|

Some attribute this priceless piece of wisdom to Gautam Buddha, others believe it was not him who said this. Regardless of which visionary actually said this, Prashant Jain draws on these words of wisdom to show us the path to investing successfully at a time when investors find themselves at a crossroads of having to choose between short term concerns vs long term conviction to guide their investment actions.

In this well-articulated piece, Prashant showcases why he believes that the direction of the economy and therefore markets is pointing clearly towards growth and why therefore we must ignore all the noise around us about near term challenges. As Prashant notes, even the most ardent critics of the economy or markets will hopefully agree with him that the long term direction of the economy is pointing towards growth and not contraction. If that be the case, just keep walking.....

"Do not dwell in the past, do not dream of the future, simply be in the present", Gautam Buddha

had thus advised about life.

"Dwell in the past and learn from it, imagine the future and ignore the present" would be an apt,

though a rather contrary adaptation of this for the stock markets.

The Past - What can we learn from it?

A simple study of the stock markets in India over last few decades throws up four key lessons.

These are

Lesson number 1

Over the long term, stock market indices in India have grown around the same rate as the nominal GDP

(GDP Growth + Inflation) of India. This implies that when in any extended period of, say 10 years, indices

grow less than nominal GDP, they tend to make up in the future by delivering higher returns.

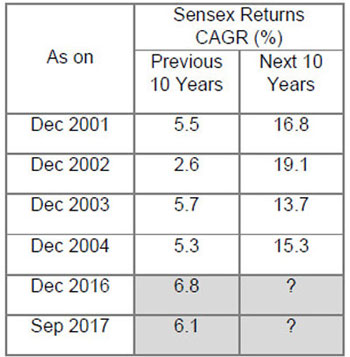

The table below summarizes the returns of the SENSEX in those 10 year periods (since its inception in

1979), when the returns were less than 7% CAGR (approximately half of long term nominal GDP growth rate of 12-

16%), and the returns of Sensex for the next 10 years.

Source: Publicly available information

[Refer to the disclaimer at the end of this note]

It is interesting to note that thus far every 10-year period of below 7% CAGR of returns by Sensex was

followed by a period in which Sensex delivered 14-19% CAGR over the next 10 years.

Interestingly, we are at such an instance again, as CAGR of Sensex in last 10 years is just 6.1%

Lesson number 2

This one is really simple. It suggests that Stock markets are volatile year to year and are hard to

forecast in the short term.

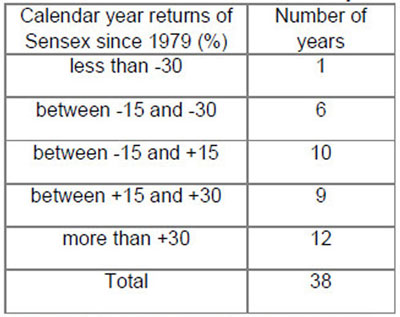

The table below summarizes the 1 year return distribution of Sensex since its inception in 1979.

[Refer to the disclaimer at the end of this note]

The wide variation in the annual Sensex returns clearly brings out the futility of attempts to forecast short

term movements in stock markets.

And this applies to experts as well!

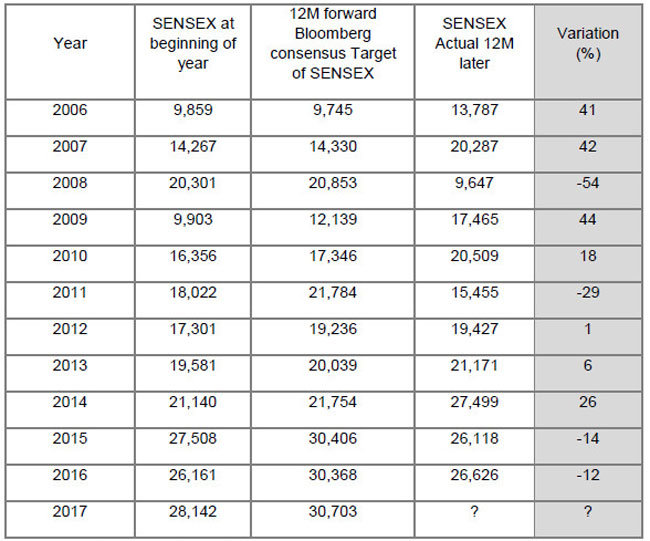

The table below gives for each year since 2005, the value of the Sensex at the beginning of the year, the

