In this part, we share findings from the AMC confidence section of the survey. We asked leading IFAs from across the country, who were invited to participate in this survey, to list out their top 5 AMCs on each of these parameters :

Ability to deliver superior long term returns from equity funds Ability to deliver healthy returns from debt funds, with lower volatility Distributor engagement, training and support Innovate new products and services and new sales ideas Impactful and relevant investor education initiatives Convenient, investor friendly processes and approach

We asked participants to name and rank only their top 5 in each category - as mindshare rarely goes beyond 5 names for each parameter. In the tables below, we have listed out and ranked the top 10 AMCs that featured the most in the lists provided by the 198 leading IFAs who participated in this survey. Each of the names mentioned here across each region therefore features in the top 5 list of some, many or most of the leading IFAs in each region. Below each table, a reference table has also been provided that compares ranks on each parameter in this survey with the previous two surveys conducted in June 2013 and Dec 2011.

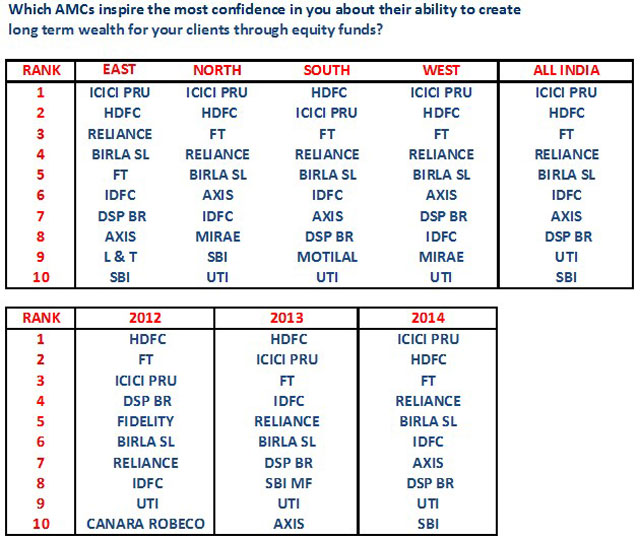

1. AMC Confidence - Equity Fund Management

The steady climb of ICICI Pru from 3rd to 2nd and now to pole position over these 3 years is clearly a key highlight. Also noteworthy is the comeback of Reliance - from 7th to 5th and now 4th position. Birla SL has also moved up a notch this year, in a fiercely competitive market. Axis MF, which made its debut at no 10 position last year, has moved up now to No.7 position - no mean feat for a new fund house.

The top 3 positions continue to be populated by the same three fund houses - HDFC, ICICI Pru and Franklin Templeton - only the pecking order has changed a bit over these 3 years. In the regional lists, the presence of Mirae, Motilal Oswal and L&T bear testimony to the fact that good performance and strong processes are indeed getting noticed, despite a very competitive market place, where over 40 fund houses vie for that "top 5" mindshare from every distributor. At an all India level however, there is no new entrant into the top 10 list this year, but the changes in the pecking order give good insights into fund houses on the move.

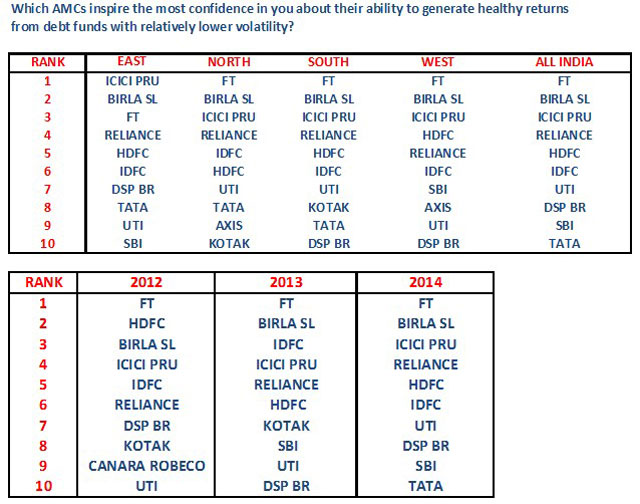

2. AMC Confidence - Debt Fund Management

Franklin Templeton has retained its stranglehold on the pole position for the 3rd year in a row, while Birla Sun Life retains its 2nd position for a second year in a row. ICICI Pru has now moved into 3rd position. Like with equity, the comeback of Reliance is noteworthy - from 6th in 2012 to 5th in 2013 to 4th in 2014. HDFC has moved up a notch to 5th position, and Tata makes its debut into the top 10, displacing Kotak from the top 10 league table.

