Part II: Market Confidence

Market Confidence: Equity

After scoring a hat-trick by getting their equity market predictions right three years in a row (Click Here), the law of averages has finally caught up with India's leading IFAs. Their mean prediction in June 2015 for the Sensex level by March 2016 was 30,112. As it turned out, the Jan-Feb global market correction put paid to their prediction, and the Sensex closed on 31st March 2016 at 25,342.

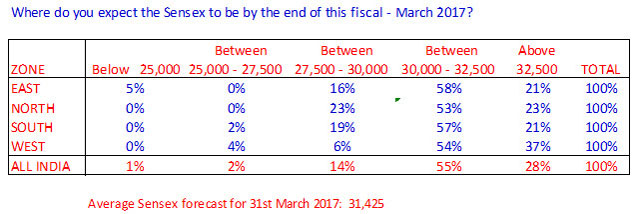

What's their forecast for March 2017?

The correction of Jan-Feb 2016 has not dented advisor confidence on near term equity market prospects. Only 3% of respondents believe the market will drift lower than the 26,000 levels it has traded in May 2016, when the survey was conducted. A huge 83% see the market at a new life time high by March 2017 (above 30,000) and the mean prediction is a Sensex level of 31,425 by end of March 2017 - which is some 17% higher than the 26,800 levels as we write this piece on 6th June 2016.

Market Confidence: Debt

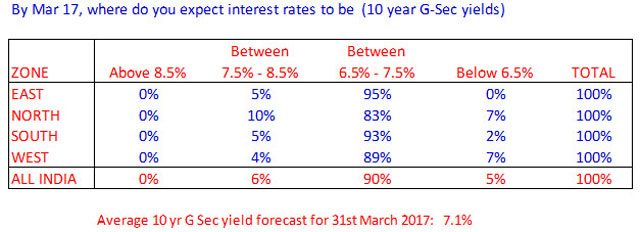

Last year, our champion IFAs forecast the 10 yr G Sec yields at 7.4% by March 2016. As it turns out, they were bang on - to the decimal! On 31st March 2016, the 10 yr G Sec yield closed at 7.46. So, what's their forecast for March 2017?

As we write this piece on 6th June 2016, the 10 yr G Sec yield is around 7.49%. Our champion IFAs are betting on a reduction in yields, to a mean level of 7.1% within the next 9 months. If we do get a 40 bps drop in bond yields in the next 9 months, duration strategies could deliver healthy returns by the end of this fiscal. A massive 94% of respondents expect yields to drift downwards - only 6% are somewhat bearish on interest rates.

The only worry in the equity and debt forecasts is that both are crowded trades - our champion IFAs are overwhelmingly optimistic about both equity and debt markets for the rest of this fiscal. One hopes their optimism bears out, but a small red flag does go up in a seasoned mind when any trade gets too crowded.

Market Confidence: Currency

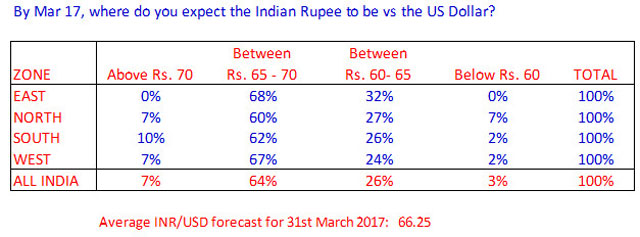

Our champion IFAs forecast in June 2015 that the Indian Rupee would trade at INR 64.60 to a US dollar by end of March 2016. The reality, induced by the sell off in Jan-Feb 2016 was worse - the rupee settled at 66.17 to a dollar by 31st March 2016.

Looking ahead, our champion IFAs see the rupee range bound over the rest of this fiscal. Their forecast for March 2017 is INR 66.25 to a dollar, while it currently trades at INR 67 as we write this piece on 6th June 2016.

No major move anticipated in the currency would imply low probability assigned to any global shocks from Brexit, US rate hikes and so on. This would mean that our equity and debt markets would march to their own beat. This in turn could also explain high confidence in both equity and debt markets for the rest of the fiscal.

