerned about the performance but should also give due weightage to the credit quality of corporate bond funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The information contained herein is only for the reading/understanding of the registered Advisors/Distributors. All data/information used in the preparation of this material is specific to a time and may or may not be relevant in future post issuance of this material. ICICI Prudential Asset Management Company Limited (the AMC) takes no responsibility of updating any data/information in this material from time to time. The AMC (including its affiliates), ICICI Prudential Mutual Fund (the Fund), ICICI Prudential Trust Limited (the Trust) and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Nothing contained in this document shall be construed to be an investment advise or an assurance of the benefits of investing in the any of the Schemes of the Fund. Sectors/stocks mentioned in the article do not constitute any recommendation and the Fund through its schemes may or may not have any future position in these sectors/stocks. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Share this article

|