12 month forecast of the Sensex at the beginning of each year (as per Bloomberg consensus), the actual

Sensex at the end of each year and finally the variation between the forecast and the actual.

Source: Bloomberg, # Note: 12-month price target based on aggregation of underlying index member price targets. Calculated by

summing the Consensus Target Price, times number of shares in the index for each member, divided by the index divisor.

[Refer to the disclaimer at the end of this note]

The wide variations between the actuals and forecasts, particularly in years when the Sensex was not

range bound suggests once again, that the markets are not amenable to near term forecasts, even by

experts.

In a lighter vein, probably only those who can correctly forecast the outcome of a toss of coin, can

forecast one year returns of markets!

Lesson number 3

This lesson deals with sector rotation and suggests that there is a time and place for virtually every sector

in the markets. Few sectors are perpetually good or bad investments. Market preferences periodically

change as can be seen from the table below:

Source: Bloomberg

Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual Fund /

AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

It is clear from the table above that markets are fickle and their loyalties change i.e., between 1995 -

2000, IT was the preferred sector and markets shunned capital goods, banks, metals etc. This changed

and between 2001- 2007 while IT sharply under-performed, capital goods, metals, banks etc were the

best performing sectors. A similar role reversal was experienced when pharma, FMCG etc. that were out

of favour around 2007, delivered the best returns between 2008-2015 and the erstwhile favourites -

capital goods, metals etc. under-performed significantly in this period.

It is evident that repeatedly, sectors that were popular at one point of time fell out of favour and sectors

that were considered untouchables became market darlings.

Lesson number 4

This is probably the most difficult lesson, certainly to practice, if not to understand. The lesson here is,

that irrespective of what the majority in the market thinks or feels, the markets in the long term are perfect

and are driven entirely by logic and rationale and nothing else.

example 1: IT that was wildly popular in 1999 and enjoyed a nearly 100% fan following, underperformed

massively over the next few years. On the other hand, a uniform dislike for banks, capex, metals around

1999-2000 could not prevent these sectors from delivering 5-30 times returns over next several years.

Source: Bloomberg

Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual Fund /

AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

example 2: Pre Lehman in 2007, the majority opinion favoured infra, capital goods, real estate etc. while

FMCG, pharma etc. were out of favour. As things turned out, FMCG, pharma became the best performing

sectors while infra, capital goods, real estate destroyed large amounts of wealth (refer table below).

Source: Bloomberg

Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual Fund /

AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

example 3: More recently, oil marketing companies, that were shunned almost uniformly few years back

when they were bearing subsidies, are up between 5-10x since.

Source: Bloomberg

Sectors/Stock referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual

Fund / AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

These examples and several more remind one of the memorable words of Benjamin Graham, "You are

neither right nor wrong because other people agree with you. You are right because your facts are

right and your reasoning is right".

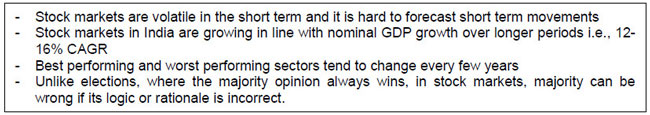

Before moving away from the past and coming to the present, a brief recap of the key learnings

presented is apt. These are:

[Refer to the disclaimer at the end of this note]

The Present - Optically challenging

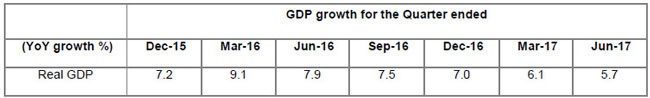

If one reads the headlines over the last few months, the impression one gets is that the economy is

passing through challenging times - GDP growth is slow, earnings growth is low and is not supportive of

markets.