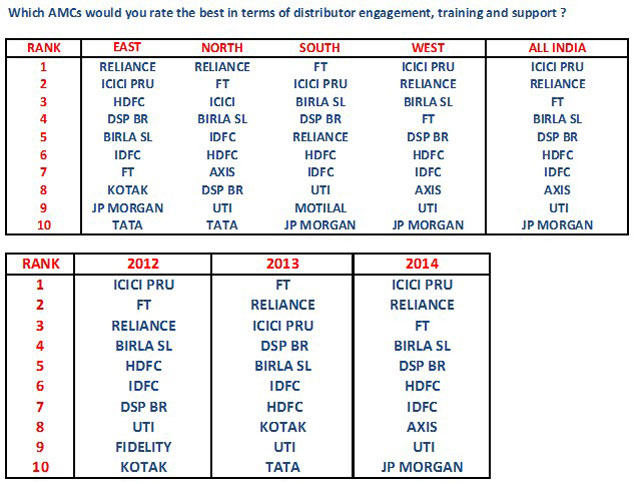

3. AMC Confidence - Distributor engagement, training and support

Winning distributor mindshare is about delivering consistently good fund performance on the one hand and maintaining high levels of distributor engagement on the other. The top 3 fund houses in terms of distributor engagement, training and support remain unchanged for the 3rd year in a row - the pecking order however has changed. ICICI Pru now takes the number 1 slot, with Reliance holding onto the 2nd position. Axis makes its debut into the All India top 10, on the strength of its engagement scores in North and West. JP Morgan too makes its debut into the top 10, and features in 3 out of the 4 regions. Tata narrowly misses out the top 10 slot on an All India basis, perhaps because it is not high enough in distributor mindshare in South and West.

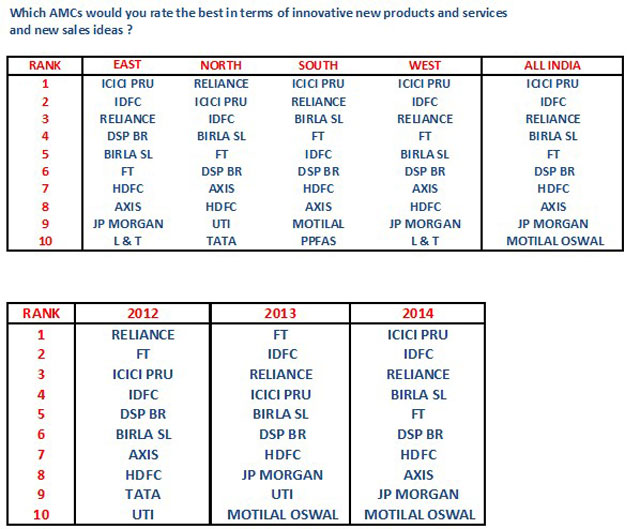

4. AMC Confidence - Innovation

ICICI Pru moves up to 1st position on this parameter too, in 2014. Could it be the well timed Value Fund series product launches that contributed to this move up from 4th position to 1st position? IDFC and Reliance retain their 2nd and 3rd positions. Axis makes a comeback into the All India Top 10 on this score this year - perhaps Shubhchintak is playing a key role here.

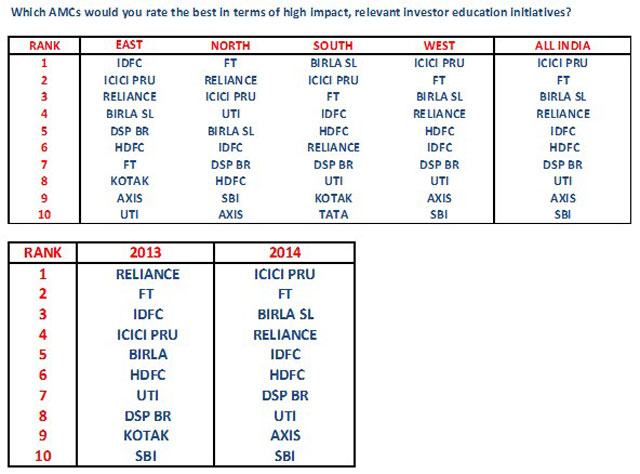

5. AMC Confidence - Impactful investor education

ICICI Pru takes the number 1 slot in yet another parameter this year! Climbing up from 4th position to no 1 is no mean achievement. FT retains its no 2 position. Axis makes a debut this year, displacing Kotak from the All India Top 10.

Impactful and relevant investor education is seen by the regulator and most experts as the single biggest long term growth driver for the industry. Fund houses that are doing a good job on this score are in no small measure contributing to long term growth of the industry.

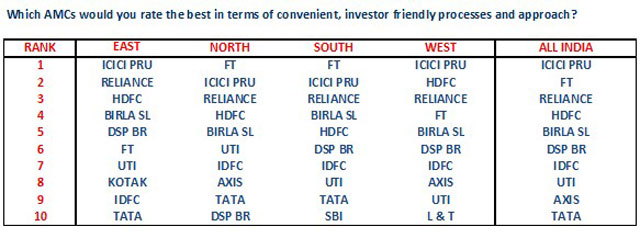

6. AMC Confidence - Convenient and investor friendly processes and approach

This is a new parameter we have introduced this year, in response to a number of issues that IFAs have been raising about the need to enhance convenience in operational processes at several fund houses. This pecking order perhaps suggests fund houses where leading IFAs have experienced relatively more investor friendly processes. We will hopefully move to a stage where fund houses will compete to offer more convenience on ground (and not just online) and not just higher returns.

To conclude

Our sincere gratitude to all the leading IFAs from 42 cities across the country who agreed to participate in this very exhaustive survey and shared their insights and outlook on a wide range of business, market, product and AMC partner confidence parameters. Our heartiest congratulations to all the AMCs who feature in these lists above : it is indeed a very competitive market place and winning the mindshare of India's leading IFAs is not an easy task. We hope you have found these 3 articles useful in comparing and contrasting your own outlook on a number of business parameters with those of the respondents of this survey. We hope these findings give you a sharper perspective and help clarify your own thinking.

Share this article

|