Part III: Product Confidence

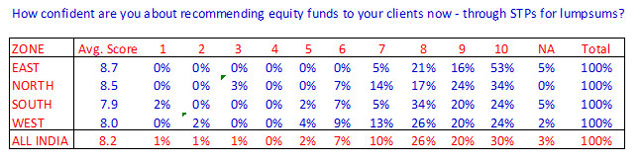

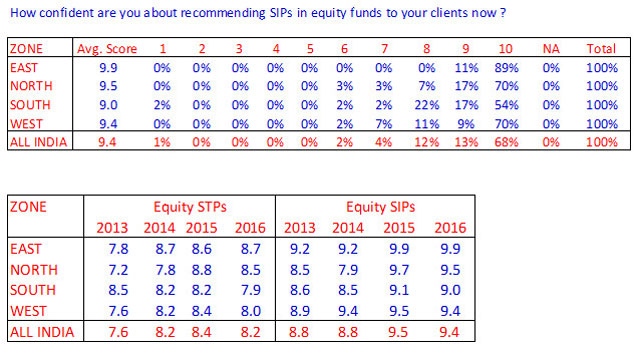

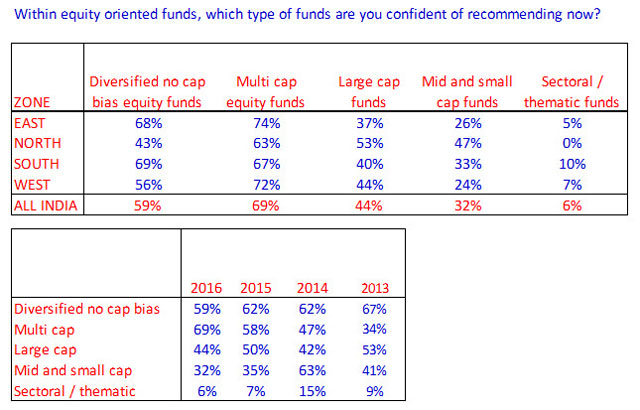

Product confidence: equity funds

No surprises here - confidence in equity markets and equity funds continues to be very high. Equity STPs continue to enjoy high confidence of over 8 for three years in a row, while equity SIPs are about as close to a perfect 10 as you can expect.

Confidence in midcaps peaked in 2014, and has tapered off since, given the rise in valuations of that market segment. Its not as if this interest shifted to large caps - instead, the beneficiary seems to be multi-cap funds. Clearly, champion IFAs are betting on a more broad-based market rally going forward, and would much rather prefer betting on the market than any one segment of it at this stage in the market cycle. Sectoral and thematic funds continue to enjoy poor overall confidence. Its clearly time for mainstream equity funds - diversified and multi-caps.

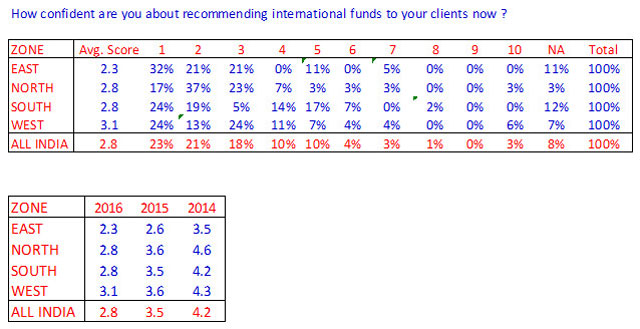

Not much joy here - fund houses that have put out a range of global funds on their shelves will have to continue to bide their time for these products to become relevant. Interest in global funds peaked in the immediate aftermath of the 2013 currency shock, and since then, its been a downhill drive for this product category.

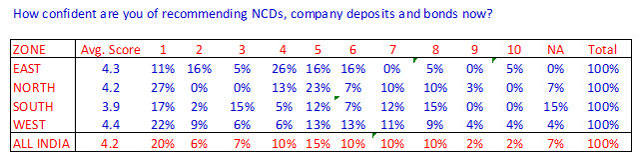

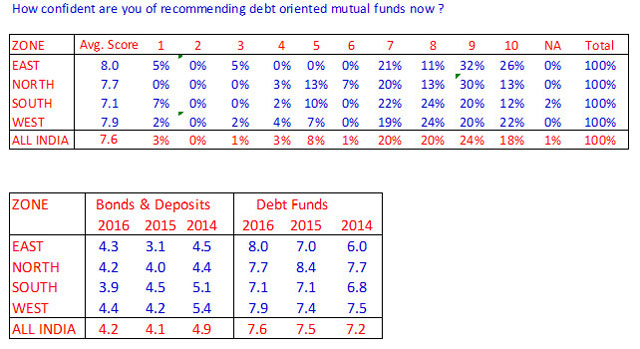

Product confidence: debt

The good news is that despite a couple of credit accidents that created major newsflow for weeks on end on both occasions, overall confidence in debt funds hasn't reduced - in fact it's gone up a notch. Bonds and deposits continue to trail debt funds by a wide margin.