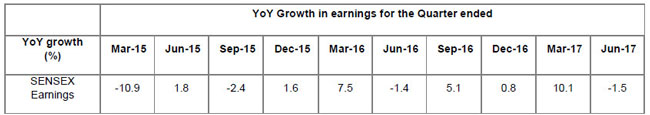

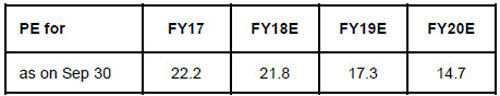

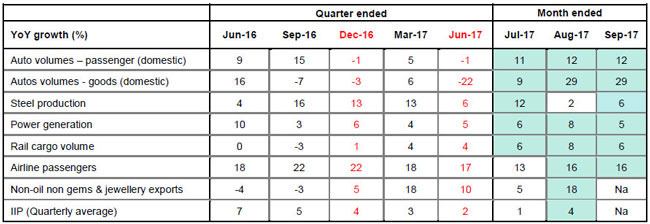

As the tables below suggest, observations about slower GDP growth in last two quarters and weak

earnings growth are indeed correct.

Source: CEIC, Kotak Institutional Equities

Source: Kotak Institutional Equities

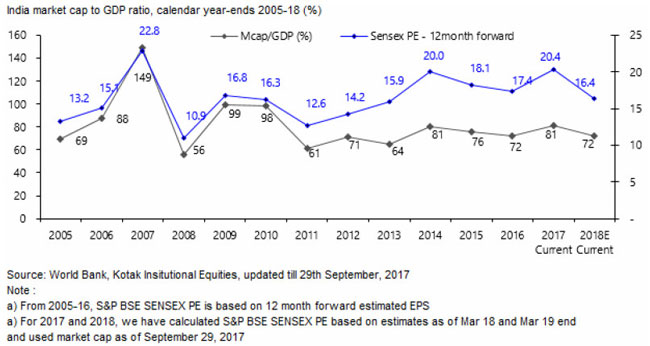

However, the comment by many that markets are expensive etc., is not borne out by P/E multiples as the

following table clearly suggests.

Sensex valuations

Source: Kotak Institutional Equities, E- Estimated

More on this later.

The Future - looking beyond the obvious

Sometimes, what is visible is incorrect and what is invisible is correct. The situation is somewhat similar

today.

1. GDP growth - sharp improvement ahead

GDP Growth has indeed slowed down in last few quarters. However, this is, in all probability driven by

demonetisation and GST, two very significant reforms that have caused temporary disruption in the

normal functioning of the economy. However, as things normalise, growth rates are expected to recover

smartly over the next few quarters. Monthly data for July, August and September for several parameters

(refer table below) already points in that direction.

Note: Figures indicate yoy growth unless otherwise indicated; Passenger vehicles include MUVs;

Source: UBS, IDFC, Company data, JPC, CMIE, CEIC, SIAM, Central Electricity Authority, CapEx, Haver, Datastream, naukri.com,

CSO, RBI, Bloomberg

It is evident that in the quarters around demonetisation (Dec 16) and GST (Jun 17) various parameters

like auto volumes (both passenger & goods) did experience a sharp slowdown. The data for July, August

and September is however very encouraging. Auto volumes, power generation, rail cargo are all showing

good improvement in growth rates.

The medium term outlook for the economy is even more encouraging. This view is driven by a likely

acceleration in infra capex, affordable housing and a revival in private capex. As per recent news flow,

there are reasons to be optimistic about revival of private capex in the not too distant future primarily led

by metals sector.

