|

It has been an uneventful debt market journey (or so we assume) since March 2016 when Downgrade in one of the Debt securities shook the entire Mutual Fund Industry. Most of the Media & Twitteratis went to town on panning this event along with blaming the AMCs & their respective Fund Managers.

All of us predicted a Dooms Day scenario as far as investing in debt schemes was concerned (specifically Accrual Schemes). Fortunately I had penned 4 articles during this period (which are still relevant in terms of its content & message) & wish to take some credit for bringing sanity back in the Industry. We would have killed Accrual Schemes as an Asset Class; the only alternative to beat Fixed Deposits which is the preferred investment vehicle of the investors. On top of that we would have created a huge liquidity risk based on perceived credit risk (which has blown off since then).

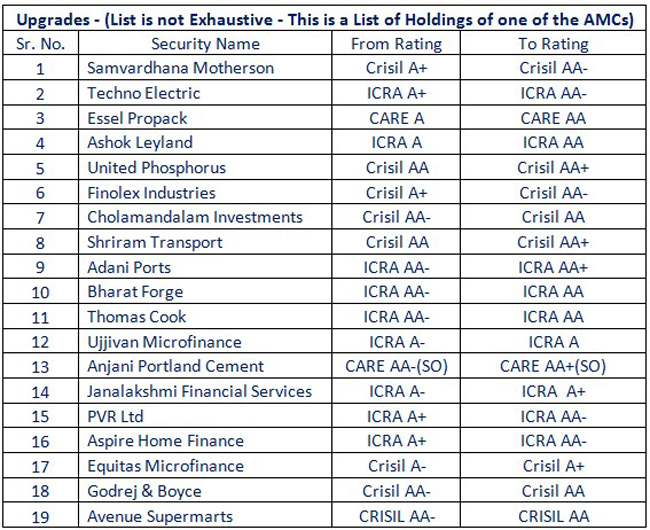

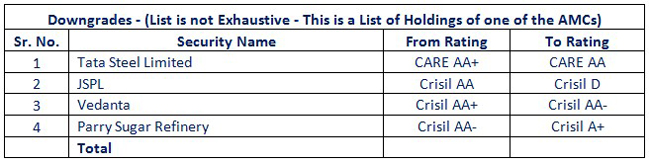

As we all know, Media has a habit of amplifying negative news & many times creating a story (where none exists). However, when it comes to positive stories & positive news; these either go unnoticed or unreported as I am about to share with you. In the past couple of years, there have been at least 30 + upgrades v/s much lower number of downgrades as below.

So let us once again introspect on what we would have lost out on if we would have behaved irrationally based on one off downgrades & exited from Accrual schemes in March 2016 & if our investors would have moved back to Fixed Deposits. I am sure many Advisors had recommended exits from accrual schemes of their client portfolios.

Following table will scream the entire story in a Nut Shell

(Data of some popular Accrual Schemes since Pre Downgrade till date):

Now just visualize the situation where many investors exited during this chaotic time of Downgrade & were part of some or all of the following horrible scenarios:

Many would have ended up paying short term gains tax (if they had capital gain situation in their portfolios) Many would have ended up paying Exit Loads Many would have ended up generating actual loss (if they would have entered just before the downgrade in March 2016) Many would have switched their investments to Fixed Deposits & will now be paying tax @30% + Many would be facing reinvestment risk in both FDs as well as Accrual schemes (if FDs were maturing now) And, all those who exited with above permutation/combinations of different scenarios would have lost on generating almost double digit returns in the same accrual schemes since March 2016 till date

Then the moot questions are:

How did we act as Advisors during this period? Why should Investors trust us as Advisors? How were we different from Investors in terms of following THE HERD? Why should investors invest in MF schemes when there is no one to guide them properly? & finally, Why should Investors not remain in their comfort zones of Traditional Investment vehicles like FDs, etc.

I rest my case.

Content is prepared by Wealth Forum and should not be construed as an opinion of HDFC Mutual Fund.

Share this article

|