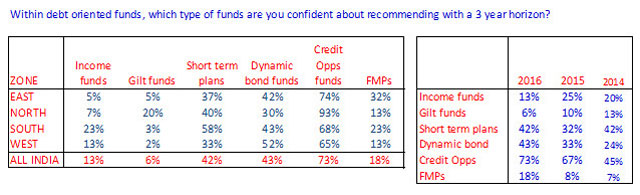

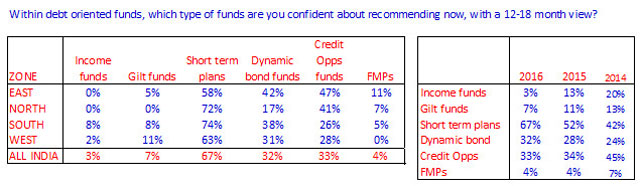

There are some interesting zonal variations here. Leading IFAs in West and South have reasonably high confidence in income funds, while their Northern counterparts clearly are going for the jugular with gilt funds rather than income funds, and in sharp contrast, their Eastern brethren aren't really interested in either. There seems to however be a lot more confidence in playing the duration game using dynamic bond funds rather than income or gilt funds - and that is coming across in all regions.

The biggest story here is that credit opportunities funds - which were in the eye of the storm in recent months - actually enjoy more advisor confidence than ever before. Have credit funds come out of their agnipariksha successfully? Seems so.

Short term plans have become the default choice for 12-18 month allocations. Clearly, champion advisors are looking to cut out risk when it comes to nearer term horizons. Confidence in short term plans rising from 42% to 67% in the 12-18 month segment should perk up interest among marketing executives of fund houses. Is there an opportunity to use short term funds, package them with add-ons for typical short term savings like overseas holidays, down-payment for homes etc, and come up with neat solutions for short term consumer savings needs?

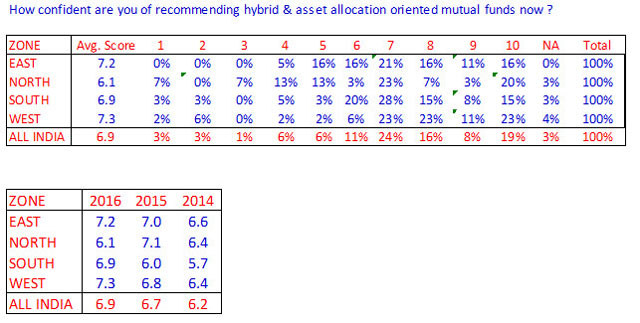

Product confidence: hybrid funds

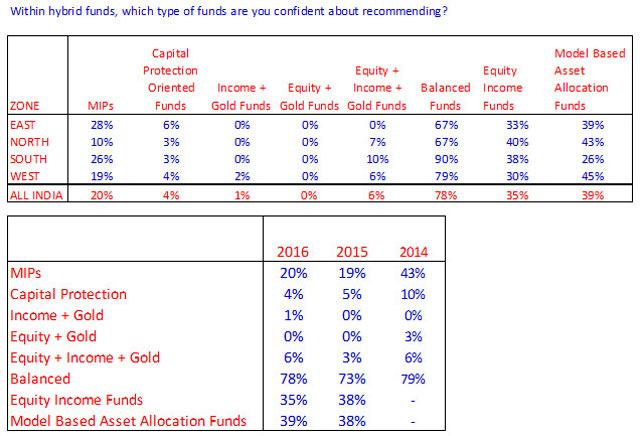

Hybrids as a product category are gaining advisor confidence with each passing year, which is good news for the retail segment of the industry. It is now accepted wisdom that retail investors who don't get proactive asset allocation and periodic rebalancing support from advisors, are perhaps better off in some form of advice-embedded and auto-rebalancing products within the hybrids space.