One more important point that needs to be explained is the low growth in mature categories. As a country

and society progresses, certain categories of goods become increasingly affordable and penetration

therefore increases. After reaching a certain level of penetration these categories witness natural fall in

growth rates. For example: Salt which is highly penetrated is unlikely to grow at healthy rates. Certain

consumer staple categories like soap, shampoo, toothpaste etc. have become affordable and are thus

well penetrated in India, resulting in slower growth. As income levels rise, consumers move to more

expensive or discretionary products in the same category. This explains the faster growth of motor cycles

compared to bicycles in last two decades and the faster growth in 4 wheelers compared to 2 wheelers

currently; this also explains the faster growth of air travel compared to rail travel and so on so forth. Slow

growth in mature categories should therefore not be attributed to economic slowdown and is not a cause

for concern. It is in fact a cause for celebration as it suggests that the masses are able to afford that

category or are moving to better substitutes.

Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual Fund /

AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

2. Earnings recovery is imminent

Expectations in financial markets move much faster than the real world. It typically takes two years to

build a house, one year to renovate it, but we expect the economy growth to surge, NPAs to resolve,

earnings to recover and much more in few quarters. Unfortunately, to bring about changes in the real

world and more so in a large and complex country like India takes longer. Besides the environment is not

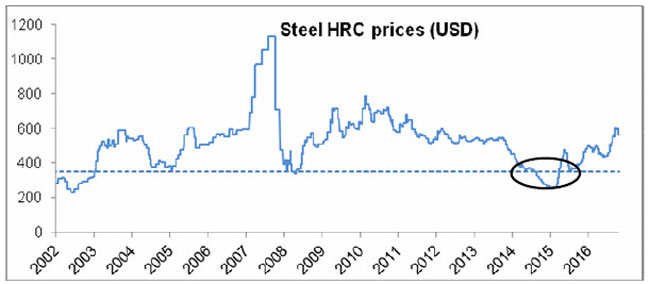

static and sometimes while you fix one problem, another one crops up. Take for instance the fall in steel

prices to near 15 year lows in 2015 unexpectedly. This set back not just the steel sector but also the

banks by a few years.

Source: Bloomberg, HRC- Hot Rolled Coil

Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual Fund /

AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

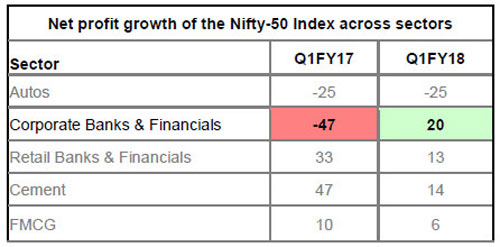

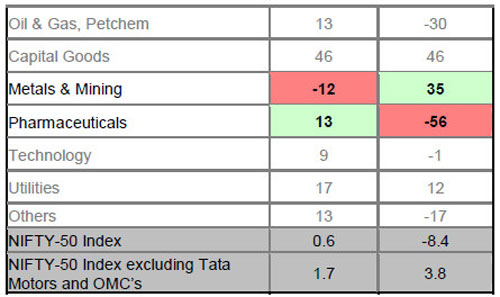

The earnings disappointment in recent past has been weak mainly due to the sharp fall in profits of

sectors like steel, engineering & capex and corporate banks. This however, is all set to change.

With the sharp recovery in steel and other metal prices as the above chart indicates, with the peaking of

provisioning costs in banks and with a slow but steady improvement in infra capex, earnings recovery is

underway and it should become increasingly evident with each passing quarter.

The last quarter's results are already pointing in that direction. In the table below it can be seen that

corporate banks and metals that witnessed a fall in profits in Q1FY17 have reported decent profit growth

in the Q1FY18 albeit on a low base. The biggest disappointment in earnings this year in Q1FY18 was in

fact in pharmaceuticals!

Source: Kotak Institutional Equities

Further, barring the large hedging losses in Tata Motors (profit down ~90% YoY) and the inventory losses

in OMCs (profit down ~70% YoY) which clearly are adventitious, earnings grew by 4% (vs de-growth of

~8% as reported).

