|

Click here to know more about ICICI Prudential Infrastructure Fund

|

WF: Many advisors continue to be wary of the infrastructure theme, as investor experience with this sector in the peak of the last bull market and the subsequent crash was very unpleasant. How would you suggest your fund be positioned by advisors in investors' portfolios, in this context?

Naren: We do agree that people are weary of the infra theme but in line with our contrarian view that profits can be made by being a contrarian, and where valuations are attractive, we are recommending this theme. Like all sectoral themes, in infra too there are times to invest and disinvest. Not booking profits at the opportune time was one mistake that was made by investors in the first cycle.

WF: What is the current investment strategy of ICICI Prudential Infrastructure Fund?

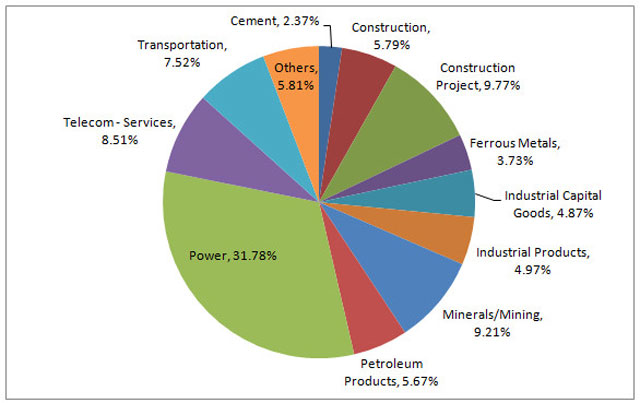

Naren: The fund is heavily invested in power sector with an aim to benefit from the various Government reforms initiated in this sector. Telecom and construction project companies are the other areas where the fund has major investments.

The portfolio breakup is as given below. Data as on October 2016

WF: Your fund has a very significant exposure to the power sector (32% of portfolio). This sector has already seen a lot of reforms and the UDAY scheme has already been implemented. Could it be a case that all the good news is already in the price? Is there a growth/re-rating story yet to be discounted by the market?

Naren: The general market presumption is that power demand won't go up in the near to medium term but believes that consumption of different products will keep increasing. However, over the next three to four years, we see both of these increasing. Currently, consumption oriented sectors in India are trading at high valuations on various market parameters like PB, EBIDTA, trailing PE etc whereas power oriented sectors are relatively cheaper. This contrast is primarily because of the problems the sector faced between 2008 and 2015 which derailed the power story significantly, leading to relatively attractive valuations.

Initially, we believed that only the safe regulated return transmission companies would be a beneficiary in the future. However, since the negative cycle has completely played out in power space, we are of the view that the entire power ecosystem - generation, transmission, distribution and companies which are supplying for transmission and distribution - are all likely to be benefited by the improvement in the power sector.

WF: A year ago, roads, railways, defence and sanitation were identified as key sectoral themes to invest in by most experts, given the Government's focus. Your presentation focuses on roads, but is silent on the other three. Has the investment argument for the other three sectors become less attractive now?

Naren: While railways, defence and sanitation were identified as themes, we did not see an opportunity here when it comes to bottom up stock selection, due to inherent valuation or fundamental concerns in different stocks in these sectors. As a result, we are not focused on these stocks in our portfolio. However, we still continue to believe in these three themes.

WF: Many experts tell us that unless private sector capex picks up, it will be difficult to sustain the investment cycle only on the back of government spending. What is your take on this? To what extent is the infrastructure theme critically dependent on resumption of private sector capex?

Naren: We are of the view that investment cycle in private sector can come only after capacity utilization increases from current levels. In the sectors outside Government spending, investment cycle is most likely to play out post 2018-2019. So, we believe that infrastructure theme is not dependent on private sector capex alone. The first half of the cycle will be led through public sector capex followed by private sector capex in the second half of the cycle.

WF: Is the recent Essar deal in energy sector a one-off event or the beginning of a welcome trend in deleveraging of conglomerates? To what extent can this deleveraging cycle impact the fortunes of the infra theme?

Naren: While we don't comment on individual deals, over the last three years several leveraged corporates have been continuously deleveraging and the impact of this deleveraging cycle is likely to benefit financial institutions with a lag. However, the infra theme is not connected to deleveraging cycle because Government oriented infra projects will continue to have happen irrespective of what happens of deleveraging.

WF: Is telecom a contrarian buying opportunity now or is it a sector best avoided given the changing dynamics with Reliance Jio's entry?

Naren: We believe that telecom is a contrarian sector because it has become a basic sector for every consumer. At a time when the industry as a whole is facing disruption and the prices have come down, we see this as a good time to add to the sector.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The information contained in this communication is only for the reading/understanding of the registered Advisors/Distributors and should not be circulated to investors/prospective investors. All data/information used in the preparation of this communication is specific to a time and may or may not be relevant in future post issuance of this communication. ICICI Prudential Asset Management Company Limited (the AMC) takes no responsibility of updating any data/information in this communication from time to time. The AMC (including its affiliates), ICICI Prudential Mutual Fund (the Fund), ICICI Prudential Trust Limited (the Trust) and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this communication in any manner.

Nothing contained in this communication shall be construed to be an investment advice or an assurance of the benefits of investing in the any of the Schemes of the Fund. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Share this article

|