|

I have penned three articles under this series on Equity Investing - Some Qualitative Parameters to be seen besides just the returns analysis.

1st article (3 wise suggestions): I had mentioned about Where Not to Invest rather than Where to Invest. This included negative list of not investing in Sectoral Themes, Investments based on Market Caps & Close Ended schemes.

2nd article (Don't fall for the long term argument): I spoke about being sensitive to market valuations & investing based on Red Zone, Yellow Zone & Green Zone of markets. Simple parameters like market PE/PB etc. to be kept in mind while investing & disinvesting in Equity markets.

3rd article (This data suggests likely equity returns): I had shown Sensex 10 Year Rolling returns analysis & its correlation to current market investment condition. Whenever 10 year rolling returns have been less than 9% (as in the current market scenario); investments in Equity markets at that juncture, if held for 3 years thereafter had resulted in tremendous returns potential for the investors.

Other parameter that can be looked into is the Market Cap to GDP ratio. Less than 100% indicates that markets are undervalued or fairly valued & a ratio way higher than 100% indicates that markets are in the overvalued zone. Currently Market Cap to GDP ratio is approx.79%; thereby indicating that we are still in fair or under valuation zone. All other parameters as stated above are also giving similar indications.

Fund manager alpha and advisor alpha

However, one most important factor which we are not considering is the Active Management by the Fund Managers who are generating Alpha over benchmarks on an ongoing basis. Credit should be given where it is due. Hence, Fund Managers' active management on Sector selection, selection between Large/Mid/Small Cap, etc. generates that extra Alpha. Most schemes have consistently beaten benchmarks by huge margins.

However, as Advisors our role does not end by selecting right scheme/AMC/Fund Manager over the Benchmark. There is one more Alpha that we can generate over & above the Fund Managers' Alpha & that is the right Asset Allocation, Buy Low Sell High & incorporating a strategy for regular profit booking.

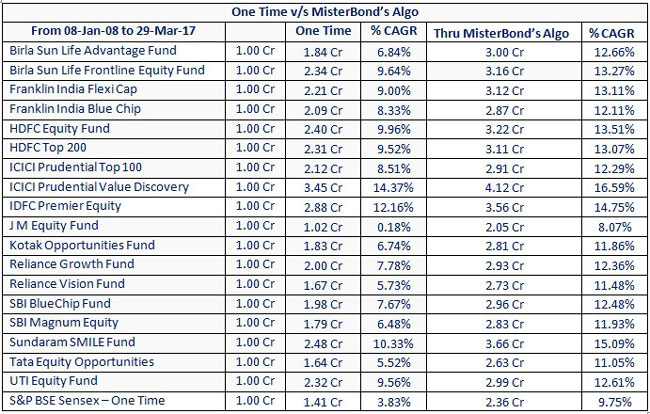

Classic example of this can be show cased for investments made in January 2008 in 1) Benchmark Sensex, 2) Investment in right Equity Schemes - One time investment (selection of right scheme & Fund Manager & show casing Fund Managers' Alpha over the Benchmark) & 3) Advisors' Alpha through Asset Re allocation (in this example I have used MisterBond's Algo for Asset Re allocation). Please note that I have selected some popular Equity schemes which have been in existence since January 2008:

As can be seen from above

Benchmark Sensex returns from Jan 2008 to March 2017 has been a meagre 3.83% Almost all schemes (except one) have beaten the Benchmark returns by a huge margin of almost 3-10% However, by right asset allocation thru the Algo of MisterBond, the same scheme returns have jumped up from 5.50-14.37% range to 11-16.59% (excluding one scheme of JM which has not even beaten the benchmark returns over this period) This is where role of Advisors becomes extremely crucial as they would have shown Value Add from their end & not selected schemes, invested in the same & sat over it for long period of 9 years plus & generated average of about 7-8% even in these equity schemes. Returns in these schemes have jumped to almost 12.50% thru the Algo

Conclusion

Please do not only look at past returns on point to point basis & select a) Equity as an asset class & b) schemes Look at various market parameters like PE, PB, Market Cap to GDP ratio, Sensex 10 Year rolling returns, various Valuation Indices available in the market, Fund Manager & Scheme selection based on their consistency in track record (based on 3 year & 5 year rolling returns) & finally adding YOUR ADVISORS' Alpha through adopting right Asset Reallocation Strategies, incorporating Strategy of Buy Low/Sell High & finally incorporating some Exit cum Profit Booking Strategies as well Finally look at other Macro factors, Global cues, Interest rate direction, Credit Offtake data, GDP growth data, Corporate Earnings data, etc. before finally deciding on investments in equity as an asset class

Hope my 4 articles in this Series on Equity Investing will help you going forward in helping your Investors to generate Wealth, meet their Goals & Add Value from your end.

Please remember that Investors have a choice of going Direct if they don't see any valuable advice coming from our end.

Content is prepared by Wealth Forum and should not be construed as an opinion of HDFC Mutual Fund.

Share this article

|