Stocks/Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual

Fund / AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

3. Promising markets

As highlighted in the beginning of this note, index has trailed nominal GDP growth by ~8% p.a. for last 10

years (SENSEX CAGR of ~6% vs Nominal GDP growth at a CAGR of ~14%). As a result, India’s market cap to GDP on

CY18 is ~72%, which is low (see chart below). This will be lower still for next year.

[Refer to the disclaimer at the end of this note]

Even in terms of p/e, markets are reasonably valued. In fact, as earnings growth improves, the p/e's

should look more reasonable and move lower.

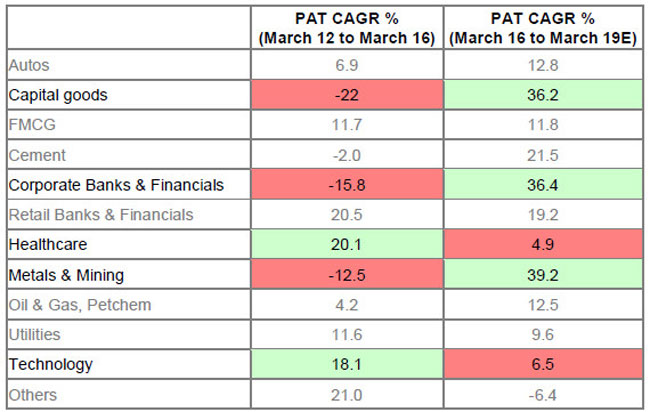

4. New sectors should lead earnings growth over next few years

The table below gives the profits growth sector wise for last few years and the estimates for the same for

the next few.

Source: CLSA, based on CLSA coverage universe, E- CLSA estimates

It is interesting to note that there is a significant divergence in the profit growth across sectors between

the past and estimates for the future. For instance: profits for capital goods de-grew by 22% CAGR

between March 12 and March 16, are expected to grow at a CAGR of 36% between March 16 and March

19. Similarly, healthcare, where profits grew by 20% CAGR between March 12 and March 16 are likely to

grow by only 5% CAGR between March 16 and March 19. This divergence in profits between the past

and future opens up prospects for new sectors to gain leadership in the markets going forward.

Sectors referred above are for general information and for illustrative purpose and are not recommended by HDFC Mutual Fund /

AMC. The Fund may or may not have any present or future positions in these sectors.

[Refer to the disclaimer at the end of this note]

Conclusion

India is an economy that has delivered secular growth in the past and is likely to deliver continued growth

for many years to come.

The last few years have witnessed a spate of reforms that have improved the macroeconomic

fundamentals of the country and future growth prospects. Two important reforms viz., demonetisation and

GST while being very beneficial over the medium to long term have adversely impacted growth in last few

quarters. This slowdown in growth should not be extrapolated into the future and in fact there are reasons

to believe that the economy should bounce back strongly in next few quarters.

Profitability in general and specifically for some sectors is cyclical.

As explained earlier, profitability in few sectors has been weak over last few years and this has hurt

aggregate profit growth. This again should not be extrapolated into the future and in fact there are factors

that suggest profit growth over next few years should be strong. Lower interest rates, peaking NPA’s and

higher metal prices etc. should aid this.

Equity markets have lagged nominal GDP by 8% CAGR over last 10 years and are consequently at

attractive market cap to GDP ratio. In p/e terms, markets are trading near 17x FY19(e) and 15x FY20(e),

which are reasonable, especially given the low interest rates.

In view of the above, there is merit in increasing allocation to equities or in staying invested as the case

may be (for those with a medium to long term view and in line with individual risk appetite).

Successful investing needs more patience than intelligence. The track record of a few mutual fund

schemes over decades and the experience of those investors who have stayed invested in these funds

for long periods amply demonstrates this.

Let me end this long note once again with a thought attributed to Gautam Buddha.

"If the direction is right, all you need to do is to keep walking"

Hopefully, even the most ardent critic of economy or of stock markets, will agree that the direction is

indeed right.

Content is prepared by Wealth Forum and should not be construed as an opinion of HDFC Mutual Fund.

Share this article

|