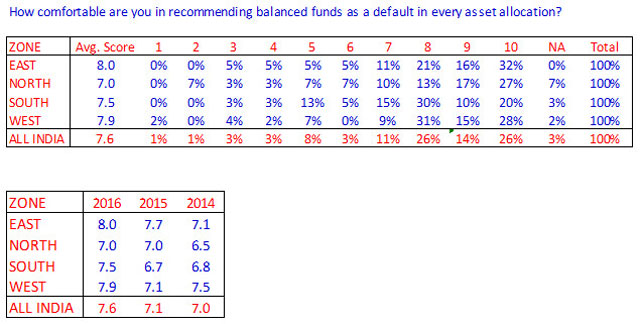

Not much has changed over the last 3 years in terms of advisor preferences within the hybrids range. Balanced funds continue to rule the roost. Model based AA funds and equity income funds continue to enjoy healthy advisor confidence. For all the theoretical advantages of model based AA funds, one would have expected the confidence score to keep rising over time. That it is not happening should be a point to ponder for fund houses.

Balanced funds have clearly moved centre stage now. Advisor confidence in them is just as high as in debt funds. Rising popularity of balanced funds should (like with short term plans) be a wake up call for marketing executives in fund houses. Its time to find ways to package balanced funds into creative solutions that address long term saving and investment needs of retail households.

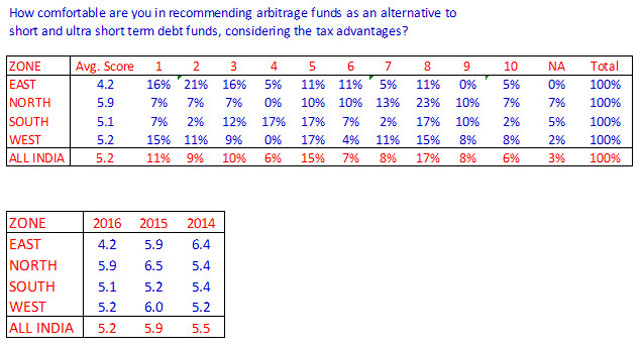

Product confidence: arbitrage funds

Enthusiasm for arbitrage funds is on the wane. Could it be because of poorer than anticipated performance?

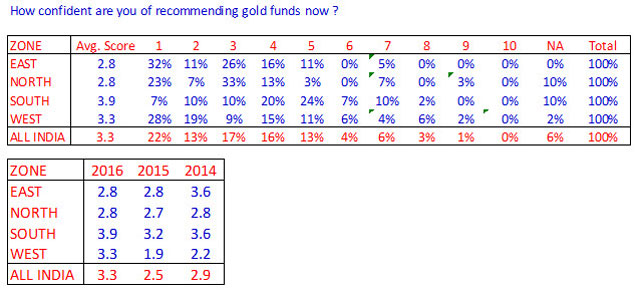

Product confidence: gold funds

Advisor confidence in gold has turned the corner. After plummeting all the way to an abysmal 2.5 last year, its now up to 3.3 this year, in tandem with a spike in gold prices in recent months. Will gold come back into favour like it was in its heady days until its 2011 peak? Around 23% of respondents are reasonably confident of recommending gold to their clients now (scores of 5, 6 and 7) while only 4% are very confident (scores of 8 and 9). Will these 27% deliver alpha in client portfolios with an early call to get into gold? Only time will tell.

Product confidence: insurance

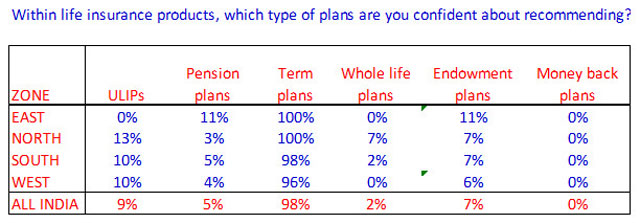

No surprises here at all. For the 4th year in a row, champion advisors are unequivocally behind term plans as the best insurance solution for their clients. The "reforms" in life insurance products carried out in recent years don't seem to have convinced many champion advisors that ULIPs and traditional products ought to find a place in their clients' financial plans.

Share this article

|